Table of Contents

ToggleKey Takeaways:

- ImmutableX price has dropped by nearly 10% in the past 24 hours, recording consecutive red candles since the beginning of the month

- The bearish actions are presumed to reach a peak in a while, post to which a bullish breakout appears imminent

- The bears currently appear to be dominant as the network activity drops with a jump in the supply on exchanges

The ImmutableX price soared significantly since the beginning of the year and doubled its price from $0.3 to $1.5. Presently, the bears have largely dominated the rally and hence the price is witnessing extreme selling pressure, driving the prices south. While the possibility of a bullish breakout does not loom subsequently, the bearish pressure may drag the prices relatively lower in the coming days.

Both in the short-term and long-term, the ImmutableX price is not displaying any possibility of a bullish flip as the technicals have plunged to the ground levels. The price is believed to maintain a bearish trend for some more time before the bulls jump in. Hence, the price is believed to drop, test the lower support, and trigger a bullish flip.

Read more: Polygon Price Prediction

ImmutableX (IMX) Technical Overview

- The IMX price broke down from the rising wedge pattern and is heading toward the immediate lower support

- The support levels between $0.67 to $0.69 can also be considered as a trend reversal zone and hence the descending trend may be reversed on contact

- Moreover, the RSI which has dropped to the lower levels may also enter the oversold zone and later trigger a rebound, lifting the price back above $0.65

- Currently, the volume appears to have lowered a bit and hence this may compel the price to consolidate due to low user activity.

- Hence, after a brief consolidation, the prices are believed to revamp a fine bullish trend very soon

ImmutableX (IMX) On-Chain Overview

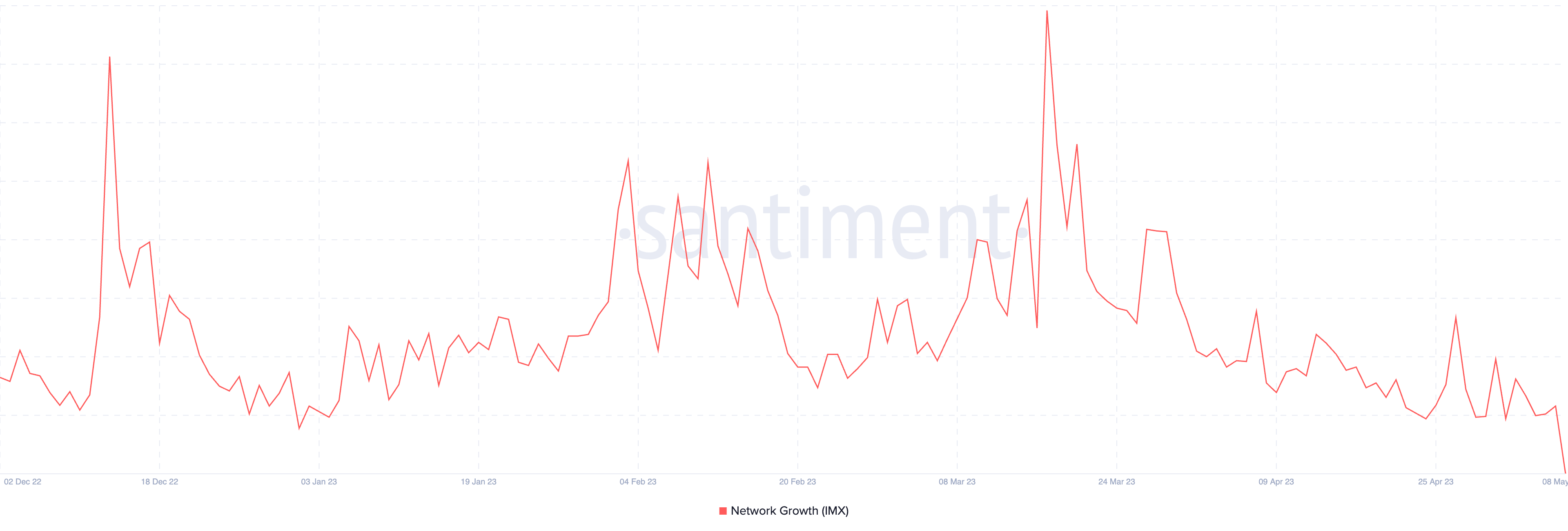

ImmutableX Network Growth

Network growth is much similar to the daily active address which monitors the number of addresses interacting with the platform in a day. Network growth considers the number of addresses that interact with the platform for the first time. It can also be considered to be the number of new addresses created in 24 hours.

The metrics determine the adoption over time and can be used to understand whether the project is gaining traction or not. The network growth of IMX has dropped excessively in recent times. The new address count has fallen from over 500 to as low as below 100 indicating the platform is losing traction.

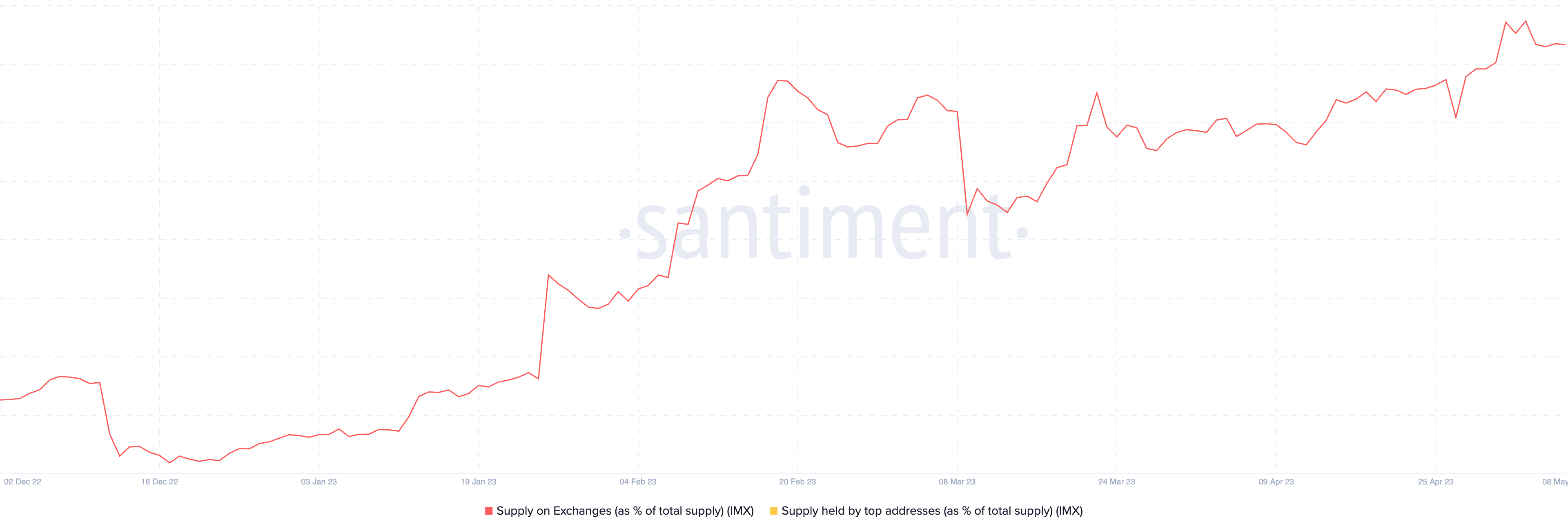

ImmutableX Supply on Exchanges

The supply of exchanges is nothing but the reserve balance of all consolidated exchanges within the space. Whenever the trader wishes to sell his tokens or swap them to another, he transfers his holdings to the exchanges and this is when the metric levels rise. On the contrary, a drop in the levels indicates the bullish intentions of the market participants as they tend to hold them for the long term in their wallets.

The current levels of the supply have surged enormously as nearly 5% of the total circulation is held on exchanges. This indicates bearish sentiments prevailing among the market participants. It may impact the value of the cryptos as the possibilities of accumulated selling volume also hover over the crypto.

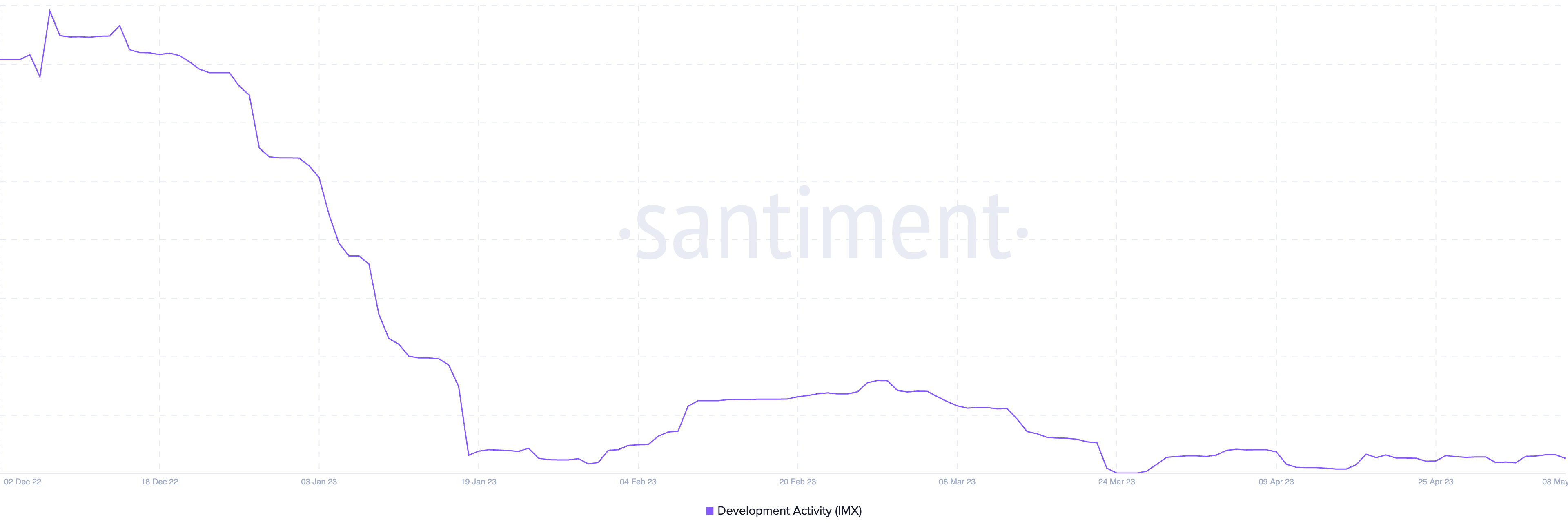

ImmutableX Development Activity

The development activity is recorded on the GitHub repositories and calculated by the number of commits registered about the platform. The rising levels of development activity indicate the team behind the project is extremely serious about the business proportion and is working hard to deliver new features and upgrades in the future.

Woefully, the development activity appears to have come to a halt as the levels have hit the ground. The levels are hovering around 0 and this may lose the confidence of the market participants in the platform which is not good for a healthy rally ahead.

Additional Read: Solana Price Prediction

Concluding Thought

The ImmutableX price has been undergoing a massive price crash since the beginning of the month, indicating the bull could remain off-the shore for a while. Moreover, the halt in the development activity may not be a good sign as the risen levels of the exchange reserve have already flashed bearish signals for the crypto.

Values as on May 8, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more