Table of Contents

ToggleKey Takeaways:

- PEPE’s Volatile Journey: PEPE started strong but suffered a steep 60% decline in just one month, breaking all-time lows by August 2023.

- Current Technical Status: PEPE is aiming to breach S1 with support at the S2 level and trades below its 50-day moving average.

- Hope for a Rally: Overcoming key resistance zones could lead to a 100% price increase to R1 at $0.00000128, but it depends on broader market recovery.

- Facing Bearish Pressure: PEPE has experienced significant losses, over 40% in the last 30 days and nearly 60% in the last 60 days. Maintaining support at S2 is crucial.

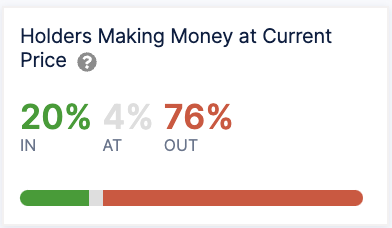

- Profitability Imbalance: Around 20% of PEPE investors are profitable, while 76% are at a loss, marking a slight improvement from the previous week. This could impact market sentiment, hindering price recovery and investor confidence.

PEPE Price Technical Overview

-

The PEPE token started on its journey with a lot of hype, initially making significant gains upon listing, but it was soon engulfed by a bearish downturn. As observed in the chart above, it has witnessed a substantial decline of over 60% within a month. In mid-June, there was an attempt at recovery, but it was swiftly met with selling pressure. This led to a continued downward trajectory, ultimately breaking its all-time lows by the end of August 2023.

- Currently, the PEPE token found support at the S2 level and is now attempting to breach the S1 level – as indicated by the Fibonacci pivot points. But at the same time, it is also trading below its 50-day exponential moving average.

- To revive market enthusiasm for PEPE, it needs to overcome several critical resistance zones depicted on the chart. This journey begins with the region between the S1 level and the pivot point (P). This area also coincides with the former all-time low region, which could now potentially act as a resistance level. Thus, a breakout beyond this zone holds significant importance.

- In the upcoming months, if PEPE price manages to breach these levels, there’s the potential for a continued rally up to the R1 level at $0.00000128, representing a substantial 100% increase from its current levels. However, this accomplishment would likely hinge on a broader recovery in the crypto market, aligning with PEPE’s price surge.

- Currently, PEPE token’s price is under significant bearish pressure, as is evident in its decline of over 40% in the past 30 days and nearly 60% over the past 60 days. Consequently, it is imperative for PEPE’s price to maintain levels above the S2 support, which stands at $0.0000006 according to the Fibonacci pivot points.

Read More: Pepe Price Prediction

PepeCoin On-chain Overview

Profitability of Pepe Holders

The current profitability scenario for PEPE token holders depicts a bearish landscape within the token’s ecosystem. According to data from IntoTheBlock, a mere 20% of investors are currently witnessing gains on their holdings, while a significant 76% find themselves at a loss, seeing their investments in the red.

It’s worth noting that this situation represents an improvement from the previous week, where over 80% of PEPE holders were facing losses.

But, the prevailing imbalance, with a majority of investors in the red, has the potential to adversely impact market sentiment. It often results in increased selling pressure as many holders may decide to sell their tokens to mitigate losses or reduce risk. Such a bearish sentiment can impede price recovery and potentially initiate a downward spiral, making it challenging for PepeCoin to regain bullish momentum.

In the realm of crypto markets, investor psychology plays a crucial role, and when a majority of investors experience losses, it can contribute to extended downtrends and decreased confidence in the future prospects of the PEPE token’s price.

Conclusion

PEPE’s journey has been marked by significant volatility, with recent steep declines. While it’s currently trying to overcome key resistance levels, it faces substantial bearish pressure. The profitability imbalance among investors presents a challenge, with a majority at a loss. This situation could impact market sentiment and make it harder for PEPE to regain bullish momentum. As with many cryptos, PEPE’s future performance will be closely tied to broader market trends and investor sentiment.

Values as of September 27, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more