Table of Contents

ToggleKey Takeaways:

- The GMX price displayed acute strength and surged by more than 100% in the past 30 days while recording a 15% jump in the past few hours

- The price has been bullish for quite a long time and hence the rally is believed to maintain a firm upswing for the rest of the year ahead

- The token is gaining traction as the sentiments are flipping to positive with a notable increase in the active address count

Read More: Avalanche price Prediction

GMX, the popular decentralized exchange dealing with both spot and perpetual contacts, is making huge rounds nowadays. Along with the exchange, its utility token GMX also topped the leaderboard and surprised the entire crypto space. The reason behind the popularity and hiked value is said to be outperforming the DeFi pioneer Ethereum. Moreover, the value of the token also remained largely elevated, manifesting acute strength compared to the other popular tokens in the market.

The platform has attracted many in the past few months and helped the platform to surpass Ethereum in terms of daily fees. The DEX collected $5 million in a 24-hour period over the weekend which made it the largest revenue generator in the DeFi space at the moment, surpassing Ethereum. As per the data from GMX, the total fees collected since its inception till now is around $120 million.

Besides, the native, utility, and governance token GMX has also topped the leaderboard by surging with a huge margin while the majority of the cryptos were consolidating. The price leaped by more than 15% to mark highs close to $80 but woefully failed to surpass these levels. Despite a minor pullback, the price is believed to regain bullish momentum and record a 3-digit level soon.

GMX Token Technical Overview

Source: Tradingview

- The GMX price has been trading within an ascending parallel channel for quite a long time, being self-assured to testing the higher targets soon

- The price faced a minor pullback after reaching the upper resistance and may experience a minor pullback, maintaining its trend close to the upper resistance

- The RSI displayed a bullish divergence, while the ADX is possessing the possibility to rise high including some contractions

- Therefore, the GMX price is believed to rise beyond the pattern in the coming days to reach close to $100 very soon

GMX Token On-Chain Analysis

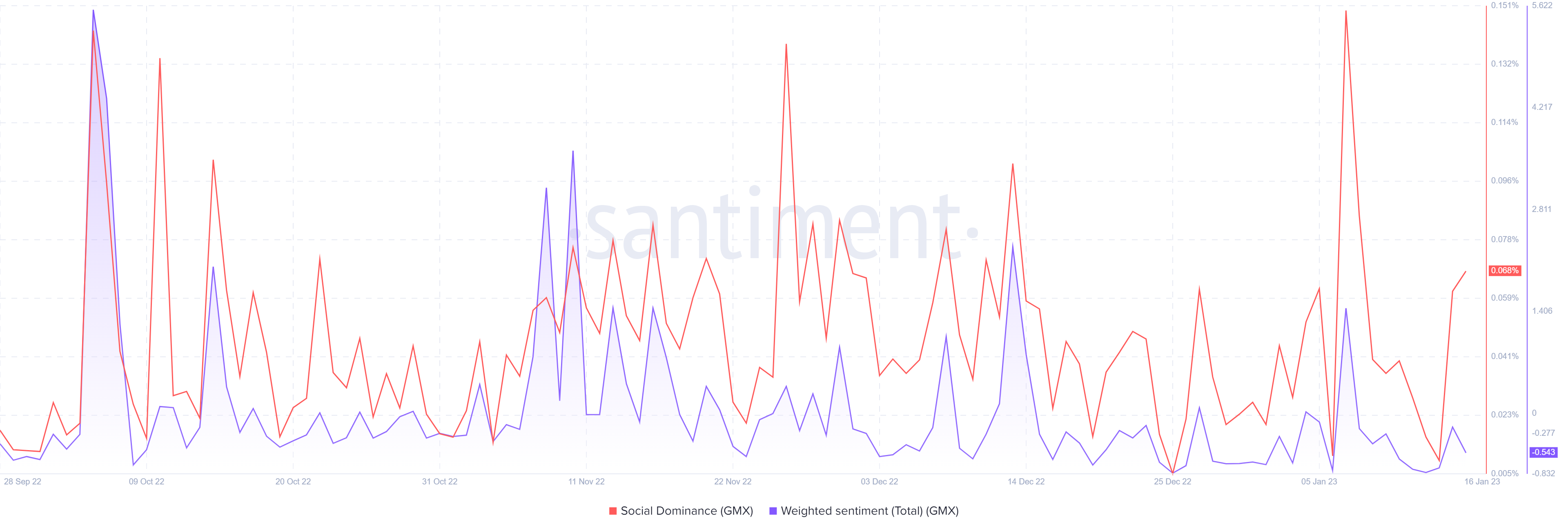

GMX Social Dominance-Weighted Sentiments

Source: Santiment

The social dominance of the token reflects the trader’s interaction over the social media platforms in form of mentions, posts, engagements, etc. The dominance of a token is calculated by the rising traction against the other top 100 cryptos as per the market capitalization. Besides, the weighted sentiments is also much similar but clearly indicates whether the market participants are positive or negative on the token.

The social dominance of the token has risen notably indicating the rising dominance of the token among the top 100 tokens in the market. Meanwhile, the weighted sentiments have dropped which indicates the traders are somewhat bearish on the token. As the sentiments are calculated by considering all the sentiments divided by the frequency of their occurrence over time.

Additional Read: How To Trade Using Moving Average

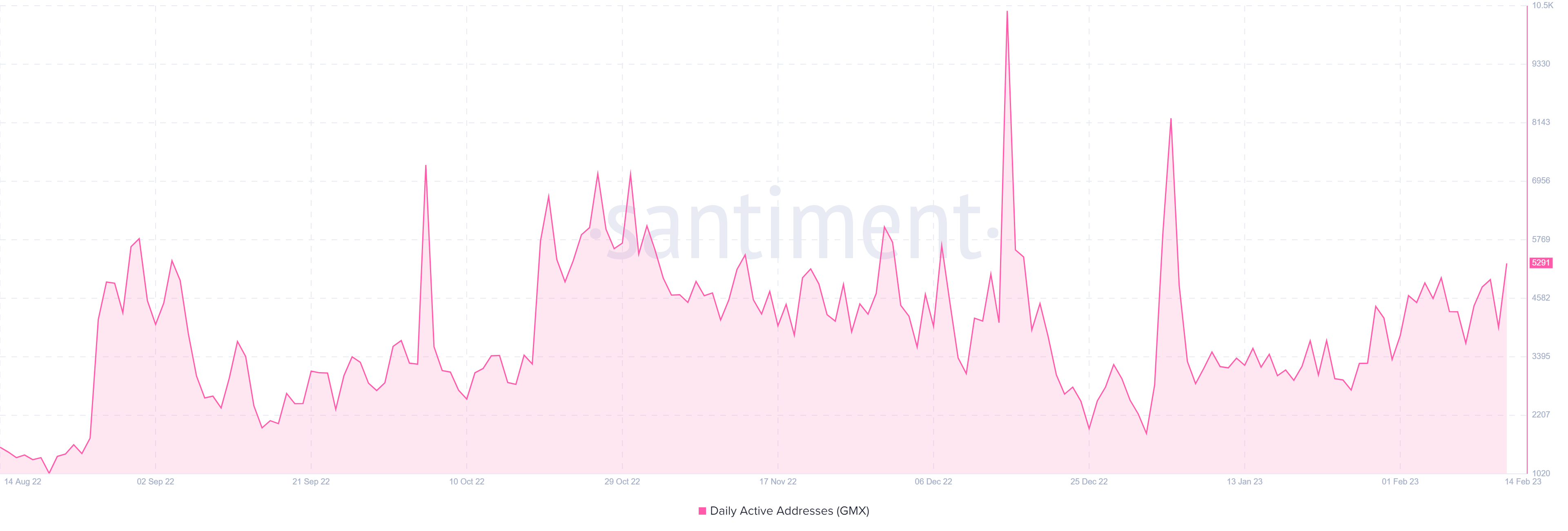

GMX Daily Active Address

Source: Santiment

The daily active addresses are the number of addresses that have performed a trade on the platform in a day. Each address, regardless of whether it is a buy, sell or swap address is counted only once per day. The DAA count indicates the interest of the market participants over the token that keeps the platform active.

The DAA in the case of GMX has maintained decent levels since the beginning including a couple of huge spikes. Presently, the DAA has surged massively in the past few days which indicates swelling traction of the platform which is much required to keep up the volatility of the token that may impact the price in either way.

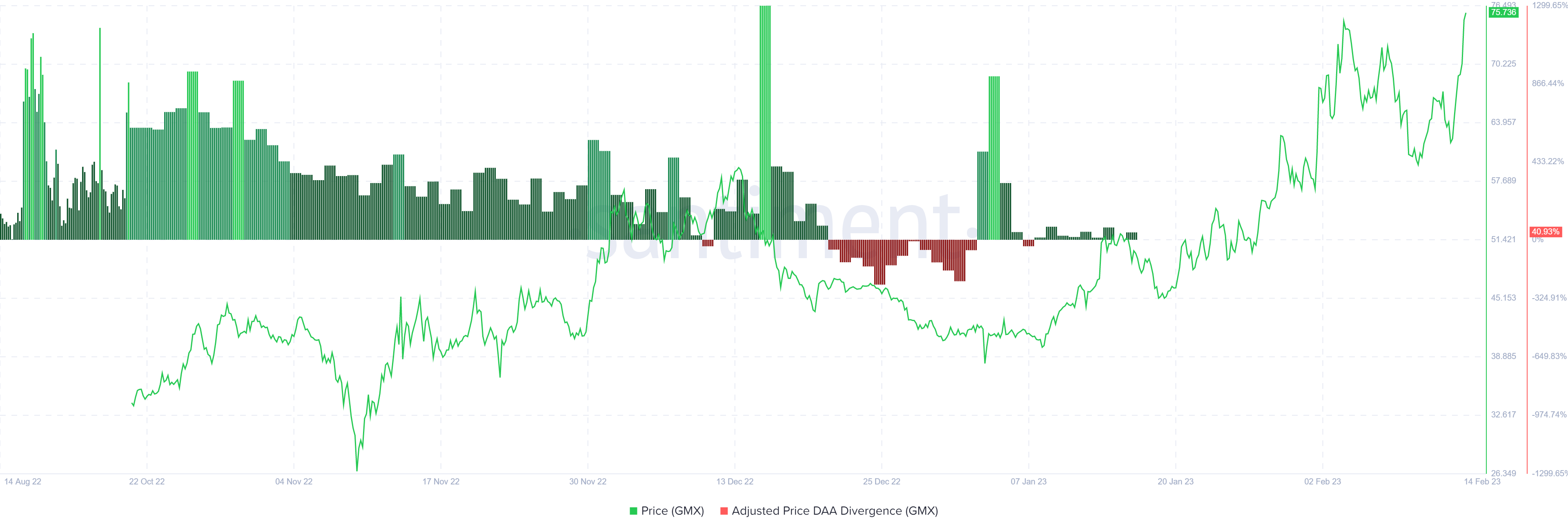

GMX Adjusted Price DAA Divergence

Source: Santiment

As mentioned before, DAA is nothing but a Daily Active Address count referring to the number of addresses contacted by the platform to carry out a trade. It can also be determined that the price of the token is directly impacted by the DAA. A rise in the DAA levels increases the price but a drop slashes the price notably. The levels are adjusted when the price of the token and the indicator moves in the opposite direction. Indicating the prevailing trend is weakening and hence may flip at any moment.

Concluding Thought

GMX price has been under the bullish influence for quite a long time and hence is believed to possess significant bullish momentum in the coming days. Although the price is experiencing bearish actions, it may wane in no time. The surging DAA indicates the rising popularity of the token in the market while the sentiments are also positive signaling that positive sentiments prevail for a long time ahead.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more