In a strategic move to maintain the decentralized nature of the Ethereum network, several liquid staking providers are taking the initiative to establish a self-limit rule. This rule stipulates that no single entity should possess more than 22% of the Ethereum staking market, safeguarding against potential centralization concerns. The move has sparked mixed reactions within the Ethereum community, with some lauding it as a necessary step while others remain skeptical.

The aim to own 22% of Staked ETH

The five prominent Ethereum liquid staking providers, including Rocket Pool, StakeWise, Stader Labs, Diva Staking, and Puffer Finance, have committed or are working towards adopting this self-limit rule of not exceeding 22% of the Ethereum staking market. This self-limit proposal is aimed to counteract fears of the Ethereum staking system becoming overly centralized, preserving the decentralized ethos of the network.

These providers are committed (or are in the process of committing) to self-limit to <22% of Ethereum validators. This is how our chain will be successful: Coordination above greed. Cooperation instead of winner-take-all.@Rocket_Pool @stakewise_io @staderlabs @divastaking

— superphiz.eth 🦇🔊🛡️ (@superphiz) August 30, 2023

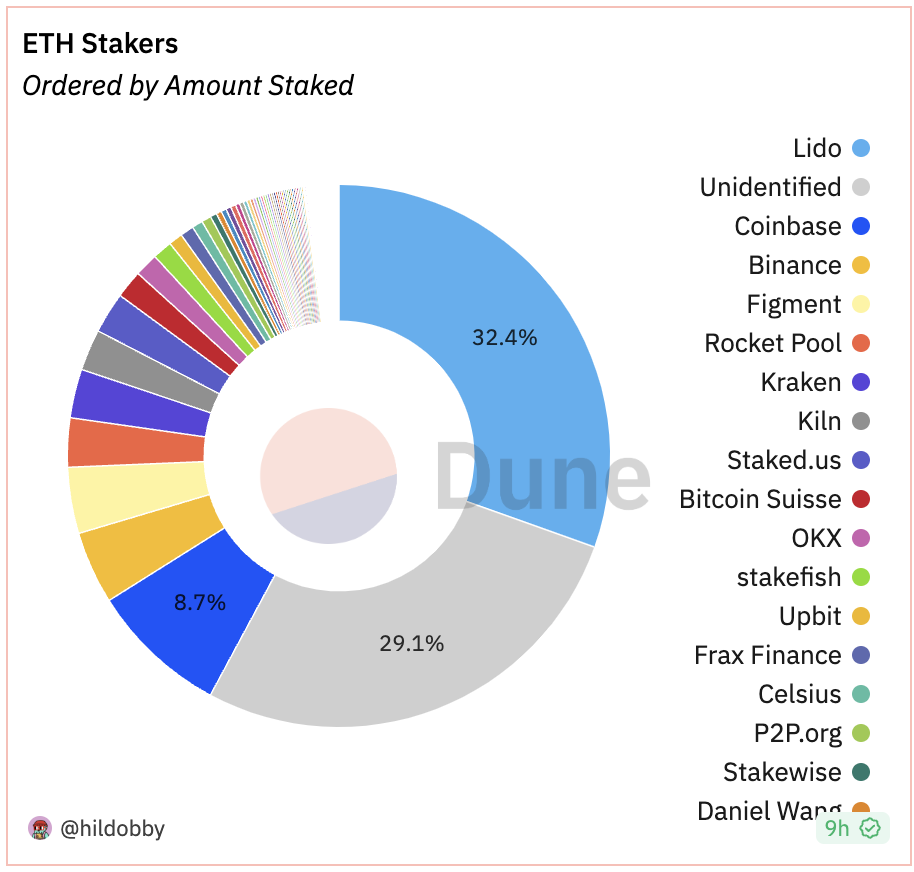

Ethereum core developer Superphiz proposed the 22% self-limit rule, highlighting that the requirement for 66% of validators to agree on the Ethereum state necessitates at least four major entities to collude for the chain to reach finalization, thereby enhancing the network’s security. Lido Finance, the most significant Ethereum liquid staking provider, chose not to self-limit, with a vast majority of 99.81% of votes against the measure.

Lido DAO, which is currently dominating the ETH markets, as per the DUNE data, accounts for about 32.4% of all staked Ether; has interestingly voted with 99.81% majority not to self-limit back in June.

Source: Dune Analytics

This decision has led to debates within the Ethereum community about the right approach to maintaining decentralization.

Read More: Ethereum Price Prediction

Implications and Conclusion:

The Ethereum community finds itself at a crossroads regarding adopting the self-limit rule among liquid staking providers. While some argue that market dominance should not necessarily be seen as a greedy pursuit, others emphasize the potential dangers of centralization. The initiative signifies a collective effort to ensure Ethereum’s long-term health and resilience. As the industry navigates this dynamic landscape, maintaining a balance between market efficiency and decentralized control remains a paramount concern.

Source: Cointelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more