Table of Contents

ToggleKey Takeaways:

- Despite having a slow beginning to the year 2023, but in the following days – the altcoin king, Ethereum has managed to perform significantly well.

- Ethereum price has managed to rake up nearly 9% on the upside in the past week alone.

The new year of 2023 began on a very slow but in the past week but despite that, it has been a better performer than the king of cryptos, Bitcoin. While Bitcoin price has been able to gain only about 3.5-4% in the past week, Ethereum price has managed to gain nearly 9% in the same timeframe.

In fact, we have observed in the last week that many of the altcoins, including memecoins like Dogecoin (DOGE) and Shiba Inu (SHIB) have been trying to gain back its lost ground bit by bit, while Bitcoin remained flat. Now, with that in mind – are we seeing the beginning of an altcoin season, and if so we will need to take a closer look at the largest altcoin by market capitalization – Ethereum.

Additional Read: Top Ethereum ERC-20 Tokens

ETH TECHNICAL OVERVIEW

Ethereum price has been managing to gain quite a lot of lost ground on the chart, as we can observe above. In the past week, ETH price has added nearly $100 of value of its token since the beginning of the year, going from $1200 to $1300 as of writing. All this has happened while Bitcoin has remained more or less flat in the same timeframe, as mentioned earlier. This is a decent indicator of the oncoming of altcoin season. By definitions, an ‘altcoin season’ is marked by a period of decreasing Bitcoin dominance along with rising altcoin market capitalisation.

On the technical front, ETH price has been becoming stronger too. In the past week, it has broken past two coinciding resistance levels, the 50 day moving average and the medium term resistance level (marked in black). It has convincingly broken out of both these levels and indicate underlying strength in the token. Also, ETH current market price is on the way to touch and possibly breach two more coinciding resistance levels, the 200 day moving average and the next trendline resistance (horizontally marked in blue). A breakout over this would also result in a breach above the $1400 mark and bring it ever so closer to the psychological level of $1500. With a Relative Strength Index level of 65 as of writing, we could possibly see some greater upside before a correction comes into the picture post the rally.

Now let’s take a look at a few on-chain metrics that could possibly be helping this bullish action.

Read on: What is the Ethereum Price Prediction for 2023?

ETH SUPPLY ON EXCHANGES AT A 1-YEAR LOW!

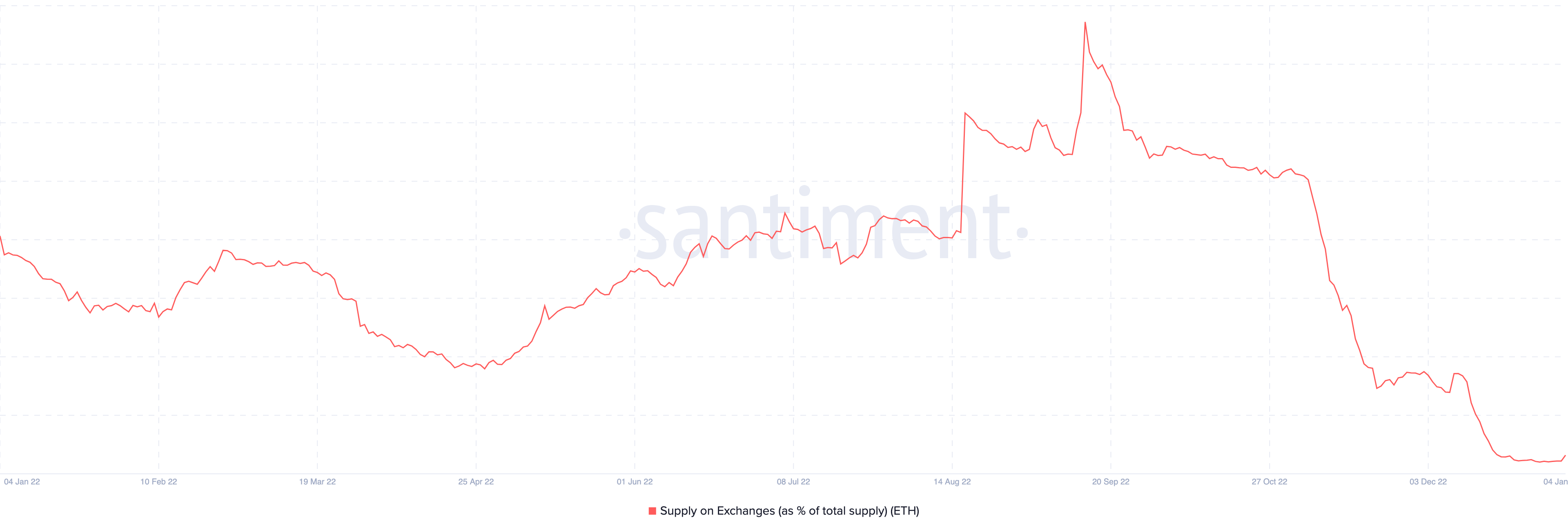

In a major positive signal for Ethereum’s native crypto token, ETH – its supply on exchanges is practically at the lowest point in the past one year. And that too, by a large margin. In fact, according to data sourced from Santiment, a crypto on-chain analytical tool – ETH’s supply on exchanges is at a multi-year low! ETH supply on exchanges (as a percentage of total supply) has never touched such low levels since the month of May, 2018!

This is a reasonably strong signal for ETH token holders because – a lower supply on exchanges means people are taking their ETH tokens off their exchange wallets and putting them in their personal, self-custodial hardware or cold wallets to hold for the long term. This trend began right at the moment the Ethereum Merge took place, back on the 15th of September 2022 and since then has been on a strong downtrend. Thus a lower supply on exchanges means more people are intending to HODL their tokens and thus bodes well for the long-term prospects of the coin.

ETH supply held by top addresses has also doubled in past 2 months!

To further add to the bullish prospects by the above metric – Ethereum’s supply held by top addresses on the chain have nearly doubled in the past two months alone! It has gone from under 25% in the middle of November 2022 to over 52% as of writing! This indicates strong HODLing activity being undertaken by the major heavyweight ETH holders in the ecosystem. While, this could be a concerning signal that a lot of coins is held by a few – it is also a good signal for the time being that the current price consolidation of the ETH token is being heavily bought into by these seasoned large scale players in the market.

Read More: Ethereum Shanghai Upgrade

Conclusion

Thus, in conclusion from the above two metrics – namely the supply on exchanges and the supply held by top addresses – we can safely say that larger, more competent and knowledgeable investors in the market are buying up ETH as weaker hands are selling them off in the price consolidation period. This is a strongly bullish signal for any crypto token and indicates a continued bullishness may happen in the near future and that the altcoin season might just be at hand!

Prices as on 9 January, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more