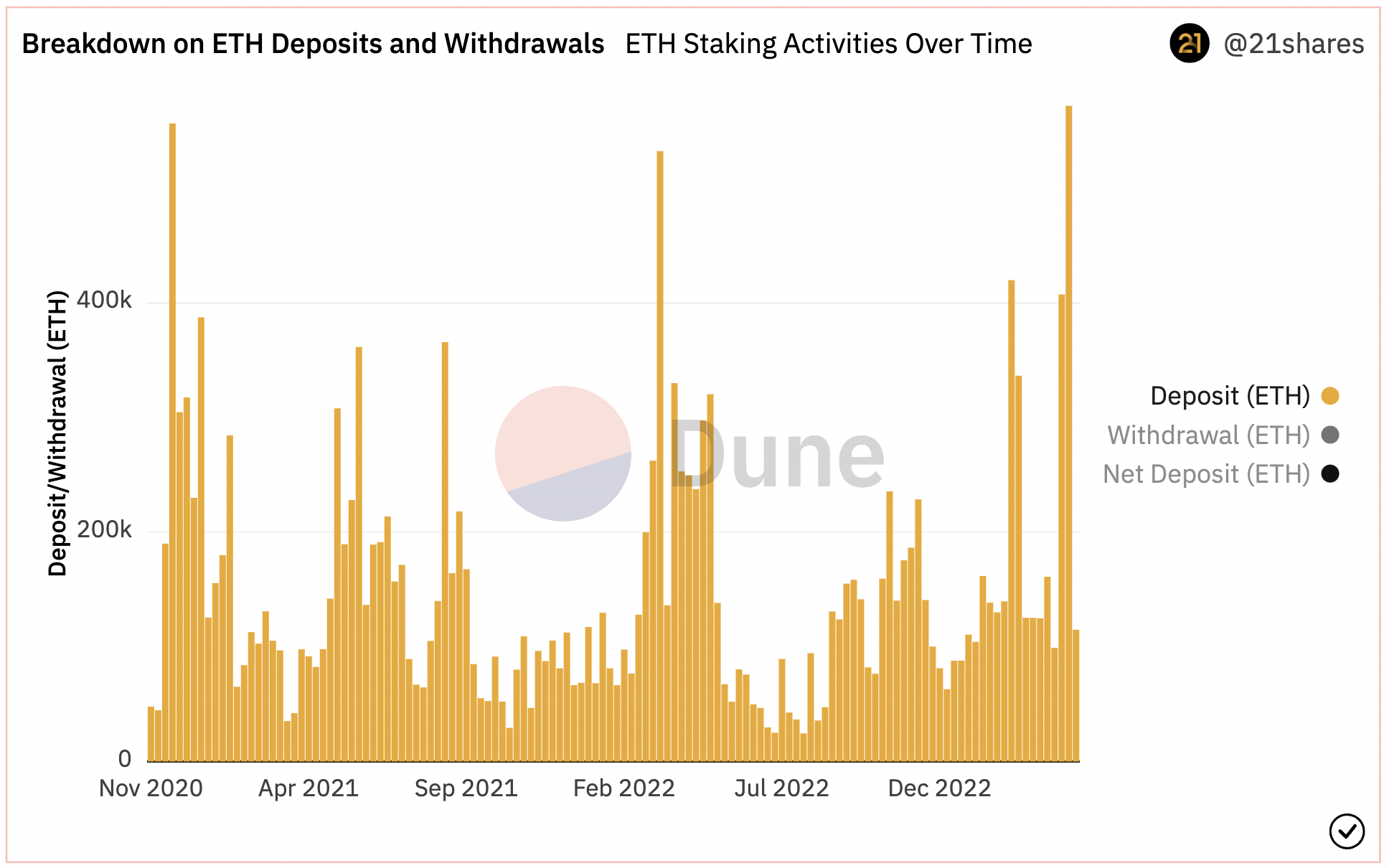

The Ethereum Shanghai Upgrade went live successfully earlier this month on April 12 and in the past week the largest smart contract network by total-value-locked (TVL) has seen a record-breaking weekly inflow of Ether (ETH)! In fact, according to an article by CoinDesk, about 572k ETH tokens were deposited into staking contracts, worth over a billion dollars. Crypto analysts think that this bout of heavy ETH staking was mainly undertaken by institutional staking service providers and investors reinvesting their rewards after withdrawal.

For some context: under the EIP-4895 in the Ethereum Shanghai Capella Upgrade, validators on the PoS-based Beacon Chain for the first time could now withdraw their staked tokens and also all the rewards they had accumulated ever since the Beacon chain went live back in December 2020.

According to data from Dune Analytics data dashboard created by Tom Wan, an analyst of digital asset investment firm 21Shares, institutional investors deposited about 571,950 ETH tokens into staking contracts, which are worth well over $1 billion. This was the biggest weekly token inflow in the Beacon Chain’s two-and-a-half-year history.

Read on: Bitcoin & Ethereum Price Jump 2%, Checkout Why?

ETH staking deposits | Source: Dune Analytics, 21Shares / CoinDeskAccording to Tom Wan, an analyst at digital asset investment firm 21Shares – institutional staking services drove a lion’s share of the major surge in deposits on the Ethereum network.

Last week had the largest weekly $ETH Staked with 571K. Flow is mainly driven by Institutional Staking Providers:

Last 7D ETH Deposit@stakefish: 73.9k @staked_us: 46K @Kiln_finance: 17K @Figment_io: 6.6K@BitcoinSuisseAG: 4.9K

Data: @DuneAnalytics https://t.co/ulhZnfflUJ https://t.co/932yulhuLw pic.twitter.com/x2xiZlgczD

— Tom Wan (@tomwanhh) April 24, 2023

Institutional ETH investors taking the lead!

Ever since the Ethereum Shanghai Capella Upgrade went live, the top 5 institutional staking service providers, ranging from Bitcoin Suisse, Figment, Kiln, Staked.us and Stakefish – staked a total of 235,330 ETH, which converted to dollar terms comes to about $450 million, according to the 21Shares’ Dune dashboard.

Additionally, Wan in another tweet highlighted that this move by institutional investors indicates that enabling withdrawals from Ethereum’s proof-of-stake chain has reduced the liquidity risk associated with locking up tokens on these staking contracts.

Read more: Ethereum Price Prediction 2023

3/ Institutional Staking Providers have significant inflows of $ETH Staked as Shanghai has reduced the liquidity risk for investors

Last 30 Days ETH Staked:

– @stakefish: 90k

– @staked_us: 70K

– @Kiln_finance: 35K

– @BitcoinSuisseAG: 17K

– @Figment_io: 12K pic.twitter.com/aRQFkGLbqk— Tom Wan (@tomwanhh) April 23, 2023

Restaking validator rewards

Additionally, another aspect of this major spike in the number of ETH tokens flooding back into the staking contract is likely due to the positive investor sentiment which results in investors choosing to reinvest the staking rewards they had earned and withdrawn post the Shapella Upgrade.

According to data from K33 research, In the first week after the Shapella Upgrade went live, investors withdrew about 900,000 ETH worth of staking rewards. While staking deposits totaled around 667,000 tokens – nearly 6 times a week before the Shanghai Capella Upgrade went live.

Thus overall, things seem to be moving in a very bullish direction for the altcoin king as more and more withdrawal staking rewards are coming back into the system to secure the network further.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more