The highly anticipated Ethereum Shanghai Upgrade went live last week – which marked the completion of the transition of Ethereum from a proof-of-work (PoW) consensus mechanism blockchain to a fully functional proof-of-stake (PoS). With Ethereum Shanghai Capella Hard Fork going live last week on April 12, we saw one of the most sought-after functionalities – the withdrawal of staked Ether from the deposit contract on the Beacon Chain finally being allowed.

Hi Shapella 👋

Withdrawals have appeared! pic.twitter.com/POqeZwkZJ4

— Etherscan (@etherscan) April 12, 2023

With the withdrawals of Ether from the PoS Beacon Chain finally being unlocked for validators, over a million ETH tokens, worth over $2.1 billion have been withdrawn in the past 6 days, since the date of the upgrade. According to data from beaconcha.in, the withdrawals have come from 473,700 withdrawal requests, on April 15, recording the largest withdrawal day at 392,800 ETH. As of now, nearly 87% or about 469,000 out of 540,000 active validators are enabled to withdraw their staked Ether on the Beacon Chain.

ETH price holds strong!

There was a lot of debate around the price of Ethereum’s native crypto token, ETH – and whether it would rise or fall after the then-proposed unlocking of staked Ether. While there was a large cohort thinking that the sudden supply could result in some selling pressures on the price of the ETH token, looking back now, it is clearly evident that wasn’t the case. Within two days after the upgrade went live, ETH price managed to rally over 10%, to touch the $2100 level – and is currently trading at an 11-month high!

It is even speculated that much of the stake that is being withdrawn isn’t being sold off in the market to be redeemed for dollars but rather is going back into the Beacon Chain as validators are looking to compound their stake and returns from staking. This is indicative of the fact that the net ETH staked on the Beacon Chain is actually increasing!

Read on: Ethereum Price Prediction 2023

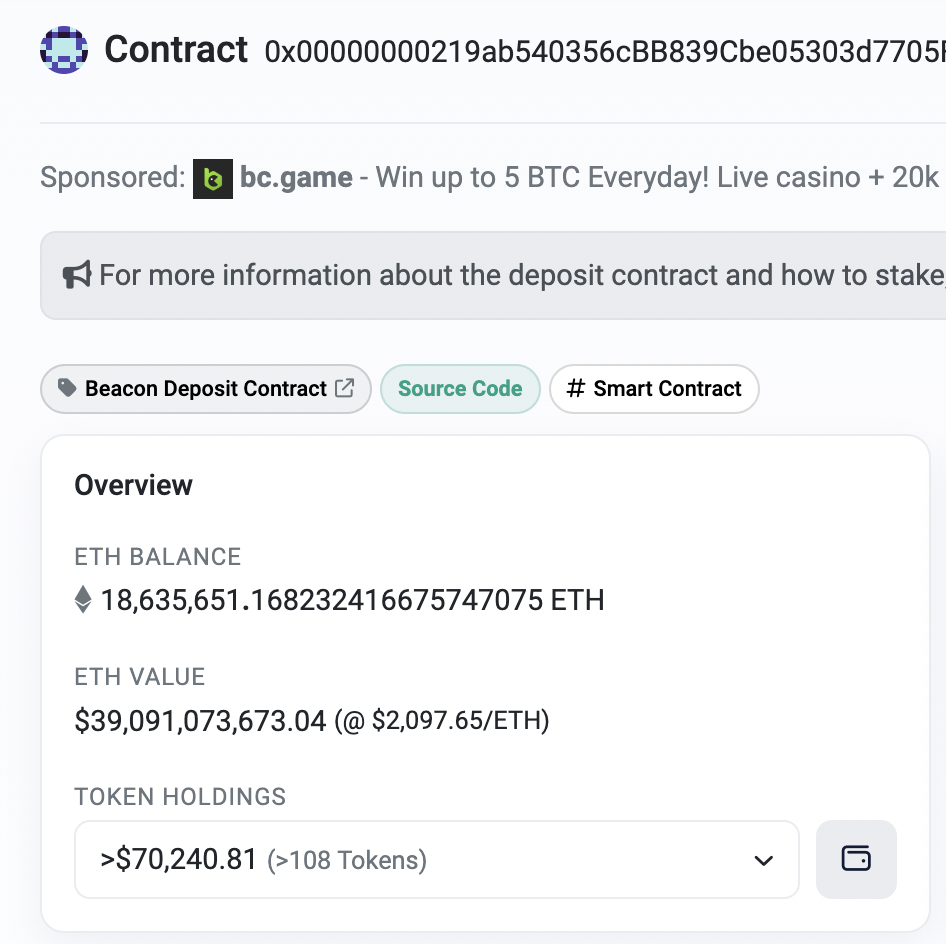

As of writing this article, according to data from Etherscan.io, the total ETH balance in the deposit contract stands at a little over 18.6 million ETH, which is worth over $39 billion, at a value of $2097 per ETH. This means that a large portion of the ETH that is being unstaked is coming back into the system, being reinvested to secure the Ethereum network.

There were a lot of factors that played into the overall reaction to the Shanghai Upgrade and the unlocking of staked ETH tokens. Many early stakers, who stuck with Ethereum ever since the launch of the Beacon Chain back in December 2020, wanted to liquidate their assets and redeem some value. But this reinvestment of those unlocked tokens indicates the overall bullish sentiment regarding the second largest crypto by market cap, about its future, and has a long-term outlook on the network.

Read on: Crypto Market Cap Sustains, Ethereum Price Surges to $2100

The Beacon Chain is the PoS-based chain that is running in parallel to but is expected to completely replace Ethereum’s earlier PoW execution layer. This PoS algorithm is expected to bring down energy consumption by the network as a whole, is expected to reduce the energy consumption required for mining, and increase the efficiency of the network. With the success of the Beacon Chain withdrawals, the transition to PoS is looking more promising than ever before. It is also expected to solve Ethereum’s skyrocketing gas fees problem by reducing network congestion, increasing transaction speeds, and reducing transaction costs on the network, and bringing it to par with some of its competition.

Thus overall, Ethereum being able to process over a million ETH tokens, worth over $2 billion in the past five to six days is an overall bullish sign. It indicates that the upgrade is running fine and overall Ethereum is fully transitioning to a proof-of-stake (PoS) network!

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more