Table of Contents

ToggleKey Takeaways:

- Ethereum Classic has been one of the most promising proof-of-work based smart contract capable cryptos out there in the market ever since the Ethereum Merge took place back in September 2022.

- Ethereum Classic price had been rallying strongly ahead of the Merge but soon after succumbed to broader market pressures and saw major fall in price.

- However, with the beginning of 2023, ETC price has managed to show over 12% rise – will this be able to sustain in the year to come?

Ethereum Classic was one of the biggest outside beneficiaries of the Ethereum Merge, as proof-of-work miners needed to shift to another platform that used a similar architecture as that of Ethereum’s but on the PoW consensus mechanism. This way – these older miners wanted to fully utilize the funds they had invested into purchasing mining hardware but were suddenly rendered useless by the Ethereum Merge.

Read More: Ethereum Shanghai Upgrade

ETC TECHNICAL OVERVIEW

From a technical standpoint, Ethereum Classic price is presently very weak as of writing. Despite the significant jump in ETC price in the past 24 hours of over 10% – it is trading well below crucial support level of $22 (marked in yellow). It is even trading below its 5o and 200 day moving average. To further add to that, ETC price also suffered a death cross in the early days of November, when the 50 DMA crossed below the 200 DMA – which would further put selling pressures on the price.

However, on the flip side – despite the over 10% jump in ETC price – the Relative Strength Index for the token is still around 55 as of writing – thus indicating that the coin still has some upside remaining in its current rally trajectory. If in the next couple of days it is able to break out of the psychological resistance level of $20 and the trendline resistance of $22 – that we could see a strong 100% rally from there all the way up to even $44 in the next couple of months.

Additional Read: Ethereum Classic Price Prediction

ETC’s Social Dominance on a strong uptrend!

Ethereum Classic’s social dominance has been on a strong uptrend ever since the successful implementation of the Ethereum Merge and more so in the past two months. ETC’s social dominance metric, according to data sourced from crypto analytical platform Santiment shows that it has gone from 1.2% at the end of October 2022 all the way up to almost 3.2% in the middle of December 2022 before stabilizing around 2.6% as of writing.

This is a decently good signal that there is a lot of market chatter happening around the altcoin and people are genuinely interested about it. And if the overall market supports, this could help to further strengthen any upward movement in price that may happen in the near future.

ETC Hashrate continues to sustain high levels

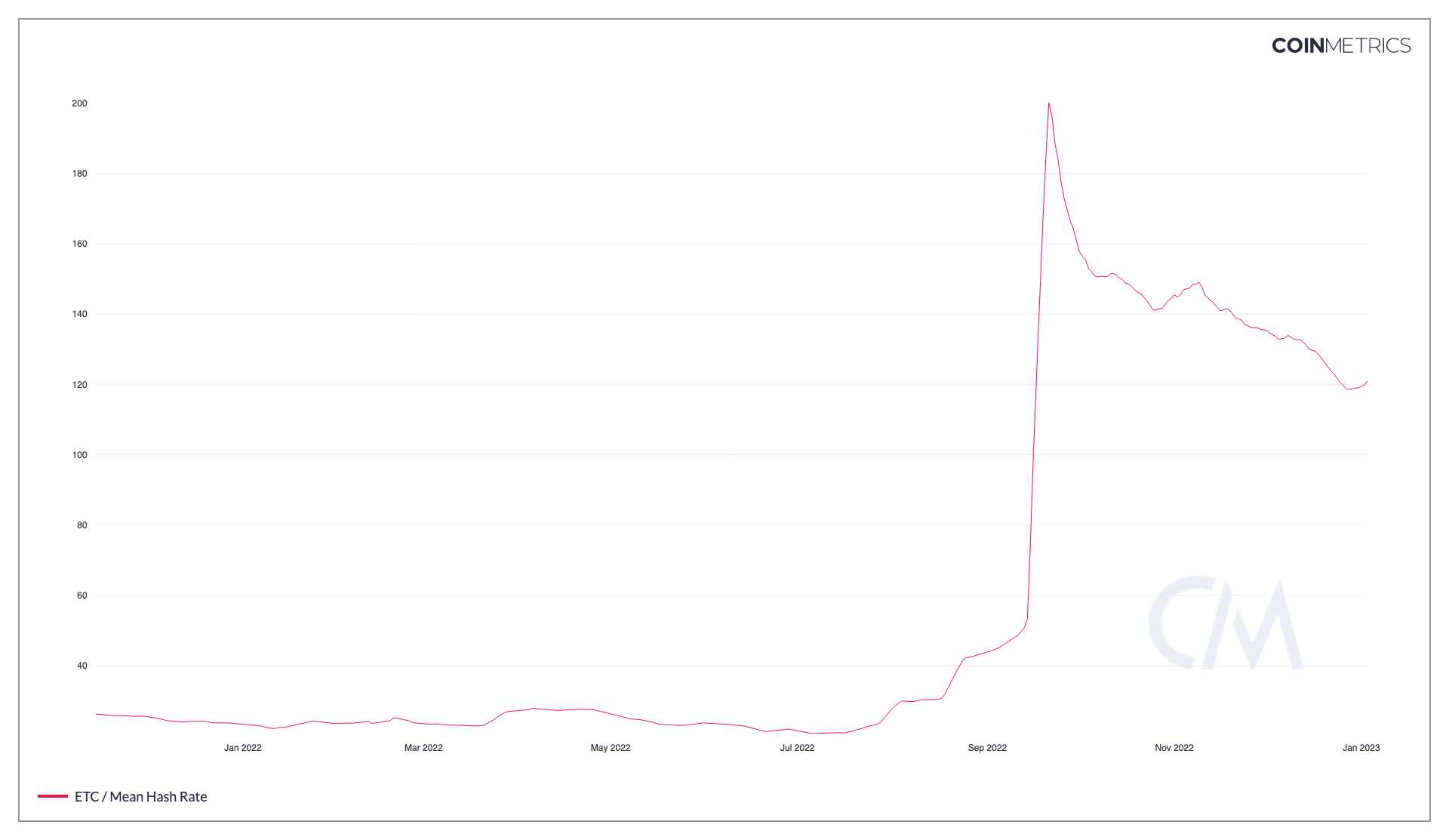

Along with the above point, Ethereum Classic’s mean hashrate has also been fairly positive. On the chart above, we can see a huge jump in the mean hashrate of ETC in the month of September, which coincides with the implementation of the Ethereum Merge – where the mean hashrate jumped by over 400%, or about 5 times in a single day.

But since then it has fallen a little bit, however that is but natural since such a high hashrate developed in such a short period of time is never sustainable. Thus if you’re looking at it from a different angle, you’ll see why the hashrate is still on a very strong trajectory. Back in July and August of 2022 – ETC’s mean hashrate was well below 40 but that is around 120 as of writing, which also presents an advancement of over 250%.

Read more: Why Solana Price is rising today?

Conclusion

Thus in conclusion, judging from the on-chain metrics we discussed about, ranging from improving social dominance and a strongly rising hashrate – things on the fundamental front looks quite positive for the Ethereum Classic ecosystem. However, on the flip side, technical factors are weighing in heavily on the bearish side, with ETC price well under important resistance zones. Thus, this is a coin that becomes a strong recovery candidate, as and when the overall market sentiment improves.

Prices as on 4 January, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more