Table of Contents

ToggleKEY TAKEAWAYS:

- Ethereum Classic delivered a huge rally when the Ethereum Merge transitioned from a PoW consensus mechanism to a PoS one.

- Since then it has corrected nearly 40% along with the market wide bearish sentiment.

- But it is now close to providing a breakout from a bearish chart pattern, but do on-chain metrics support a bullish view?

Ethereum Classic has been a favourite for short term traders for quite some time. Earlier, it served as a cheaper and more volatile alternative to Ethereum, which is the second largest crypto by market cap. ETC provided very similar features as Ethereum, with the only difference being that it was far more volatile, but tended to mimic ETH price action with some added volatility. Thus due to that, it provided good trading opportunities along the way.

But soon after the Ethereum Merge, that transitioned the largest smart contract capable blockchain network by market capitalisation from a proof-of-work to proof-of-stake consensus mechanism, Ethereum Classic became a favourite for miners too, who had invested a lot into buying expensive equipment to buy mining rigs to mine Ethereum but now were rendered useless. Since Ethereum Classic shared the internal architecture of its bigger brother, it became the de facto option for these PoW miners to earn mining rewards, that led to a skyrocketing of its hashrate within a matter of weeks.

But since the Merge, Ethereum Classic has corrected nearly 40% and now could be gearing up to create a price bottom. Will it be able to deliver yet another rally for its investors?

ETHEREUM CLASSIC TECHNICAL OVERVIEW

From a technical point of view, Ethereum Classic price looks moderately optimistic as of writing this article. The small rally in the last couple of days has brought ETC price very close to breaking out of the descending triangle pattern (marked in yellow). A descending triangle pattern is a bearish price pattern and a price breakout from it indicates that there is newfound bullishness in the asset. Thus ETC price action over the next couple of days will be quite important from that point of view.

Along with that, the abovementioned breakout would also result in two more extremely bullish things to happen on the chart. One, a good strong breakout would put ETC price above the 50 and 200 day moving averages while at the same time, it could also result in the formation of a golden crossover, a crossover of the 50 DMA over the 200 DMA. And with the Relative Strength Index just shy of the 50 mark, any upwards momentum would be well supported by the RSI too.

Read more: Ethereum Classic Price Prediction

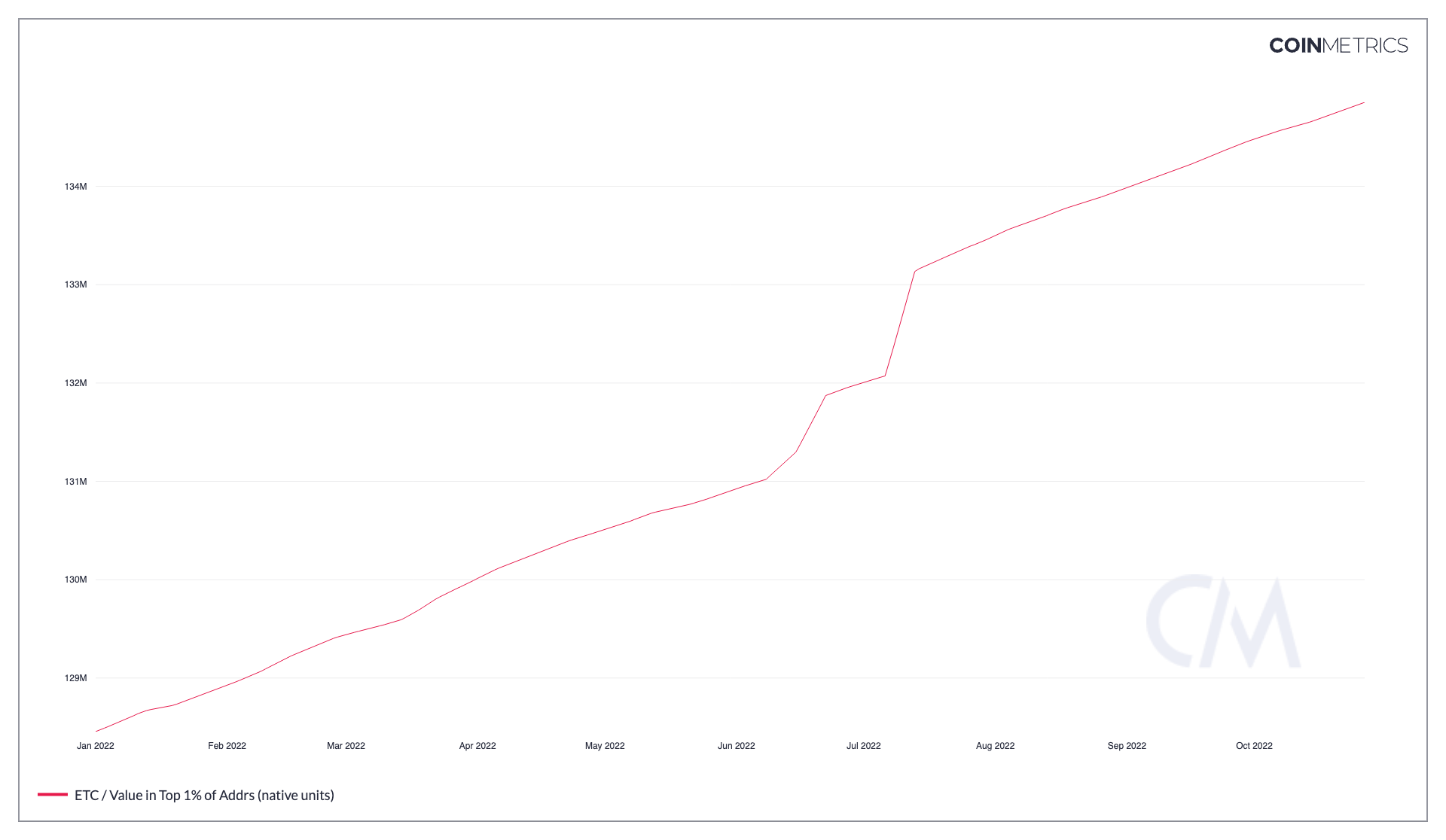

RISING SUPPLY IN TOP 1% OF ADDRESSES

As you can see from the chart above, the supply that is held by the top 1% addresses on the Ethereum Classic’s blockchain network has been on a steady rise ever since the beginning of the year, despite the many crashes ETC price has suffered in the interim. The top 1% addresses indicate the behaviour of the richest holders on the ETC blockchain and whose actions quite easily determine the price action Ethereum Classic will go through. Hence a steadily rising figure on this particular on-chain metric indicates that these large holders have high confidence on the token and are buying up more and more of the crypto despite the bear market. Thus overall, it is a good positive indication that would support any bullish action in the future.

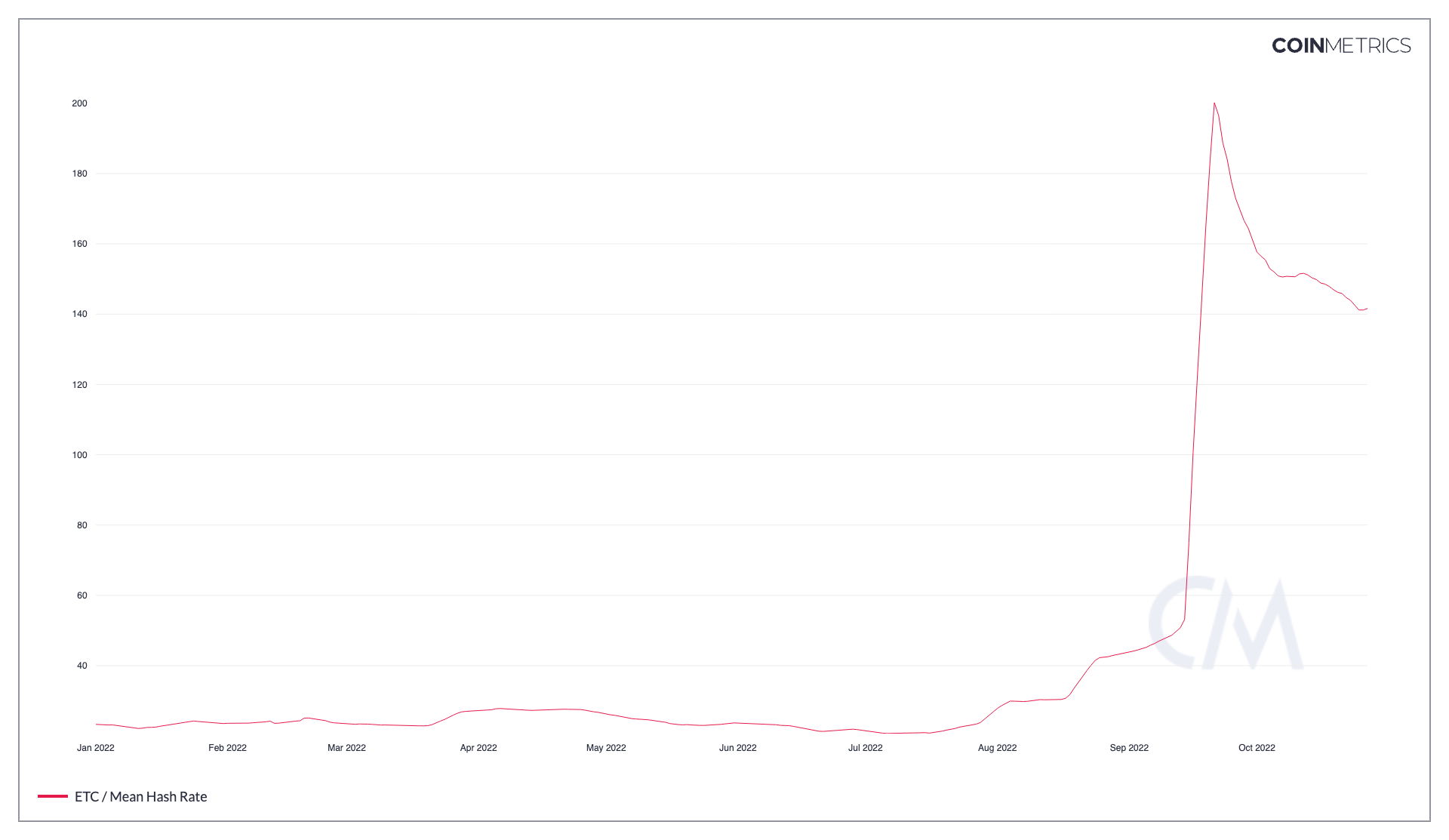

ETC’S HASHRATE ALSO JUST BELOW ALL-TIME-HIGHS!

As mentioned earlier, a lot of the Ethereum mining rigs that became useless the day Ethereum transitioned from PoW to PoS on the 15th of September, 2022 – most of it resorted to jumping onto the Ethereum Classic blockchain to ensure that they didn’t have to throw away their investments on the mining rigs. This is evident from the chart above which indicates the skyrocketing of the blockchain’s mean hashrate beginning on the 15th of September and continuing all the way till the 22nd after which it declined a little bit as the space became too overcrowded.

However, despite the slight drop off from the ATH, it is still at one of the highest points in the history of Ethereum Classic, which bodes well for the security of the network, and thus opens up a world of applications for the network in the future.

Read more: Ethereum Price Prediction

CONCLUSION

In light of the above observations, we can conclude that Ethereum Classic’s metrics seem very optimistic as of now. Analysis of both technical factors and on-chain metrics indicate that this particular crypto well poised to support any bullish breakout that may happen in the near future. Thus if we see a sustained broader market recovery in sentiment and price, Ethereum Classic would definitely be a good recovery candidate in such a situation.

Prices as on 28th October, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more