Table of Contents

ToggleKey takeaways:

- Ethereum Price rallies back above $1500 on the charts.

- $1500 is a crucial psychological price level which has been difficult to breach in the past.

Recent Updates

- The Ethereum Foundation has rolled out proposals for grants worth $750,000 to encourage research & development around layer 2 application & education. The proposals are due in 6 weeks from October 24th, 2022.

🎢 Layer 2 Grants round is open 🐼

The Ethereum Foundation seeks proposals for tools, analysis, research, and education on layer 2 rollups.

Details: https://t.co/p31cRYRfwp

The submission deadline is in six weeks. DMs are open if you have questions!

— SnapCrackle.eth (@james_gaps) October 24, 2022

Technical Analysis of Ethereum(ETH)

- After nearly a month of trading along the lower support, ETH price have inflated and are attempting to reclaim their positions within the ascending triangle.

- However, after breaking through $1500, the bulls are expected to be exhausted for some time, after which the ETH price may experience a minor pullback.

- Meanwhile, the price may test highs near $1600 and face significant rejection, but it may remain firmly above $1450.

- As a result, the Ethereum price may eventually oscillate between $1450 and $1586 for some time before breaking out of the consolidation and reaching $1750.

Additional read: Ethereum Price Prediction

Supply in Top Addresses sees a dip

The trend of the top 100 addresses reflects whales’ and long-term holders’ trust in the crypto asset. Meanwhile, no significant price change is expected to occur immediately, but it will undoubtedly affect retail or short-term trader holdings. If the top 100 addresses accumulate, it is expected that the price will rise in the coming days, whereas a drop in holdings may cause panic selling.

Currently, supply in the top addresses has risen above 30 million after falling below 28 million. As a result, the possibility of going long in the coming days is implied. An increase in the supply of these addresses may eventually reduce the number of tokens in circulation, which may raise the price of ETH in the coming days.

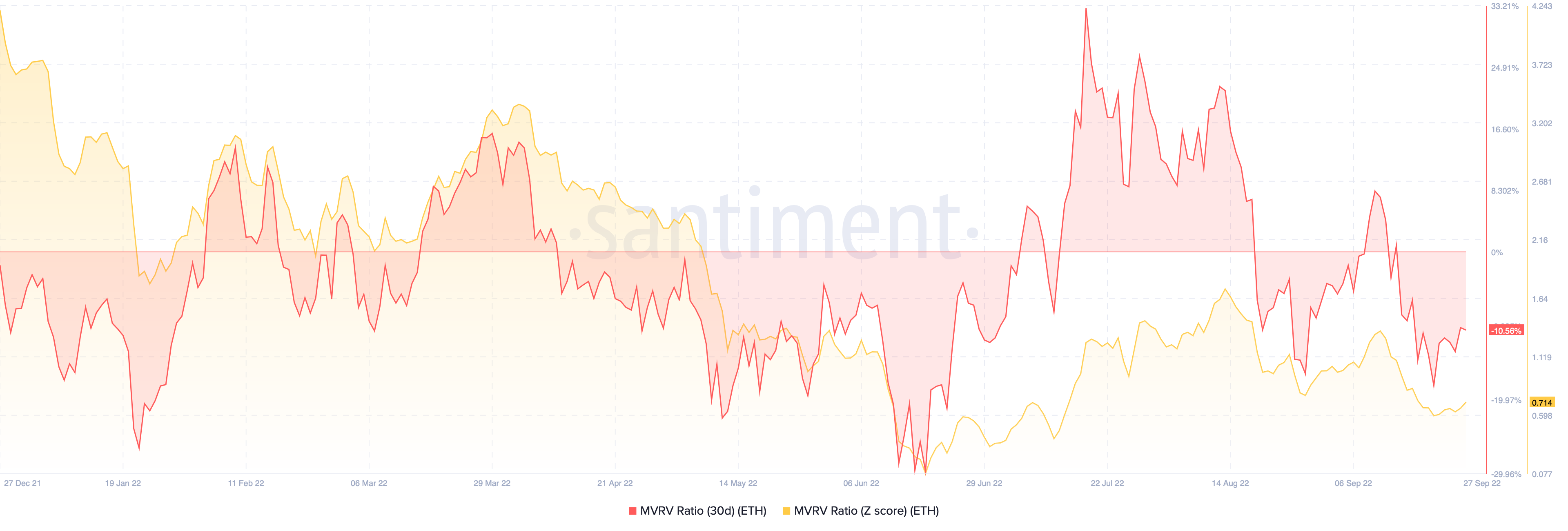

MVRV Ratio indicates undervaluation

MVRV is a ratio that compares Market capitalization to its realized cap indicates when the exchange traded prices fall below the fair price. A fair price is also called the MVRV-Z score which is the difference between market capitalization & realized market capitalization. These indicators determine whether the crypto is undervalued or overvalued.

The ETH MVRV ratio & the MVRV-Z score has plunged significantly below 0 to reach -10.56% & -19.97% respectively. Therefore, indicating that the second-largest crypto is heavily undervalued and hence could be preparing for a massive breakout in the near future.

Read more: Ethereum Technical Analysis

Staking Revenue on Rise

Staking is a process of actively participating in the validation process of the blocks, similar to mining in the working of the PoW mechanism. A holder with a minimum required balance of ETH can validate transactions and earn rewards. Ever since Ethereum introduced staking rewards, the revenue over time has been incremental and remained above $1000 with 4.8% annualized interest.

The ETH staking was launched much before the launch of the Beacon Chain in December 2020 and since then the staked ETH over the ETH 2.0 chain is making new highs every new day. Presently, more than 15 million ETH has been staked with more than 451K validations.

In Conclusion

In the recent past, Ethereum has increased by nearly 20%, rising from around $1300 to as high as $1593. As a result, the bullish momentum is expected to continue as the bearish influence appears to have diminished significantly. Meanwhile, the rise in the top address and the significantly decreased MVRV ratio point to a significant price action that is rapidly approaching.

Prices as on 27th October, 2022.

Read more: Bitcoin Price Prediction

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more