Table of Contents

ToggleKey Takeaways:

- MATIC’s price has faced significant challenges in 2023, with a 30% drop since the year’s start and a 67% decrease from its year-to-date highs.

- A persistent downward trend marked by a descending blue trendline has been a defining feature of MATIC’s price chart.

- A death cross occurred in May 2023 when the 50-day and 200-day exponential moving averages crossed, exacerbating MATIC’s bearish sentiment.

- Breaking below a descending triangle pattern in July 2023 added further confirmation of MATIC’s overall bearishness.

- MATIC is currently trading at its lowest point in 2023, with support levels around $0.48 to $0.52.

MATIC Price Technical Overview

- Polygon’s MATIC is an altcoin that has been the most beaten-up crypto out of the top 20 cryptos by market capitalization. In fact, according to data from CoinMarketCap, the MATIC token’s price has fallen just over 30% since the beginning of 2023 and fallen nearly 67% from year-to-date highs!

- MATIC price saw a decent rally early on in the year, in line with the broader market – however soon lost that bullish momentum and fell victim to a massive selling pressure across the board.

- MATIC price has been falling steadily, creating a consistent downward trend, as indicated by the blue trendline on the chart, and things do not show potential to improve anytime soon from a technical point of view.

- The 50-day and 200-day exponential moving averages underwent a death cross back in May 2023, and the gap between the two has been consistently widening since then, making it more and more difficult for MATIC price to stage a recovery.

- MATIC price also broke down below a descending triangle pattern back in July 2023, further confirming its broader bearishness. In fact, Polygon’s price is trading at the lowest point in over a year, with the last time MATIC touched this price level being in July 2022.

- Polygon price is currently trading at the lowest point of 2023, and the region between $0.48 to $0.52 will serve as levels of support going forward.

- On the upside, MATIC’s price has a lot of hurdles to clear before it can regain a convincing strong bullish momentum. So far, indications suggest that MATIC’s price will continue to remain subdued by the market-wide selling pressures.

Read More: Polygon Price Prediction

Polygon On-chain Overview

MATIC’s MVRV Ratio Down 35%

Polygon’s MATIC token has seen a notable shift in its on-chain metrics, particularly in its MVRV (Market Value to Realized Value) ratio. This ratio compares the current market price of MATIC to the average realized price of all MATIC tokens in circulation. The drop in MATIC’s MVRV ratio from 1.16 in February 2023 to approximately 0.75 today raises questions about its implications for MATIC’s future.

A declining MVRV ratio often suggests that MATIC might be undervalued. It indicates that, on average, MATIC holders are not selling their tokens at prices as high as in the past, which could signal a lack of perceived overvaluation. This may be interpreted as a potentially bullish sign, as it could imply room for upward price movement.

However, the falling MVRV ratio could also be seen as a bearish sign, indicating a decline in short-term investor confidence or diminishing speculative interest. It might reflect concerns about MATIC’s long-term potential or prevailing market sentiment.

In essence, while the MVRV ratio provides insights into market dynamics, it should be considered alongside a broader array of factors. A comprehensive evaluation of trading volumes, adoption trends, network development, and external market influences is essential for a well-rounded understanding of MATIC’s future prospects.

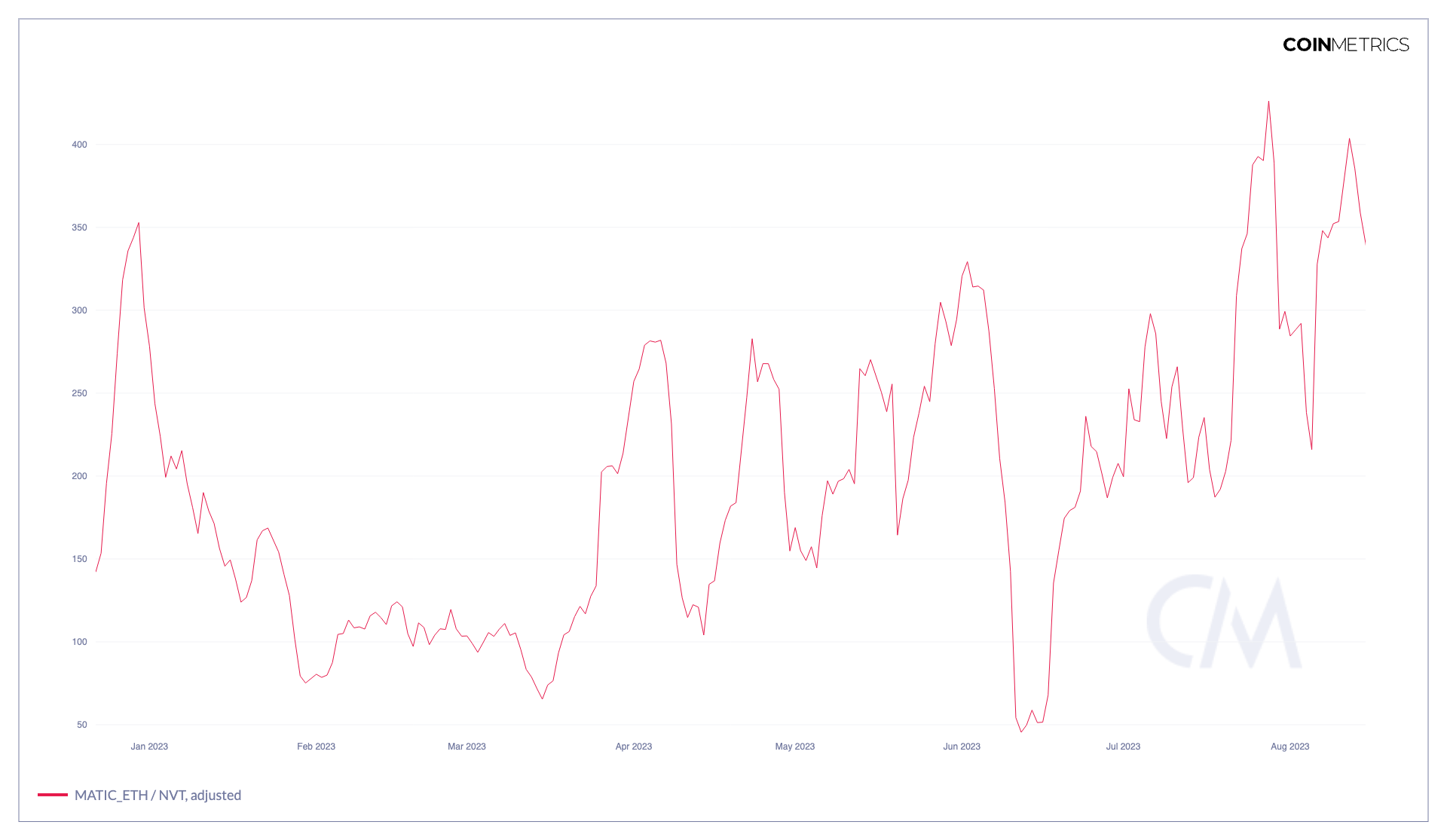

MATIC Sees Gradual Rise in its NVT Ratio!

Polygon’s MATIC token has recently experienced a gradual rise in its NVT (Network Value to Transactions) ratio, a metric that helps assess the relationship between the token’s market capitalization and its on-chain transaction activity. As you can observe from the chart above, MATIC’s NVT ratio has increased from 75 at the end of January 2023 to around 340 presently.

A rising NVT ratio often suggests that MATIC may be overvalued. It implies that the token’s market capitalization is growing at a faster rate than the number of transactions conducted on its network. This can indicate that MATIC’s price has outpaced its utility, potentially signaling an overheated market. This could be the potential case, as MATIC’s price has been falling consistently, and the active addresses on the chain have been falling too.

Learn More: Top Price Prediction BTC, ETH, DOGE, OP, XRP

Conclusion

Polygon’s MATIC token has encountered a challenging year, marked by a significant decline in its price and technical indicators pointing towards a bearish outlook. The death cross of the 50-day and 200-day exponential moving averages, coupled with a breakdown from a descending triangle pattern, has compounded MATIC’s bearish sentiment.

As the token currently trades at its lowest point in 2023, it faces numerous hurdles in regaining a strong bullish momentum. Market-wide selling pressures continue to weigh on MATIC, making it challenging for the token to stage a recovery. However, support levels around $0.48 to $0.52 may provide some stability. It is crucial for investors and traders to monitor these key technical factors and market dynamics closely when assessing MATIC’s future trajectory.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more