Crypto Market Cap back above $1 Trillion after the USDC Stablecoin Collapse

After the recent USDC stablecoin collapse, the crypto market cap has once again surged above the $1 trillion mark. However, it is still unclear what caused the USDC collapse and how it will affect the market in the long run. Read more here.

Table of Contents

ToggleKey Takeaways:

- Bitcoin & Ethereum prices mark a fine recovery during the past weekend and surged beyond $22,000 and $1600 respectively

- The global market cap which has plummeted close to $930 billion, regained levels beyond $1 trillion

Crypto Market Today at a Glance

| Global Crypto Market Cap | $1.02 trillion |

| Rise/Fall in Crypto Market Cap | +7.96% |

| Total Crypto Market Volume | $78.06 billion |

| Total DeFi Volume | $7.03 billion |

| Bitcoin Price | $22,227 |

| Bitcoin Dominance | 42.23% |

| Ethereum Price | $1592.83 |

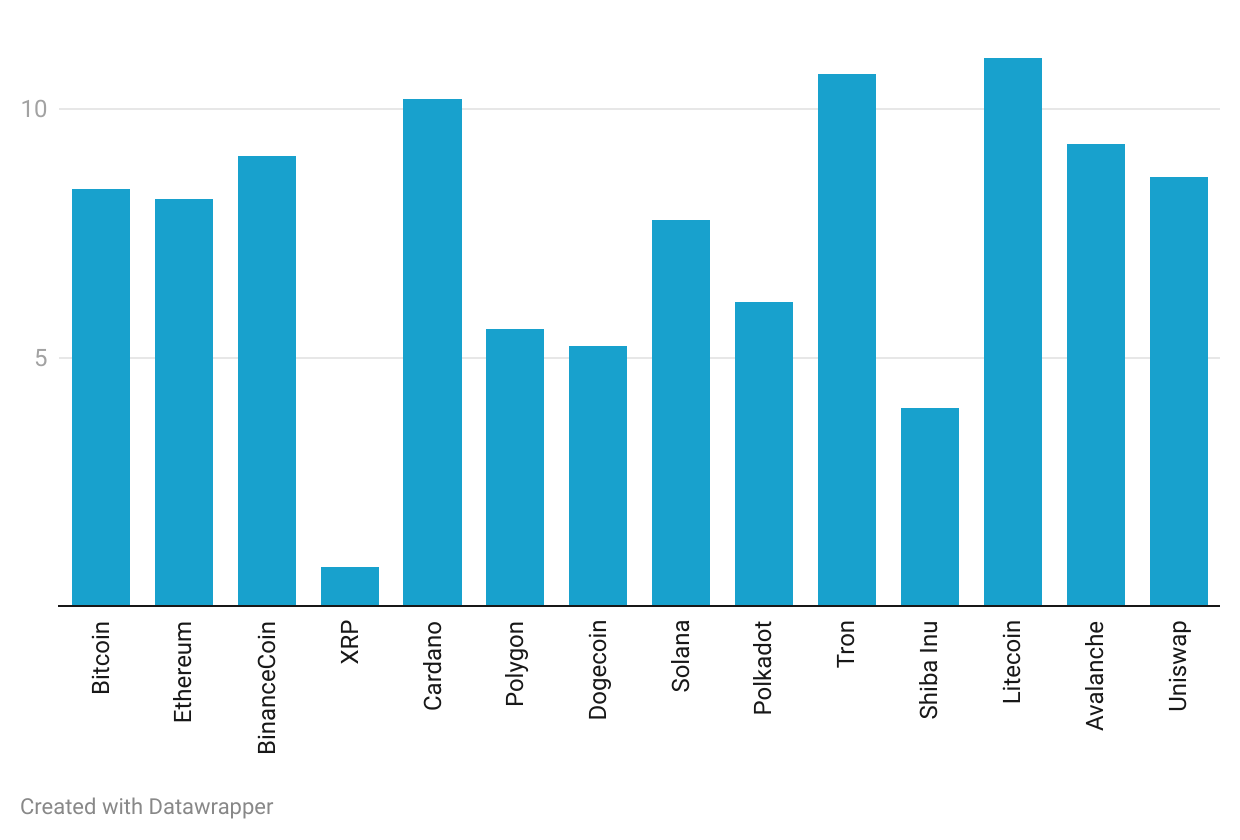

Top Cryptos Today by Market Cap

Source: Datawrapper

The global market cap has surged notably during the past weekend. The prices of the majority of the cryptos have surged finally and have attained their respective previous levels. Star crypto withstood one of the most difficult conditions which have earlier occur in 2008. Bitcoin, which was created as a sign of anger and disbelief over the traditional financial market, recovered from the losses in just 3 days and displayed its strength and being self-assured of the impending rally.

Tron witnessed a major downfall during the SVB debacle and plunged by more than 12% and presently is one of the top gainers within the top 15. Tron along with Litecoin marked a fine upswing of more than 11% each, while Cardano jumps by 10.21. The top 2 cryptos, Bitcoin & Ethereum surged by more than 8% each, but XRP price is following a lowered price action while the other tokens maintain a decent upswing.

Bitcoin has regained its dominance as it raised above 42.3% which indicates the shift of focus of the market participants over the star token. The SVB bank collapse may create a ripple of events ahead and hence the markets are expected to remain highly volatile. Besides, the fresh inflation rates along with PPI rates are to be released soon which may be accompanied by the employment data. Therefore, fueling the volatility throughout the week ahead.

Bitcoin Price Today

Source: Tradingview

Bitcoin is known for a strong recovery as the token has survived multiple bearish cycles and sudden price actions, one of which occurred just now. With the growing adoption rate, the price is believed to nullify the bearish action in the coming days which may pave way for a larger price action in the coming days. One such example occurred during the weekend when the price of BTC recovered finely after the price slash which was due to the uncertainty that prevailed after the collapse of the SVB.

BTC’s price unexpectedly dropped below $20,000 in no time and was attempting very hard to counter the selling pressure. However, once the markets calmed a bit, the bulls again uplifted the price. In the due course, the price raised beyond the falling wedge that it was trading for nearly a fortnight. However, after the breakout, the price surged but is experiencing hindrances in clearing the $22,500 crucial area and is facing a minor pullback.

A retest to the immediate lower support at $21,500 may be expected as the RSI is displaying a minor bearish divergence. This may induce catapult action to rise high beyond the $22,800 resistance.

Read More: Bitcoin Price Prediction

Ethereum Price Today

Source: Tradingview

Ethereum price is known to maintain enough strength and a calculated approach. The price maintains its volatility within decent levels and prevents sudden price actions. The token also recovered fairly by closely following the star crypto. Both the cryptos dropped with an equal margin and also recovered equally. However, despite a steep BTC price rise, ETH price continues to trade below the crucial resistance but it surely does not flash any bearish signals.

The RSI while heading towards the lower support region, rebounded without entering the oversold levels. Hence indicating the strength of the rally, which was further certified by a strong rebound. Hence, the price which rebounded from the 200-day MA levels in the short term is believed to reach immediate resistance beyond $1700 very soon.

Read On: Ethereum Price Prediction

Top Gainers & Losers

| Top Gainers | Top Losers |

| Conflux (CFX) +28.43% | UNUS SED LEO(LEO) -4.94% |

| Synthetic (SNX) +27.54% | Tether (USDT) -0.42% |

| Maker (MKR) +22.23% | Binance USD (BUSD) -0.13% |

| Stacks (STX) +22.01% | TrueUSD(TUSD) -0.01% |

| Optimism (OP) +21.17% | XDC Network(XDC) -0.38% |

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more