Table of Contents

ToggleKey Takeaways:

- Chainlink’s LINK price has surged 26% in 6 days, driven by positive sentiment and strong network activity.

- The anticipation of a spot Bitcoin ETF approval, growing interest in RWA tokenization, and increasing institutional adoption are fueling LINK price rally.

- Chainlink’s oracle services are becoming increasingly important in the evolving blockchain ecosystem.

- LINK price could continue to rise as demand for RWA tokenization and institutional adoption grows.

- Chainlink is well-positioned to become a key player in the future of finance.

Chainlink’s LINK price has recently experienced a remarkable surge, gaining 26% between November 2 and November 8, 2023. This impressive price action has propelled LINK to the position of the tenth largest crypto (excluding stablecoins) by market capitalization. With a market cap of over $8.1 billion, Chainlink is now firmly established among the top players in the blockchain industry.

Positive Developments Fueling LINK’s Rally

There are several factors that are contributing to LINK’s strong performance:

- Anticipation of Spot Bitcoin ETF Approval: The potential approval of a spot Bitcoin ETF has boosted sentiment across the crypto market. LINK, as a leading altcoin, has benefited from this positive sentiment. Analysts believe that a spot Bitcoin ETF could attract significant institutional inflows into the crypto space, leading to further price appreciation for LINK and other digital assets.

- Real-World Asset (RWA) Tokenization: The growing interest in RWA tokenization is creating opportunities for Chainlink’s oracle services. RWA tokenization refers to the process of creating digital tokens that represent real-world assets, such as stocks, bonds, or real estate. Chainlink’s oracle networks provide the secure and reliable data feeds that are essential for RWA tokenization. As RWA tokenization gains traction, the demand for Chainlink’s services is expected to increase, driving LINK price higher.

- Institutional Adoption: The listing of LINK on the HashKey exchange, which caters to professional investors in Hong Kong, indicates increasing institutional interest in the token. HashKey is a licensed trading platform with a strong reputation among institutional investors. The addition of LINK to its platform signals growing confidence in the token’s potential and could attract further institutional investments.

- Grayscale’s Chainlink Trust (GLNK) Premium: Grayscale’s Chainlink Trust (GLNK) is an over-the-counter (OTC) investment product that tracks the price of LINK. GLNK is currently trading at a significant premium compared to the underlying LINK holdings, suggesting strong buying demand from institutional investors. A premium indicates that investors are willing to pay more than the actual value of the underlying asset, reflecting their belief in the future growth potential of LINK.

Learn More: Why is Bitcoin Price Up Today?

Network Activity Supports Price Surge

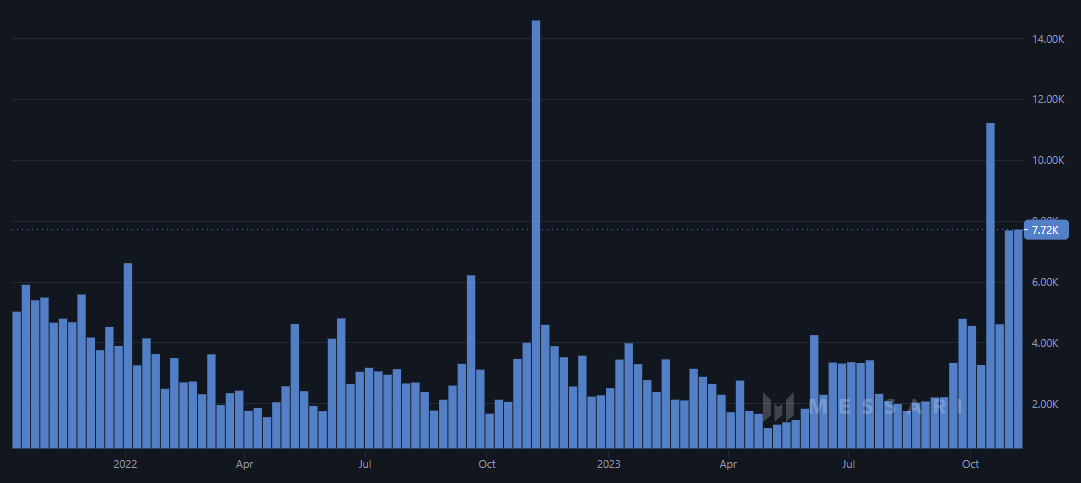

On-chain metrics also support LINK’s positive price action. The 1-day transaction count on the Chainlink network has reached its highest level since June 2021, excluding a brief spike in November 2022 due to issues at the FTX exchange. This increased network activity suggests a growing demand for Chainlink’s services.

Potential Tailwinds from the RWA Market

The RWA market is expected to grow significantly in the coming years, driven by factors such as increased demand for digital assets and the need for greater efficiency and transparency in financial markets. Chainlink is well-positioned to capture a significant share of this market with its robust oracle networks and proven track record.

While LINK has already experienced a significant rally, there may be room for further growth. The combination of positive developments, strong network activity, and potential tailwinds from the RWA market could drive LINK price even higher.

Read More: What Happened in Crypto Today?

Conclusion

LINK’s recent performance highlights the growing importance of Chainlink’s oracle services in the evolving blockchain ecosystem. As the demand for RWA tokenization and institutional adoption continues to increase, LINK is well-positioned to benefit from these trends and potentially reach new highs in the future. With a strong team, innovative technology, and a large and growing network, Chainlink is poised to become a key player in the future of finance.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more