Table of Contents

ToggleKey takeaways:

- Cardano has once again hit the top of the charts for the most developed crypto project out there, closely followed by Everscale and Ethereum.

- However, despite that, Cardano’s price performance has been well below average, other coins in the top 10 have managed to perform significantly better while responding to broader market sentiments.

- Cardano price is at the lowest point in the past 23 months!

Cardano – popularly known as the third generation of all cryptos out there, after Bitcoin and Ethereum being the first and second generation respectively – has been out of the news for quite some time. It was very well talked about all of last year, back in 2021 but since the beginning of the bear run of 2022 – Cardano price performance has been pretty poor.

But, despite that – fundamental things for the project seem to be going relatively well. As of 3 December – Cardano once again hit the top of the charts in terms of the most developed crypto projects in the entire market – according to data from GitHub on their project developer commits. This was highlighted by the Twitter account @ProofofGitHub shared a list of the top ten chains with the highest daily development activity.

GitHub Daily Development Activity:

#1: 598 Cardano

#2: 494 Everscale

#3: 494 Wrapped Everscale

#4: 419 Ethereum

#5: 394 Polkadot / Kusama

#6: 362 Decentraland

#7: 361 Status

#8: 361 Internet Computer

#9: 344 Filecoin

#10: 338 Hedera pic.twitter.com/KnuyoaM4Jz— ProofofGitHub (@ProofofGitHub) December 3, 2022

ADA TECHNICAL OVERVIEW

As mentioned earlier, Cardano price movement has been one of the poorest amongst the top 10 cryptos by market cap. This is also evident from the chart above, where other major altcoins like Ethereum, Dogecoin and several others on this list have managed to get some gains on their charts in line with the broader market. ADA price however has stayed painfully flat and could be troublesome for many investors who are holding on to ADA in their wallets.

ADA price is significantly below any and all support levels, from a technical point of view. It is below both the 50 and the 200 day moving averages on the chart – which ties in well with the overall lack of any bullish sentiment in the coin whatsoever. Despite the Relative Strength Index being somewhere near 50 as of writing, a broader perspective look on the price action clearly tells us this coin needs a major leg up if it wants to see positive recovery in price.

Additional read: Cardano Price Prediction

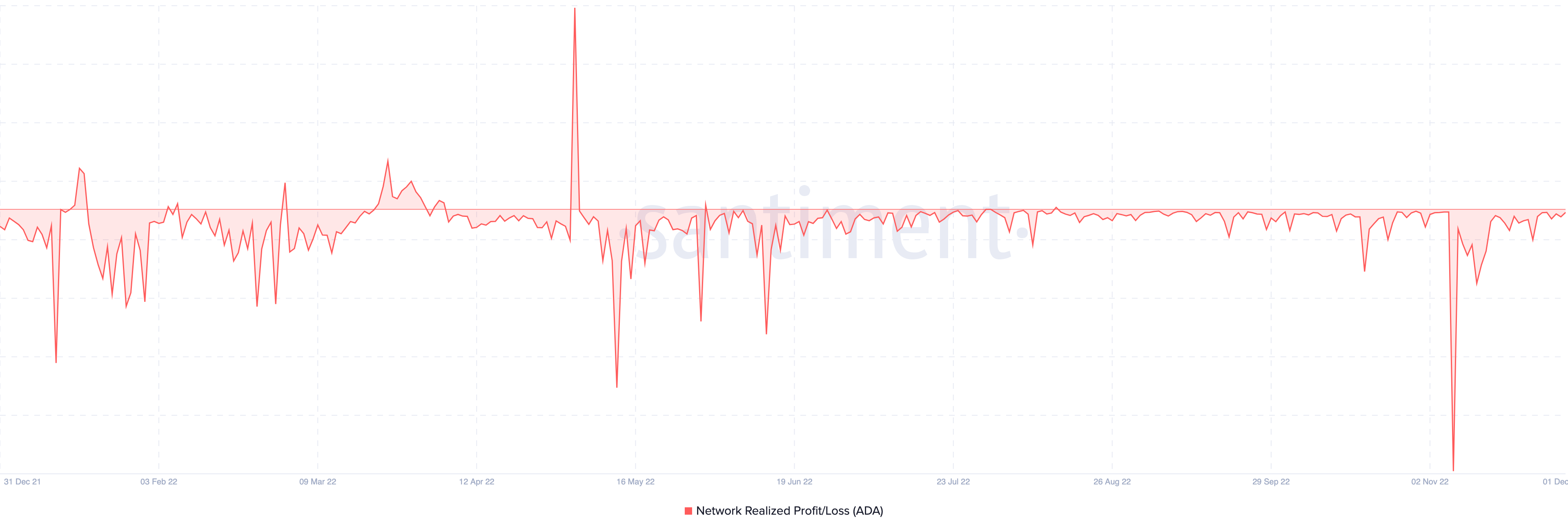

NETWORK REALIZED PROFIT & LOSS IN THE NEGATIVE

According to official definitions, Network realized profit and loss (NPL) computes the average profit or loss of all coins that change addresses, measured on a daily basis. Hence, for each coin that moves from one address to another on the chain – NPL takes the price at which it was last moved and assumed it to be its acquisition price, and when it changes addresses – NPL assumes the coin was sold.

Now, from the chart above we can see that the NPL for Cardano’s native token ADA has been in the negative zone for a very long time now, especially since the Terra LUNA crash. This indicates that a large portion of the on-chain transactions were taking place at a loss, or at a cost that was below the acquisition value of the coin itself. This is a reasonably bearish signal and could be the result of ADA’s poor price action in the past year.

Read more: Top Conversations on Crypto Twitter

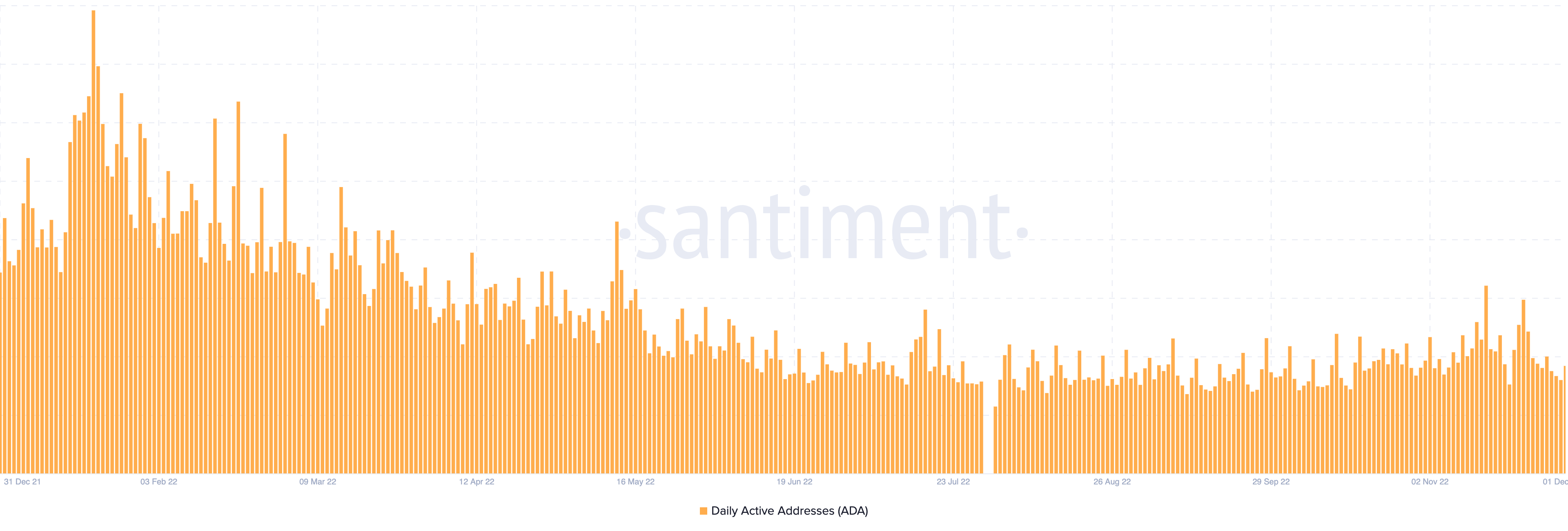

ADA’S DECLINING DAILY ACTIVE ADDRESSES

Along with that, ADA is also experiencing a gradually declining daily active addresses count – which indicates weaker sentiments amongst participants on the Cardano blockchain network. Now this could very well also be a resultant of the broader crypto market bear run that we have been experiencing ever since the beginning of 2022.

Also, along with that, a slightly closer inspection shows us that the daily active addresses, while on the down trend has been somewhat stable in the last couple of months, despite the price declines. While, it is below December 2021 levels, it is stable and that isn’t too bad a sign and this could improve as and when ADA price manages to show some recovery.

CONCLUSION

Thus, in conclusion it is evident why Cardano price is finding it so difficult to recovery from its lows. It is almost at the lowest point in almost the past two years, to be more specific, since January of 2021. Thus, even a recovery from current levels could be a long way away. To further add to that, on-chain metrics for ADA are also on the weaker side, with negative NPL levels and a lower active address count. But on the flip side, a strong developmental activity as highlighted by the Twitter account @ProofofGitHub indicates, that a recovery, whenever it comes, could be a strong one, backed by strong suite of products and service offerings solving real world problems.

Prices as on 5 December, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more