Table of Contents

ToggleKey Takeaways:

- ImmutableX’s price reclaims the $1 level after surging by more than 15% in the past few hours, flashing bullish signals.

- The bears appear to have exhausted themselves to a large extent, and hence the bulls are believed to regain their dominance and lift the price beyond 2023 highs soon.

- The technicals are flashing bearish signals as the traders have shifted their focus away from the token which could be tricky for the token’s price.

ImmutableX undergoes a giant leap of more than 30% after facing rejection at $1.5 that it reclaimed for the first time since the May 2022 crypto crash. The price action after rebounding from the lows below $1 appears to have intensified, and hence the giant price action is believed to continue for some time ahead. Meanwhile, the strength appears to have faded, which may hinder the progress of the rally ahead.

Besides, the collaboration between ImmutableX and Polygon to build a decentralized gaming platform may have a significant impact on the price. Zk-rollups technology will be used to expand Web3 adoption to new heights. However, with the volume rising with decent margins, equal participation of the bulls and the bears may be seen, which may compel the price to remain consolidated for a while ahead.

ImmutableX (IMX) Technical Overview

Source: Tradingview

- The IMX price has maintained a steep upswing since the start of the year and achieved the highest levels beyond $1.5

- The token rose within an expanding channel and after hovering along the lower support for a while, triggered a rebound

- The buying volume has accumulated finely which may keep up the bullish momentum. Also, the MACD is turning bullish and may the crossover may also elevate the levels above the average range very soon

- Therefore, IMX price may rise beyond interim resistance at $1.13 initially and later enter the next target zone around $1.2. Here if the bulls hold their strength a notable upswing may rise to levels above $1.3.

ImmutableX (IMX) On-Chain Overview

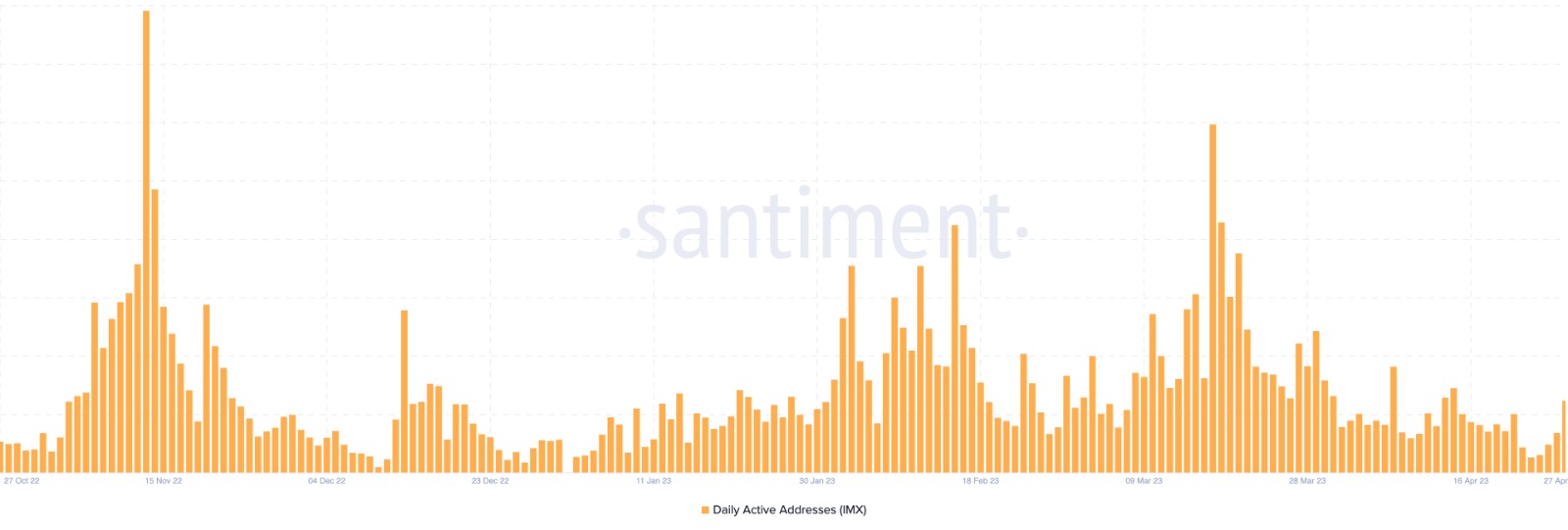

ImmutableX Daily Active Address

Source: Santiment

The network’s popularity and demand are completely dependent on the user activity over the platform. The number of trade orders placed on the platform increases the activity which in turn raises the demand. The increasing demand may further increase the volatility which may impact the price positively. Here, all the addresses regardless of whether it is a buy, a sell, or a swap address are considered but only once at a time.

The daily active address had maintained a decent upswing rising beyond 2000 addresses per day recently which has seen a drastic drop below 1000 in recent times. Woefully, these levels have further plunged below 500 nowadays. The dropped levels indicate the traders may have fled toward other tokens and hence the activity has plunged miserably.

ImmutableX Supply on Exchanges

Source: Santiment

The supply on exchanges is nothing but the reserve balance of all the consolidated exchanges. These indicate the availability of the liquidity that is required to perform a healthy trade. Besides, the more the availability of the tokens on the exchanges depletes the demand which may impact the price adversely. Moreover, it also indicates the bearish mindset of the market participants as they tend to transfer their tokens back to the exchanges when they want to sell or swap them for other tokens.

The supply on exchanges has been rising constantly and reached beyond $100M since the start of the year indicating the traders have been constantly buying or selling IMX and hence are transferring their tokens onto the platform. Besides, if the trader wishes to hold the token for the long term, then he/she may have held it in their cold wallets, away from exchanges that may have dropped the levels.

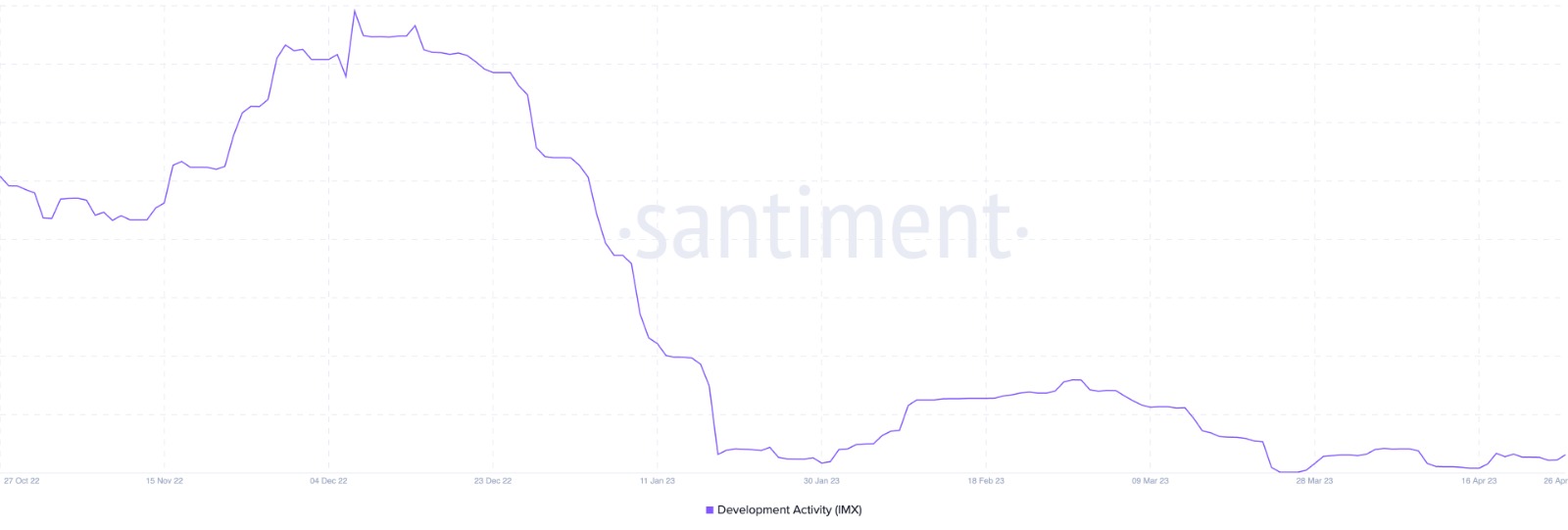

ImmutableX Development Activity

Source: Santiment

The development activity of a project is recorded on the GitHub repositories which are usually public. The activity is calculated by the number of commits, queries, notes, etc uploaded onto the platform. The rise in the development activity indicates the project is serious about its business proportion and that the developers are working very hard to deliver new upgrades and features in the long term. Therefore, this raises the confidence among the market participants who may jump in to accumulate.

Unfortunately, the levels have dropped heavily in the past few days, which indicates that development activity is at a halt. This may not be good for a healthy rally, as a sense of fear and uncertainty may prevail, which may impact the price adversely.

Concluding Thought

ImmutableX displayed a fine upswing since the beginning of the year and reclaimed the lost positions. Although the price has faced a minor pullback, it is believed to maintain a healthy upswing. But the drop in the daily active addresses and the development activity raises many concerns. Moreover, the rise in the exchange reserves may also be an alarming condition for the IMX price.

Prices as of April 28, 2023

Read more: Crypto Price Predictions

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more