Table of Contents

ToggleKey Takeaways:

- After dropping by more than 30% in the past week, the Rocket Pool price underwent a 23% recovery and is trading above $45

- The bulls are attempting to tighten their grip over the rally that may lift the price above $50 initially and later test the higher targets

- The new and the old traders become extremely active over the platform which may further impact the price positively

The crypto markets have been on a roller coaster ride since the beginning of the month as the prices of popular tokens, including Rocket Pool, faced a massive fallout following a fine recovery. While the prices have rebounded to some extent, they remain under the bearish influence and pose the possibility of a continued bearish trend.

Besides, the possibility of a bullish bounce back also emerges, which has kept investors on their toes. Therefore, will the RPL price maintain its bullish trend or lose its grip on the bull market?

A couple of days before, Rocket Pool, the popular staking protocol, gave users access to their staking rewards and also reduced the barrier of entry to creating an Ethereum validator. The platform deployed its Altas upgrade, making Rocket Pool compatible with the Ethereum Shanghai upgrade. The price received a significant push, but soon the whales extracted their profits at the local top.

Nearly 111 whale transactions worth over $100,000 were recorded as the price marked its all-time high at $59.7, triggering a massive sell-off. Presently, the RPL price is attempting a recovery that is believed to regain bullish momentum.

Read more: Lido DAO Price Prediction

Rocket Pool (RPL) Technical Overview

Source: Tradingview

- The Rocket Pool price has been trading within a rising expanding channel that is largely believed to trigger a massive bearish move

- While the recent downfall had to slash the lower support and reach the lower support at $41.82, a minor rebound has now raised the hope for a bullish rebound

- However, the ADX which represents the strength of the rally is bearish, is heading toward the south, hence the price is believed to slice through the lower support if tests another time

- The RPL price may eventually reach the lower support where-in a rebound may be triggered that may rise the levels above the 100-EMA, validating a firm upswing

Rocket Pool (RPL) On-Chain Overview

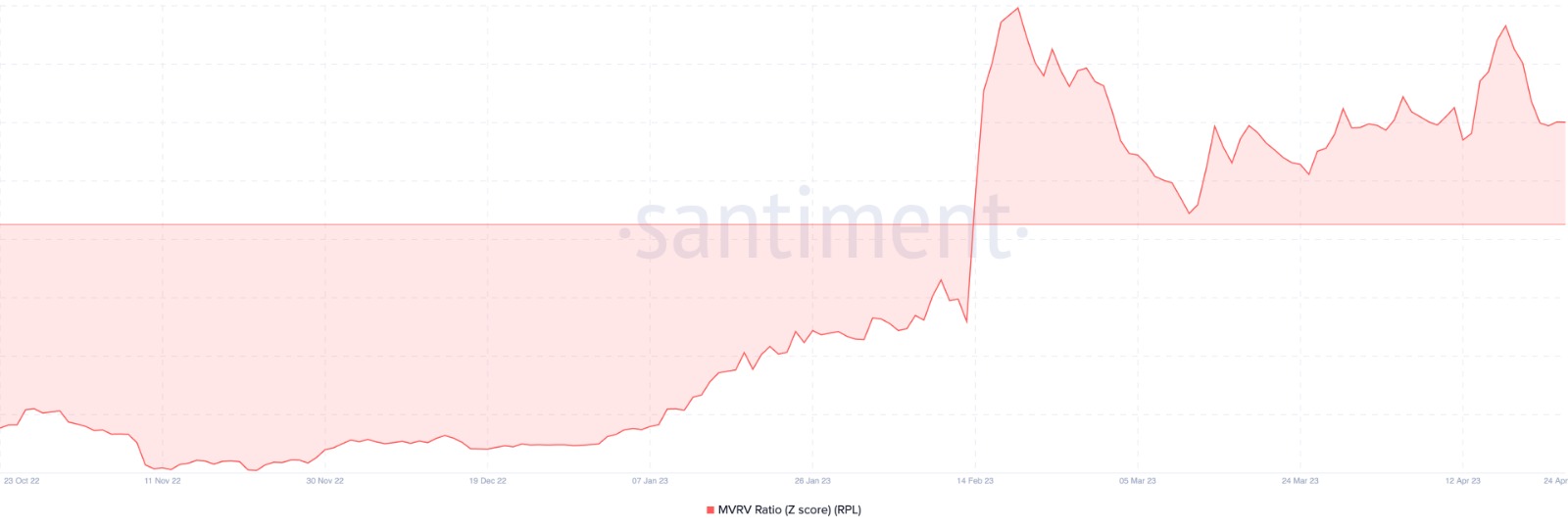

Rocket Pool MVRV Ratio

Source: Santiment

The MVRV ratio is a comparison between the current market capitalization and its realized market capitalization. The result is the fair value of the token, which is used to determine whether the current price is undervalued or overvalued. If the price is above the fair value, the token is said to be overvalued; if the price drops below the fair value, then it’s undervalued.

The price had remained undervalued for quite a while until the recent push lifted the levels above the average or fair value. As the prices in the undervalued region usually attract liquidity, a notable upswing is imminent. Besides, the prices within the overvalued range could be prone to a pullback as the traders often extract profits, and a good rejection is imminent.

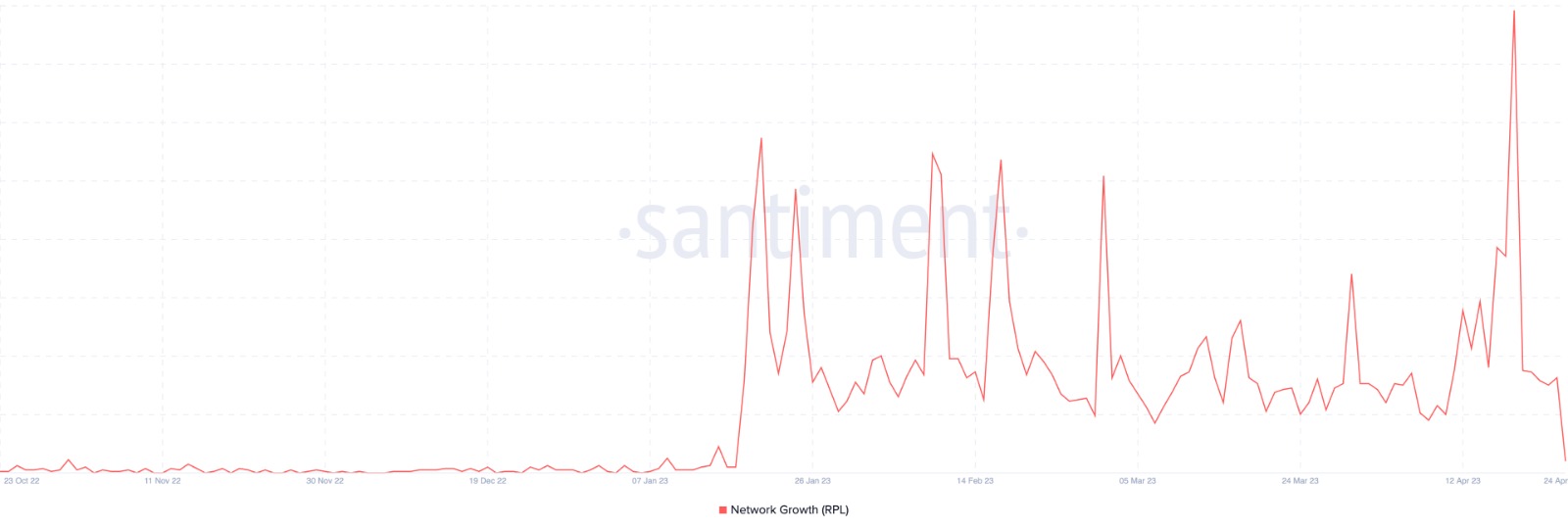

Rocket Pool Network Growth

Source: Santiment

The network growth is the number of new addresses that have transferred the given token for the first time. These metrics indicate the adoption of the token over time and also let us know whether the crypto is gaining traction or not. As the network growth indicates the new address count, the levels usually spike in a bullish environment and drop hard when the bearish pressure mounts within the space.

The RPL network growth had surged heavily in the recent past, which raised the levels pretty high as the price marked an ATH close to $60. Woefully, the levels dropped as the traders began to extract profits, indicating no new addresses were transacted, diminishing the adoption of the crypto.

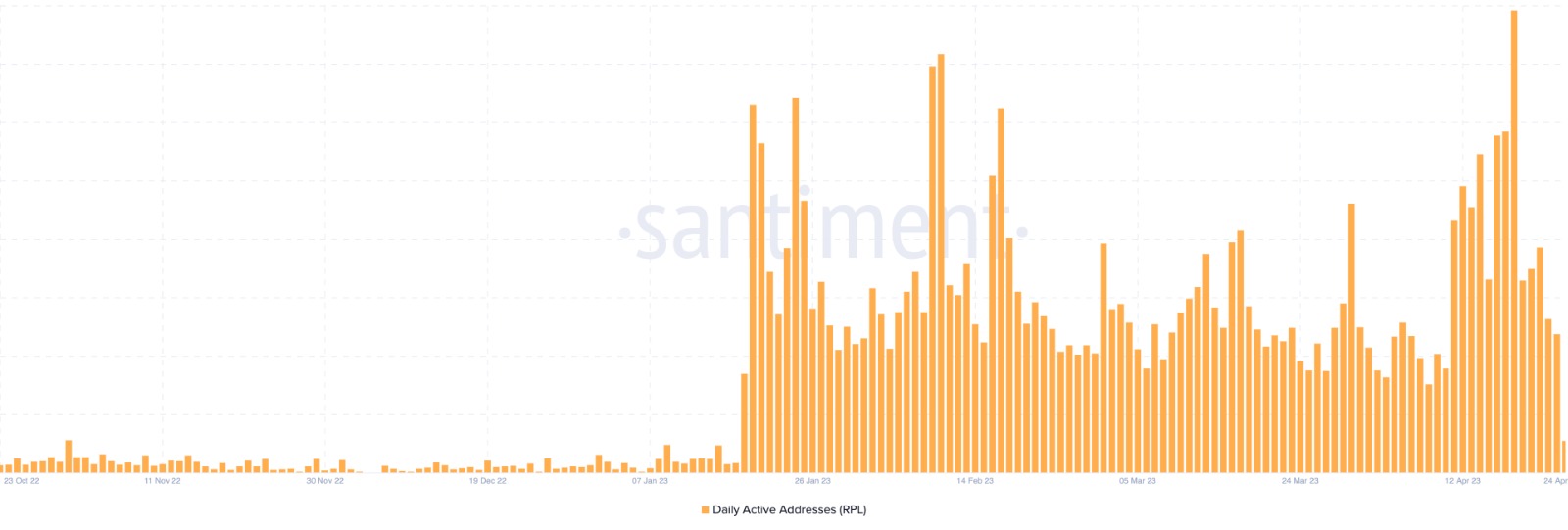

Rocket Pool Daily Active Address

Source: Santiment

Daily active addresses are very similar to network growth, but here all the addresses, whether new or old, are considered. The addresses that have interacted with the platform, regardless of whether it was a buy, a sell, or a swap address, are considered, but only once per day. A drop in the levels usually indicates a drop in the popularity of the crypto, which may further negatively impact the price.

Presently, the DAA of Rocket Pool has surged heavily as the prices witnessed a massive jump. The traders placed huge buy/sell orders, which raised the DAA levels to new highs and maintained an elevated trend for a while. Currently, the levels have dropped slightly but are expected to revive in the coming days.

Additional Read: Rocket Pool Post Shanghai Upgrade

Concluding Thought

The Rocket Pool price just marked new highs after displaying immense strength for quite a long time. The rise in the network growth and the daily active address indicate the huge participation of the traders, specifically, the new traders. Therefore, the adoption appears to have swelled which may assist the rally to maintain an elevated trend in the coming days.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more