Table of Contents

ToggleLitecoin has been a crowd favourite crypto for quite some time now. It has all the best qualities of Bitcoin, its original predecessor, but the network works with lower transaction costs and higher transaction speeds. Aptly named Litecoin, it is very much the ‘lighter’ version of Bitcoin, with transaction speeds on the network coming in at about 2.5 minutes as opposed to Bitcoin‘s which takes anywhere between 10 minutes to an hour.

And with the recently released upgrade called MimbleWimble Extension Blocks (MWEB) things can become positively brighter for this particular crypto. According to Litecoin developers, this is the largest upgrade in the LTC blockchain as it will increase LTC’s scalability over ten fold.

$LTC's #MWEB, MimbleWimble Extension Blocks, is the largest upgrade ever to the #Litecoin blockchain. It can give the Litecoin Network 10x Scalability 🚀 🚀 🚀 pic.twitter.com/Y6ycnbewmp

— Litecoin (@litecoin) October 6, 2022

But on the other side, how well is Litecoin price responding to the major developmental upgrades that the network is receiving on a continuous basis?

As is evident from the chart above, Litecoin’s native crypto token LTC price has been stuck in a range (marked in yellow trendlines) between $45 to $63 over the past four months. There has been no major bullish breakout or a bearish breakdown on the charts ever since the beginning of June after the major crash post the Terra Classic (LUNC) implosion that shocked the entire crypto market.

Even the Relative Strength Index for the LTC price has been wobbling around 50 the entire duration of the four months, going up and down but coming back to the middle right after. So overall, from a technical perspective, Litecoin is undergoing a strong consolidation phase and some kind of major movement is long time due.

Additional Read: Litecoin Price Prediction

But, how has the on-chain metrics and major long term ‘HODLers’ reacted to such news? Let’s analyse that.

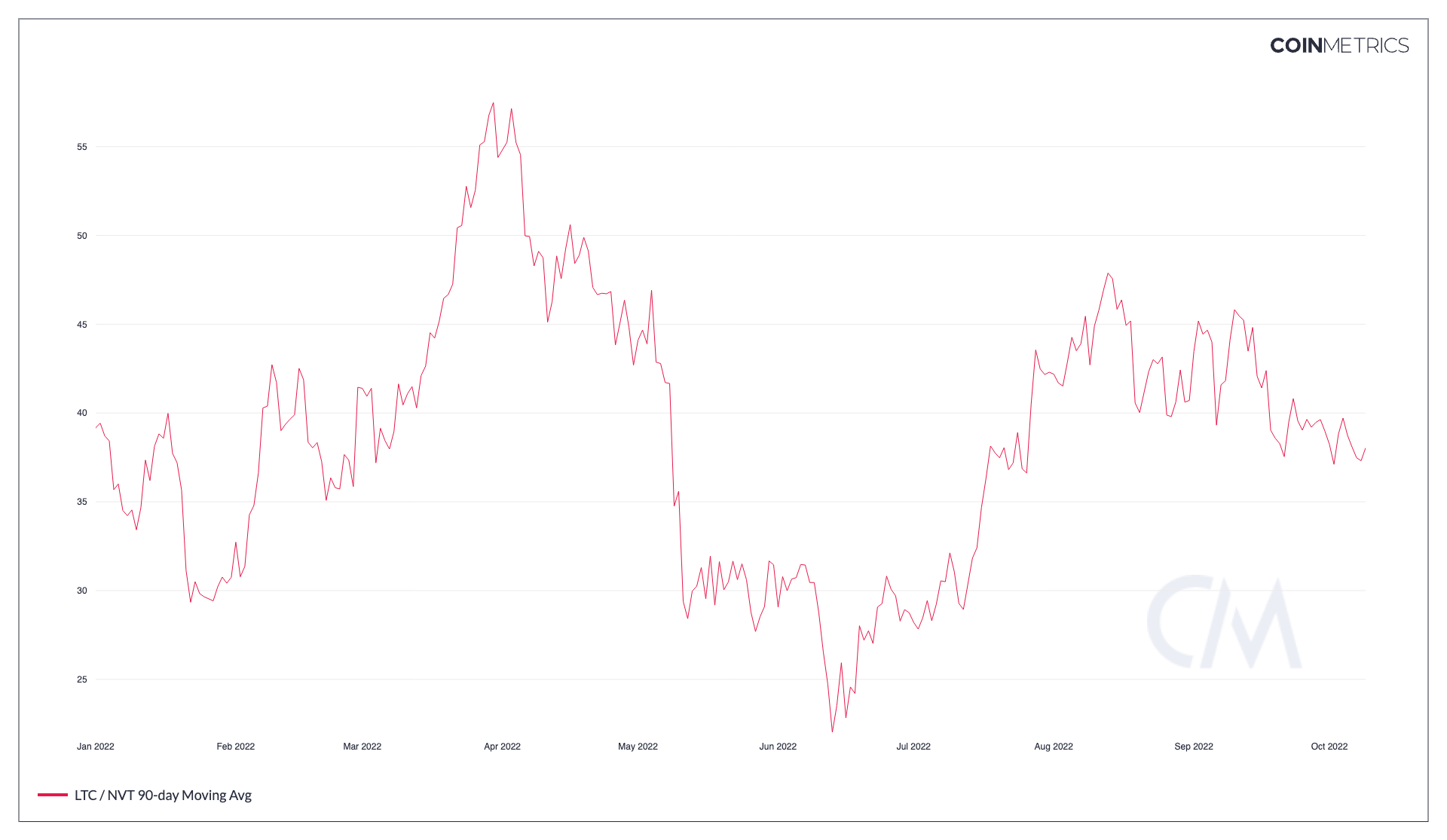

Litecoin seeing a rising NVT Ratio

Ever since the middle of June, when the overall crypto market bottomed out for the year in the bear run that began at the start of 2022 – Litecoin’s NVT Ratio or the Network Value to Transactions ratio saw a sudden spike before falling slightly once again. This has happened despite the fact that LTC price action has remained more or less within a limited range in the same timeframe.

To understand its significance, let us first understand NVT Ratio. Quite similar to the price to earnings ratio (PE Ratio) in the traditional stock market, Network Value to Transaction ratio is simple a ratio that described a relationship between market capitalisation of the crypto and its network volumes. Or in other words, market cap divided by network transaction volume – both measured in USD.

A rising NVT Ratio can mean one of two things – one that the market cap is increasing disproportionately as compared to the network volumes and (or) secondly, that investors are valuing the network at a premium than it currently is, based on its future values. While very high NVT’s have typically signified market tops, a gradually rising NVT points to an improving market sentiment regarding the coin.

On the other side, a falling NVT Ratio can also mean the same two things, in the opposite way. One, the market cap is falling much faster than the network transaction volumes warrants it, or that investors are pessimistic about the coin and are valuing the crypto at a discount than its current value.

With regards to Litecoin’s situation however, things seem to be of the bearish nature. This is because, as we have observed before, the LTC price has remained somewhat stagnant, which means the market cap has remained so too. But a suddenly rising NVT ratio in this case means that the denominator, or the transaction volume has been going down significantly – which is a cause for concern from a fundamental point of view.

Additional Read: Terra Classic Price Prediction

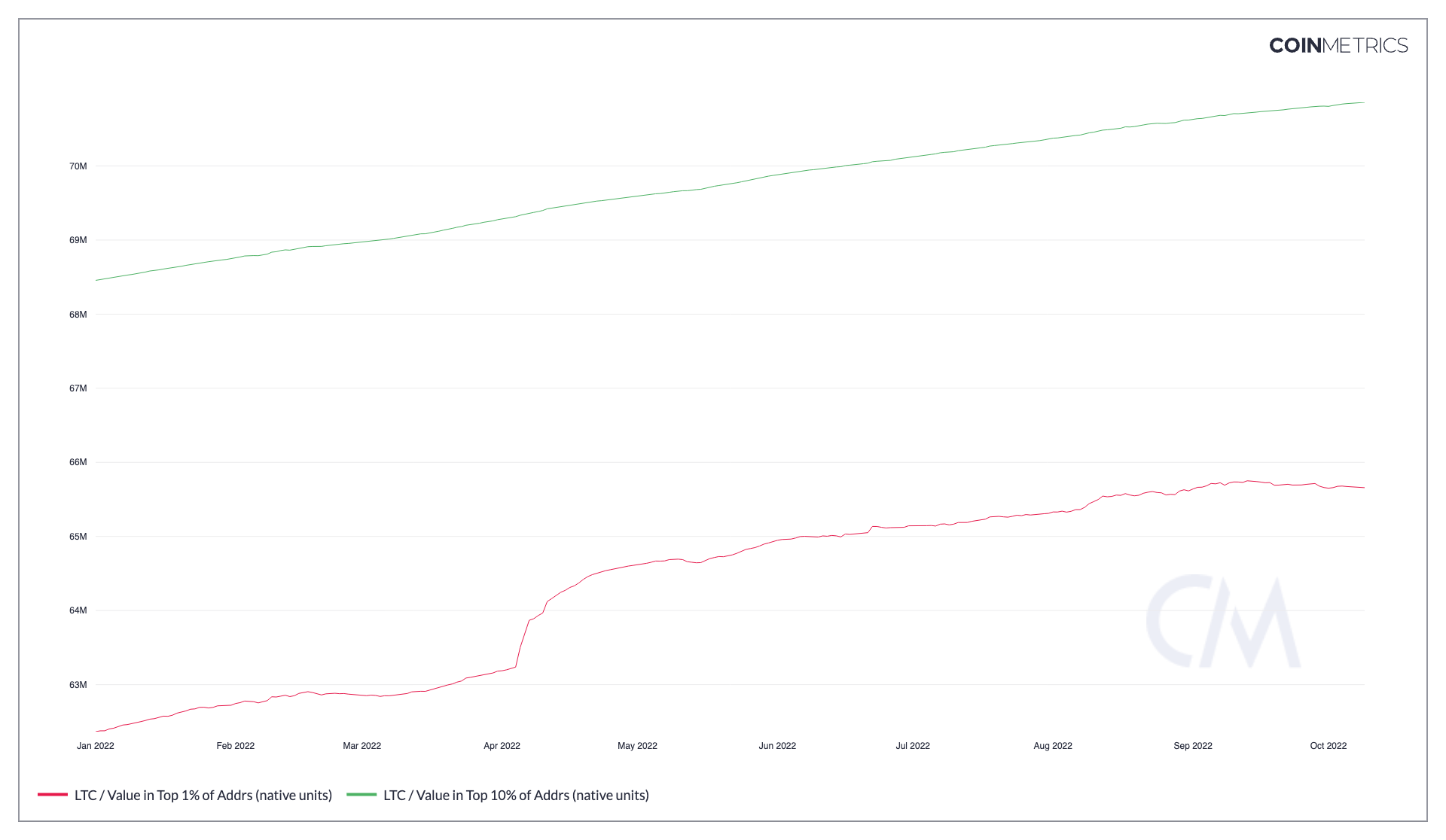

Supply in Top Addresses also sees growth

On the flip side, supply with the top 1% and the top 10% of addresses holding LTC tokens has been rising ever since the beginning of the year. This indicates that all the major ‘HODLers’ of LTC have been holding on with iron hands, and even buying into the dip and expanding their reserves which means they still believe the token has some potential.

Conclusion

Going by these two metrics, one can conclusion that a strong LTC accumulation is underway, despite the fact that actual on-chain transaction volumes may be on the weaker side. So for the short term, prices may remain lacklustre but on the long-term macro perspective, Litecoin’s native crypto token LTC seems to continue to be a favourite amongst its holders, revealing overall long-term bullish prospects in the coin. And with the MimbleWimble Extension Blocks upgrade already underway – things can be expected to get even better for this crypto project.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more