Table of Contents

ToggleKey Takeaways:

- The Binance Coin price displayed remarkable recovery in the recent past and marked the previous day’s close on a bullish note at $300.2 with a market capitalization of $47.8 billion and a circulating supply of 159.97 billion BNB.

- The BNB price with the recent surge has come back under the bullish influence and hence is believed to maintain a notable upswing ahead.

Binance Coin is the native token of the world’s leading crypto-exchange, Binance. The token was developed to back the exchange, offering use cases like paying fees and the holders also received other benefits like discounts and rewards, etc.

The token gained extensive attention and adoption during the 2021 bull rally that propelled the price beyond $650. Since then the token has secured its levels within the top 5. BinanceCoin is the world’s largest crypto after Bitcoin & Ethereum excluding the stablecoins.

Recent Updates:

- Binance recently introduced Web3 Industry Recovery Initiative and along with its partners committed to providing $1 billion+ financial support to the potential companies who require the most.

Introducing the Web3 Industry Recovery Initiative! #Binance and a number of key industry partners have joined together to commit $1B+ to provide financial support to the most promising and highest-quality companies that need it most.

Let's support industry growth together.

— Binance (@binance) November 24, 2022

- After the recent FTX collapse, Binance initiated the practice of publishing the Proof-of-Reserve, to maintain full transparency.

All crypto exchanges should do merkle-tree proof-of-reserves.

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.— CZ 🔶 Binance (@cz_binance) November 8, 2022

Binance Coin Price Analysis

- The Binance Coin price underwent a huge upswing in the past couple of days but struggling to sustain beyond the $300 resistance level.

- The fresh sell-off compelled the price to slide down below the 50-day MA levels in the short term, manifesting the growing strength of bears.

- If the BNB price fails to reclaim the levels beyond the 50-day MA at $297.5, a notable bearish wave may drag the price lower below $290.

- Besides, a firm rebound may initially uplift the price above $300 and later head towards the pivotal levels around $332.4.

Read more: Binance Coin Price Prediction

Adjusted Price DAA Divergence showing positivity

The DAA refers to the Daily Active Address which determines the user’s activity on the platform over time. An increase in DAA denotes larger user activity which in turn impacts the price of the token too. A rise in the price attracts more traders which in turn increases the DAA. A divergence occurs when the price of the token moves in the opposite of the indicator and it warns of the weakening of the current price trend which may lead to a trend reversal.

The adjusted DAA-Price divergence was higher went the price reached rock bottom levels in June. However, as the price recovered, the divergence also lowered and is presently below 35% as of October-end. Therefore, it can be interpreted that as the divergence diminishes, the price is extended to rise high.

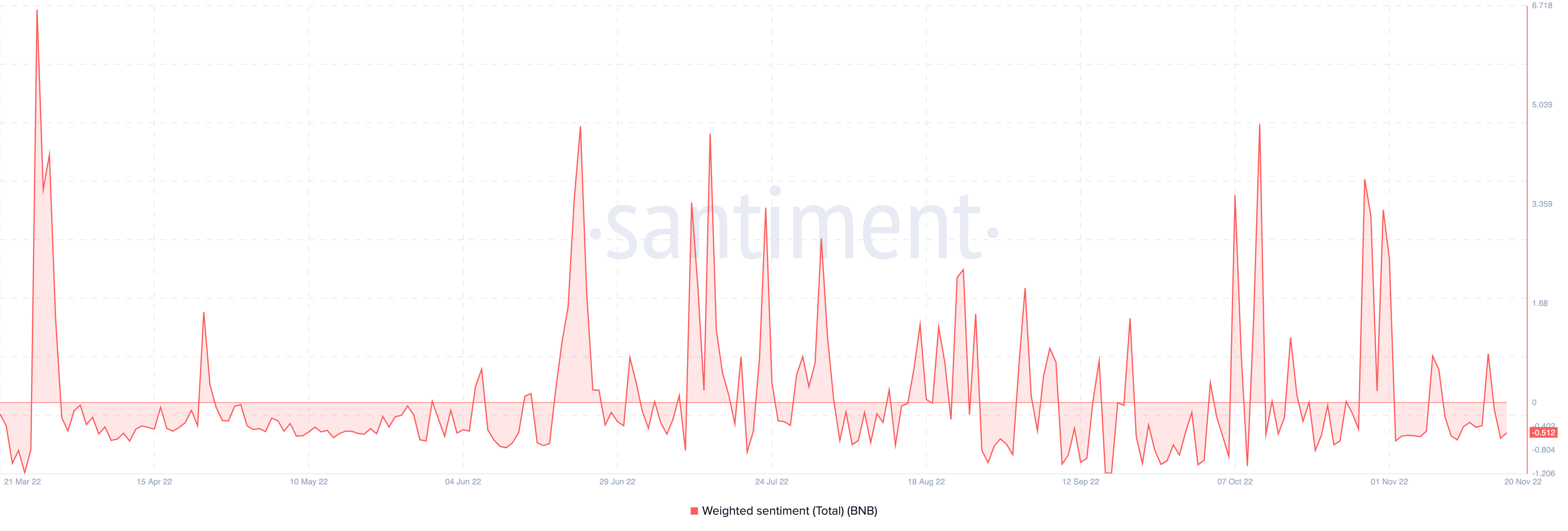

BNB Weighted Sentiment in the negative zone

The total weighted sentiment is an indicator that displays the investor’s mood as well as their price prediction expectations. It combines the positive and negative comments over time and multiples them with the amount of social volume. However, it is not necessary that the rise in the indicator may certainly impact the token’s value.

During the middle of October, the sentients weighed extremely high, while the price remained within a narrow consolidation. Since then, sentiments have been below average, with each approach met with rejection. As a result, it can be assumed that either the traders’ social engagements or the volume, or both, have decreased.

Conclusion

Binance Coin price displayed a bullish breakout due to which the speculations of reaching the higher targets woke up. Meanwhile, the positive divergence which is noticed in recent times may impact the price positively. Besides, the sentiments have also turned notably bearish and hence this may largely impact the BNB price which is feared to fall into the deep bearish well again.

Prices as on 25 November, 2022.

Read more: Top Conversations on Crypto Twitter

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more