Key Takeaways:

- BlackRock’s move into the crypto market with an Ethereum-focused ETF signals an institutional push for crypto investments, reflecting a growing interest in the digital asset space among major financial players.

- The momentary surge in Ethereum’s price following the S-1 filing highlights the market’s sensitivity to ETF-related news, underlining the potential impact of such investment vehicles on crypto prices.

- Despite the retracement in ETH’s price post-announcement, Ethereum’s recovery in line with the broader market suggests a positive outlook, especially with Bitcoin nearing the $40,000 mark and the overall crypto market capitalization hitting $1.4 trillion.

- BlackRock’s anticipation for the SEC’s decision on a spot bitcoin ETF, coupled with CEO Larry Fink’s evolving stance on crypto, reflects the financial sector’s evolving sentiment toward cryptos and their growing role in traditional investment portfolios.

BlackRock, the global asset management giant, has recently made a significant move in the crypto space by filing an S-1 form with the US Securities and Exchange Commission (SEC) for its iShares Ethereum Trust, an exchange-traded fund (ETF) focused on spot ether.

The registration for the iShares Ethereum Trust comes right after the corporate registration of its name and Nasdaq’s filing of a 19b-4 with the SEC, aiming to seek approval for this new investment vehicle. This move reflects BlackRock’s intention to expand its presence within the crypto market.

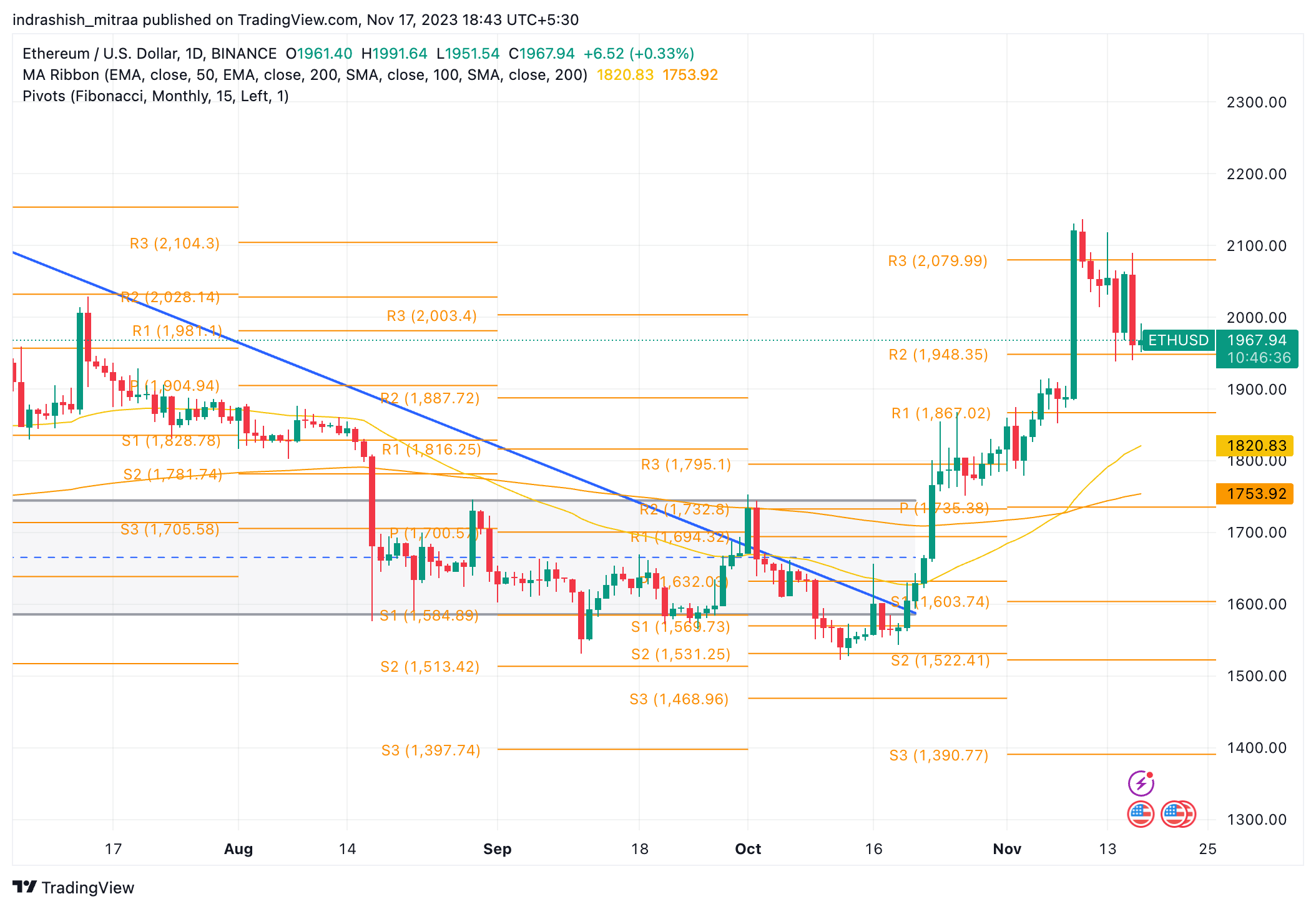

Following this news, there was a momentary surge in the price of ether (ETH), which briefly jumped nearly 2% to $2,080 upon the S-1 filing. However, the price of ETH has since retraced to levels similar to those before the announcement.

Learn More: Ethereum Price Prediction

However, broadly, Ethereum price has been recovering in line with the broader market since the middle of “Uptober” – having spiked from below $1600 levels to near $2100 at its highest. Currently trading just shy of the $2000 mark – Ethereum price is looking very optimistic for the foreseeable future. The overall crypto market capitalization has also rallied to a $1.4 trillion level, with Bitcoin price edging ever so closer to the $40,000 mark – which seems very close at hand.

The crypto market has been particularly responsive to ETF-related developments, especially after recent court rulings against the SEC’s rejection of spot crypto ETF applications. These rulings have raised hopes for potential approval. Notably, a fake iShares ETF registration referencing XRP triggered a 10% surge in the token’s price before BlackRock confirmed the registration as false.

BlackRock, alongside other asset managers, is eagerly awaiting the SEC’s decision regarding the listing of a spot bitcoin ETF. Such approval could significantly enhance access to cryptos for average investors. CEO Larry Fink, who had previously been cautious about crypto, seems to have shifted his stance, expressing support for the sector recently.

The move by BlackRock to file for an Ethereum-focused ETF demonstrates the increasing institutional interest and participation in the crypto market. If approved, this ETF could represent another milestone in the adoption and legitimization of cryptos in the traditional financial landscape.

Read More: Bitcoin Price Prediction

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more