Key Takeaways:

- October Surge: Bitcoin price saw an impressive 27% surge in October that marked its strongest monthly gain since January, driven by growing optimism about potential Bitcoin ETF approvals in the US.

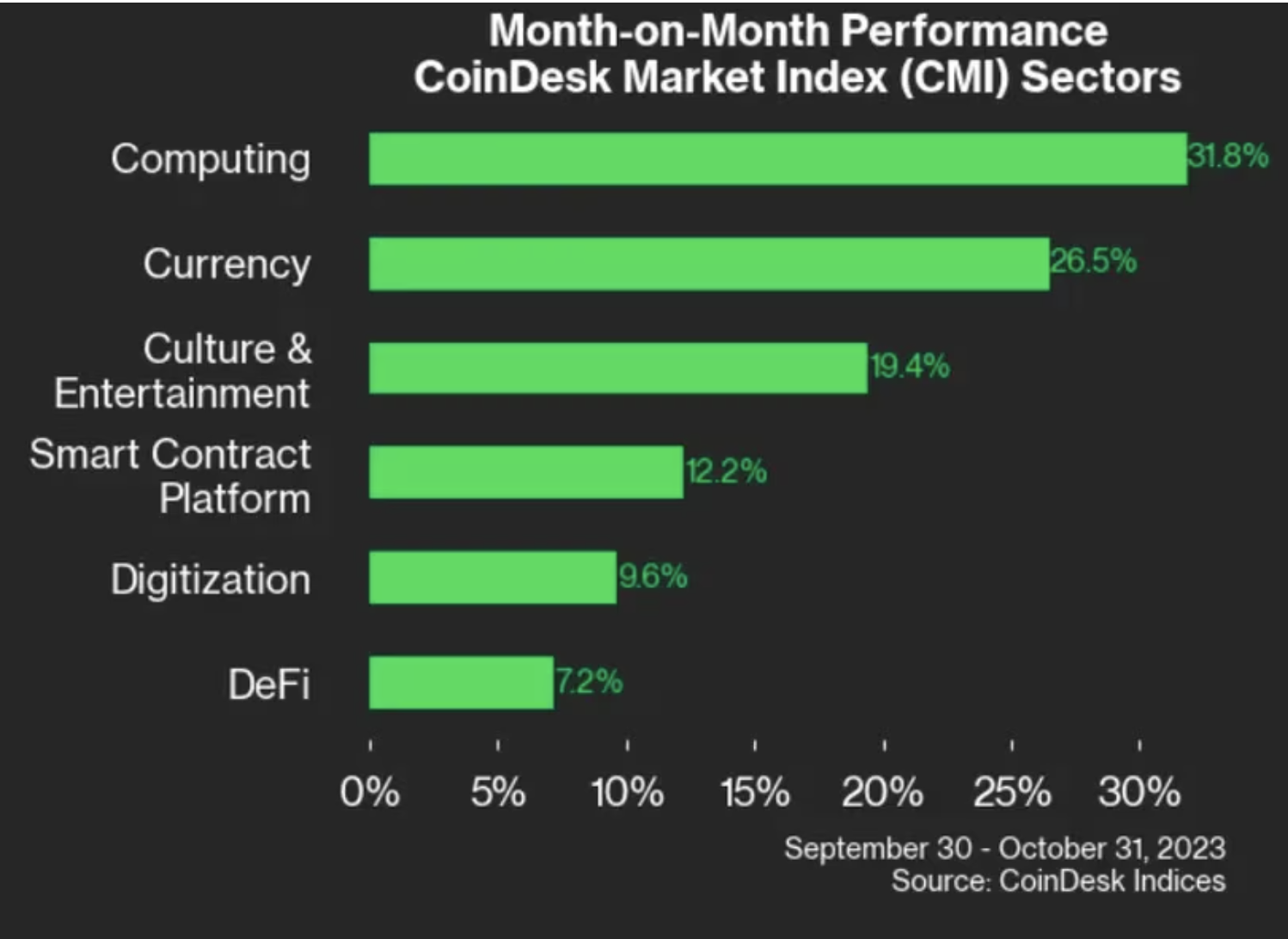

- Broad Crypto Rally: The rally extended to the broader crypto market, with the CoinDesk Market Index (CMI) rising by 22% and the overall crypto market capitalization increasing nearly 19% to $1.255 trillion, the largest monthly increase since January.

- ETF Anticipation: The discussion around Bitcoin ETFs is a significant catalyst for the crypto market, as ETFs could make Bitcoin more accessible to average investors.

- Altcoin Performance: While the overall market performed well, not all sectors saw equal gains. DeFi tokens saw modest gains, while Ethereum’s ether and the CoinDesk Computing Sector stood out with impressive monthly returns.

- Future Outlook: Analysts are optimistic about the future of Bitcoin price, with some suggesting a potential rise to $40,000 in the coming weeks, despite elevated sentiment levels and the recent surge. Investors are closely monitoring further developments in the crypto space.

Read More: Bitcoin Price Prediction

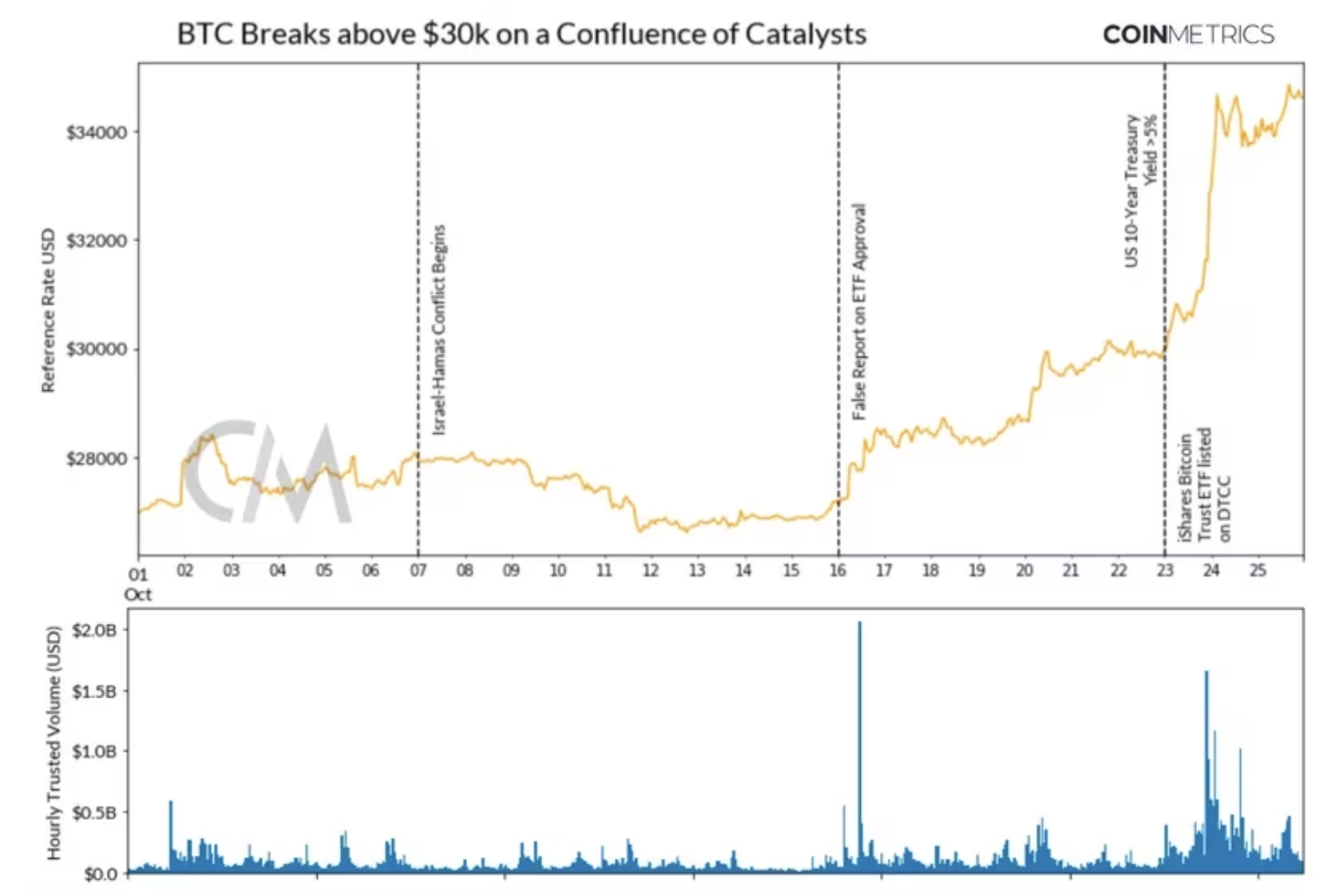

In October 2023, Bitcoin price experienced an impressive 27% surge, marking its most substantial monthly gain since January. This surge was part of a broader crypto rally, which saw various crypto assets performing well. Optimism around potential Bitcoin ETF approvals in the United States fueled this remarkable rise. This is in line with historic price movements in the crypto market, with October being popularly known as “Uptober” for being a positive month in the past too.

As BTC price hit a 17-month high of $35,000, many investors were enthusiastic about the prospect of ETFs making it easier for average investors to access Bitcoin. BTC price growth had a positive ripple effect throughout the crypto market, with the CoinDesk Market Index (CMI) advancing by 22% and the overall crypto market capitalization increasing by nearly 19% to $1.255 trillion, the largest monthly increase since January.

Crypto ETFs have been a hot topic within the crypto community due to their potential to simplify Bitcoin investment for everyday investors. While the US Securities and Exchange Commission (SEC) initially rejected the conversion of the Grayscale Bitcoin Trust (GBTC) into an ETF, recent developments in the courts may increase the odds of SEC approval for such ETFs. Additionally, ETF applications from major financial players like BlackRock, the world’s largest asset manager, are in the queue, further fueling anticipation.

Although the crypto rally in October was widespread, not all sectors performed equally. The CoinDesk DeFi Index (DCF), which covers decentralized finance tokens, saw a modest 7% gain, while prominent DeFi tokens like Curve DAO (CRV), Maker (MKR), Uniswap (UNI), and Compound (COMP) experienced small declines. Ethereum price (ETH) achieved a 7% gain and a valuation against BTC that hadn’t been seen since June 2022. On the other hand, the CoinDesk Computing Sector (CPU), which tracks Web3 infrastructure and distributed computing protocols, witnessed a remarkable 32% rise in October.

Amid the various altcoins, Solana (SOL) stood out with a monthly return of over 70%, driven by increased network activity and diminishing concerns about FTX’s token sales. These gains were partially attributed to the excitement surrounding the potential approval of Bitcoin ETFs in the United States, which could potentially attract $50 billion to $100 billion in the next five years.

The rise in crypto prices can be attributed to several factors, including the growing anticipation of Bitcoin ETFs. Ryan Rasmussen, an analyst at asset manager Bitwise, suggested that a spot Bitcoin ETF could bring in substantial inflows and significantly impact Bitcoin price. He expected the SEC to approve ETF applications as early as December, adding to the optimism.

Crypto investment firm Matrixport also noted that elevated funding rates in the BTC derivatives market indicated that many traders “panic bought” during the rally. In addition to the ETF hype, sector-specific momentum, short liquidations, and macroeconomic factors contributed to the price increase, indicating renewed confidence and shifting dynamics in the digital asset markets.

Learn More: Bitcoin Halving in 2024

Conclusion

Looking ahead, analysts anticipate that Bitcoin price momentum can be expected to continue. Joel Kruger, a market strategist at institutional crypto exchange LMAX Group, suggests that the October breakout has paved the way for a significant upside extension, with a target in the $40,000 range in the coming weeks. Despite the exuberant sentiment indicated by Matrixport’s Bitcoin price Greed & Fear Index, the firm argued that BTC could continue to rise and target $40,000 as the next significant resistance level. As Bitcoin remains in the spotlight, investors are closely watching for further developments and milestones in the crypto market.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more