Key Takeaways:

- Bitcoin’s first-quarter performance in 2024 marked its third-strongest quarter in three years, with a staggering 64% surge in value, sparking both excitement and caution among investors and analysts.

- Analysts are warning of potential volatility ahead, particularly as the Bitcoin halving 2024 approaches, advising investors to brace themselves for what has been described as “screwy price action” in the market.

- Despite Bitcoin’s impressive performance in surpassing previous all-time highs, there are indications of unexpected market behavior, leaving experts puzzled and cautious about future price movements.

- With the Bitcoin halving scheduled for April 20, speculation is rife about its potential impact on prices, with some anticipating further upward movement fueled by a supply shock while others remain neutral on short-term price direction.

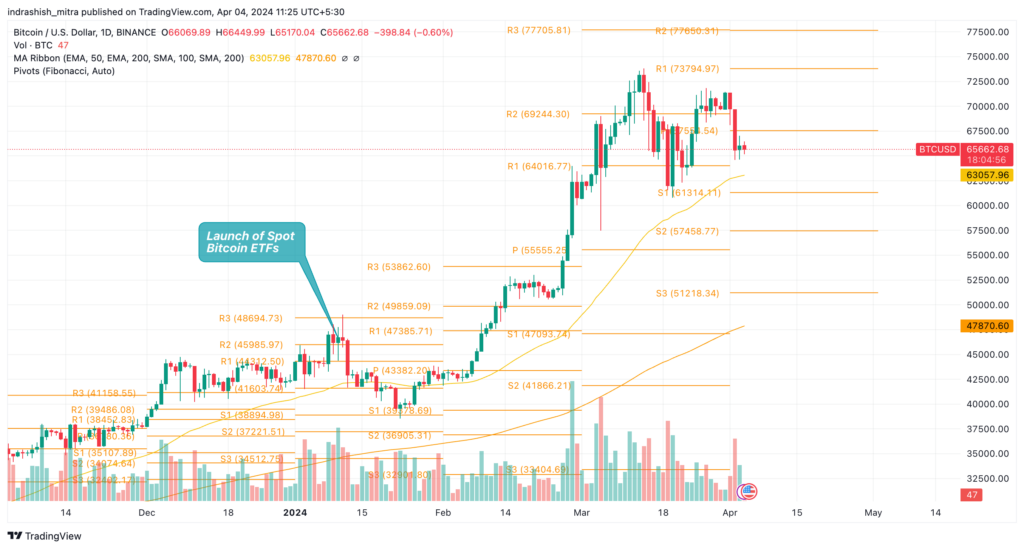

- The launch of spot Bitcoin ETFs earlier in the year has added to the intrigue surrounding Bitcoin’s price, but there are signs that initial enthusiasm may be subsiding, leading to a potential normalization of price levels in the near term.

Read More: Bitcoin Price Prediction

Bitcoin has just completed its third-strongest quarter in the past three years, with a remarkable surge of 64% recorded in the first quarter of 2024. This meteoric rise has captivated the attention of investors and analysts alike, sparking discussions about the potential implications for the king coin’s future trajectory.

Analysts are cautious, however, suggesting that such rapid growth could lead to significant volatility in the near future, particularly as the Bitcoin halving approaches. Phoenix Desmond, a prominent crypto analyst, has warned investors, advising them to brace themselves for what he describes as “screwy price action” in the lead-up to the halving.

Desmond’s concerns are rooted in the unprecedented market conditions observed in recent weeks. Despite Bitcoin’s impressive performance in terms of weekly, monthly, and quarterly closings, there are indications of a possible deviation from the expected patterns. The crypto has exhibited a consistent trend of outperforming previous all-time highs, only to retract swiftly thereafter—a phenomenon that has left analysts puzzled.

Morning ☀️#Bitcoin closed Q1 up 64%, its third best quarter over the past three years. pic.twitter.com/8Scex32Jut

— Kaiko (@KaikoData) April 2, 2024

As the countdown to the Bitcoin halving continues, speculation abounds regarding its potential impact on prices. Scheduled for April 20, the halving event is anticipated to cause a supply shock, which some believe could drive further upward movement in the second quarter of 2024. However, investor sentiment remains mixed, with opinions divided on the short-term direction of Bitcoin’s price.

Recent data on liquidations of both short and long positions suggest a delicate balance in market dynamics. Despite fluctuations, the market has maintained relative stability, indicating a neutral stance among investors regarding future price movements. However, even minor shifts in Bitcoin’s price could trigger significant liquidations, highlighting the fragility of the current market environment.

Prominent figures within the crypto community, such as the pseudonymous analyst Rekt Capital, have offered their insights into Bitcoin’s potential trajectory. While some anticipate continued consolidation within a certain price range leading up to the halving, others foresee a narrative shift that could introduce new dynamics into the market.

The launch of spot Bitcoin ETFs earlier in the year has added to the speculation surrounding Bitcoin’s price, generating increased interest from institutional investors. However, there are indications that this initial enthusiasm may be waning, leading to a normalization of price levels in the near term.

In conclusion, Bitcoin’s recent surge in the first quarter of 2024 has set the stage for a period of heightened volatility and uncertainty. As the halving approaches and market dynamics evolve, investors must remain vigilant and adaptable to navigate the shifting landscape of crypto trading.

By closely monitoring key indicators and staying informed about emerging trends, investors can position themselves to capitalize on potential opportunities while mitigating risks associated with Bitcoin’s unpredictable price action.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more