Key Takeaways:

- BTC Seasonal Weakness: Bitcoin price faced a 2% drop to $42,200, attributed to seasonal trends and year-end profit-taking, highlighting typical weaknesses during this period.

- Market Struggles: Despite expectations of a year-end rally, Bitcoin bulls remained subdued over the Christmas holiday, leading to ongoing struggles in the crypto market.

- 21-Day Moving Average Significance: The 21-day moving average of Bitcoin, a pivotal support level near $42,470, became a crucial indicator of potential price corrections and market sentiment.

- Altcoin Resilience: While Bitcoin experienced a downturn, Solana price and Binance’s BNB showcased strong resilience, with SOL reaching nearly $126 on Christmas Day, marking its highest value since April 2022.

- Altcoin Market Momentum: Solana price surge and a noticeable trend change in the overall altcoin market cap after 500+ days indicate a potential shift in market dynamics, signaling a possible resurgence of altcoins in 2024.

As the celebrations of the year-end fade, the crypto market witnessed a noticeable downturn in Bitcoin price, dropping to $42,200 on December 26, marking a 2% descent in just under a week. Analysts attributed this decline to the typical seasonal trends that historically influence BTC price weakness during this period. Despite hopeful anticipation for a ‘Santa rally,’ the Bitcoin bulls remained subdued over the Christmas holiday, indicating continued market struggles.

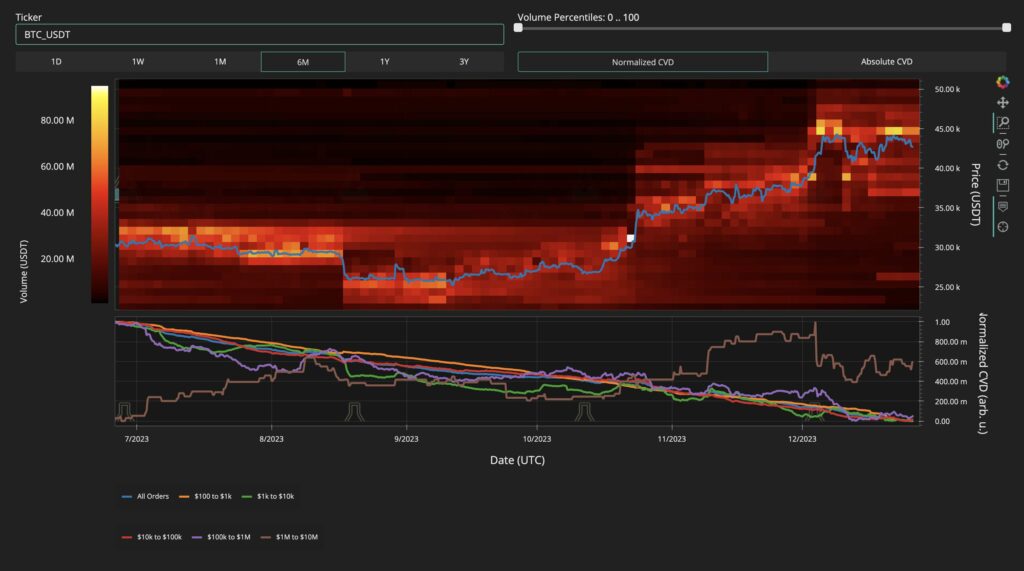

Material Indicators, a prominent trading resource, foresaw impending challenges for BTC bulls due to year-end profit-taking and tax loss harvesting, casting a shadow over the bullish sentiment. The focus shifted to whether bulls could reclaim the 21-day Moving Average, becoming a crucial checkpoint as the year comes to an end.

$BTC Binance / Bybit Open Interest & Delta

lol open interest has already been stacked back on here with tight price compression

~ often leads to volatilitylooks more like shorts positioning for a break lower, in which these shorts will want to see continued spot selling else… pic.twitter.com/CSueEXEUU3

— Skew Δ (@52kskew) December 26, 2023

The 21-day simple moving average of Bitcoin stood near $42,470, presenting a support level marginally higher than the spot price. Keith Alan, co-founder of a crypto enterprise, emphasized the significance of this trendline as recent market support, underlining its role in potential price corrections. However, the BTC/USDT order book on Binance depicted little optimism, displaying a surge in bids at $37,000 and below, reflecting a lack of bullish momentum. Skew, a well-known trader, suggested the likelihood of further downward trends as short positions prepared for a potential break, underscoring the cautious sentiment prevailing in the market.

Read More: Bitcoin Price Prediction

Nevertheless, amid Bitcoin’s temporary setback, other major cryptos showcased resilience, notably Binance’s BNB and Solana’s SOL. Both BNB and SOL demonstrated impressive weekly gains, rising by 19.5% and an astounding 56.8%, respectively. In contrast, Ethereum price saw a modest increase of 1.6%. Solana’s remarkable surge to nearly $126 on Christmas Day marked its highest value since April 2022, attributed to increased gas fees and airdrops, indicating a bullish sentiment for this altcoin.

The narrative shifted to the altcoin market gaining momentum as Bitcoin’s dominance faltered. Michaël van de Poppe, CEO of MN Trading, highlighted this shift, emphasizing the breakthrough of the total market capitalization for altcoins after a prolonged period of over 500 days.

Despite the challenges faced by Bitcoin, Solana’s remarkable performance signals a potential paradigm shift in the crypto market trends anticipated for 2024. While BTC experienced a seasonal dip, Solana’s surge underscored its resilience and potential, marking a significant development in the evolving landscape of cryptos.

Read On: Solana Price Prediction

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more