Table of Contents

ToggleKey Takeaways

- Bitcoin’s MVRV Ratio is currently at 1.27, signaling a critical juncture for the crypto.

- The MVRV Ratio compares an asset’s market capitalization to its realized capitalization, providing insights into market sentiment.

- A ratio below 1 often indicates that most holders are at a loss, which is usually considered a buy signal.

- Historical data suggests that the level of 1.2 plays a significant role in Bitcoin’s price movements.

- Recent whale activity on exchanges adds further complexity to the evolving market dynamics.

Introduction

Bitcoin, often called the king of cryptos, has been in the spotlight for its recent price performance. After trading between $25,000 and $31,000 for nearly 50 days, investors have been eagerly awaiting signs of a potential market shift.

MVRV can help pinpoint potential bottoms. When the value is <1, it signals that most people are at a loss. Historically, this has indicated the best buying opportunities. The current value for BTC is 1.27

🔗https://t.co/K9v9RhiYXG pic.twitter.com/dFdeAYJKhe— IntoTheBlock (@intotheblock) September 6, 2023

Exploring the MVRV Ratio

The MVRV Ratio is a fundamental metric in the world of crypto analysis. It compares an asset’s market capitalization (current price multiplied by the total supply of coins) to its realized capitalization (the average price at which each token was acquired by investors). This ratio provides valuable insights into market sentiment and helps traders and investors gauge potential price movements.

When the MVRV Ratio falls below 1, it suggests that most Bitcoin holders are currently at a loss. This is typically interpreted as a buy signal because investors believe that prices have reached an attractive level to accumulate more Bitcoin. Conversely, as the MVRV Ratio climbs higher, it indicates that more holders are in profit, which may lead to increased selling pressure as traders take advantage of potential profits.

The Significance of 1.2

In the context of Bitcoin’s MVRV Ratio, the level of 1.2 has historical importance. When this level is respected, Bitcoin prices have often experienced upward momentum. Conversely, breaches of this level have led to downward movements in the crypto’s price. Therefore, Bitcoin analysts closely monitor the MVRV Ratio, particularly when it approaches or surpasses the 1.2 threshold.

Read More: Bitcoin Price Prediction

Whale Activity and Market Sentiment

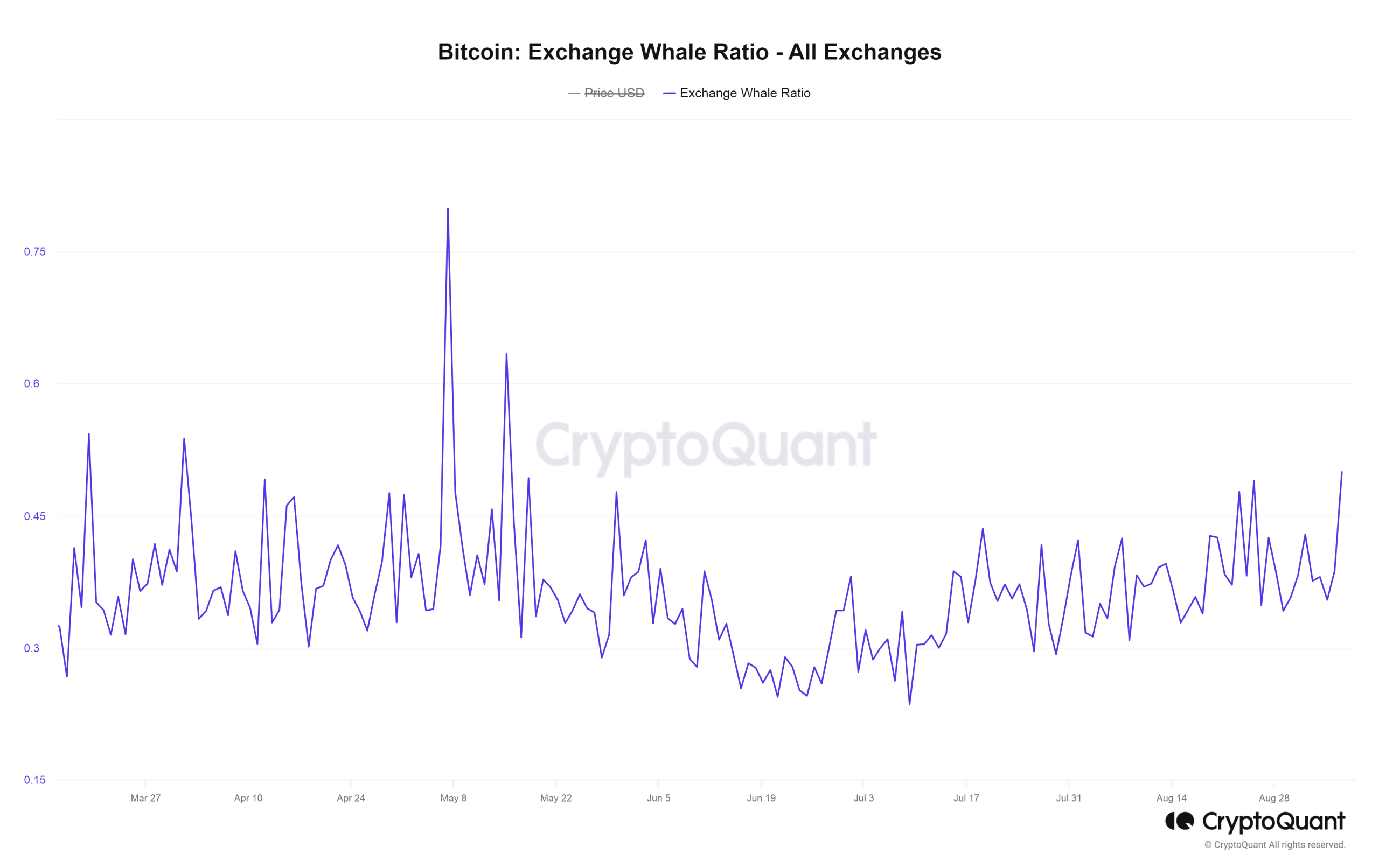

While the MVRV Ratio provides valuable insights into Bitcoin’s price dynamics, it’s essential to consider other factors influencing the market. Notably, recent data shows an increased whale activity on crypto exchanges.

Whales are large-scale investors who hold substantial amounts of Bitcoin. Their actions can significantly impact market trends.

Market sentiment also plays a vital role in crypto price movements. Positive market sentiment can attract more investors and drive prices higher. According to the weighted sentiment indicator, the overall market mood for Bitcoin has turned favorable, aligning with the increased whale activity on exchanges.

Conclusion

The MVRV Ratio of BTC is currently standing at 1.27, indicating a pivotal moment in the crypto’s price trajectory. This ratio, combined with historical significance at the 1.2 level, suggests that Bitcoin’s price could be at a turning point. While the direction remains uncertain, the recent surge in whale activity on exchanges and positive market sentiment provides additional factors to consider.

As Bitcoin continues to trade around $25,723, investors and traders are expected to closely monitor these indicators for potential market shifts. The crypto market remains dynamic, and understanding key metrics like the MVRV Ratio is essential for making informed investment decisions.

Source: AMBCrypto

FAQs

What does Bitcoin's MVRV Ratio signify?

Bitcoin's MVRV Ratio measures the relationship between market capitalization and realized capitalization. When the ratio is below 1, it suggests that most holders are at a loss, often seen as a buy signal. Higher ratios may lead to increased selling pressure as potential profits rise.

Why is the level of 1.2 significant in Bitcoin's price movements?

The level of 1.2 has historically played a crucial role in determining Bitcoin's price direction. When this level is respected, Bitcoin prices tend to rise, while violations of this level often result in downward movements.

What is the significance of whale activity on exchanges?

Increased whale activity on crypto exchanges suggests that large-scale investors are actively participating in the market. Whales have the capacity to influence market trends, making their actions significant for traders and investors.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more