Key Takeaways:

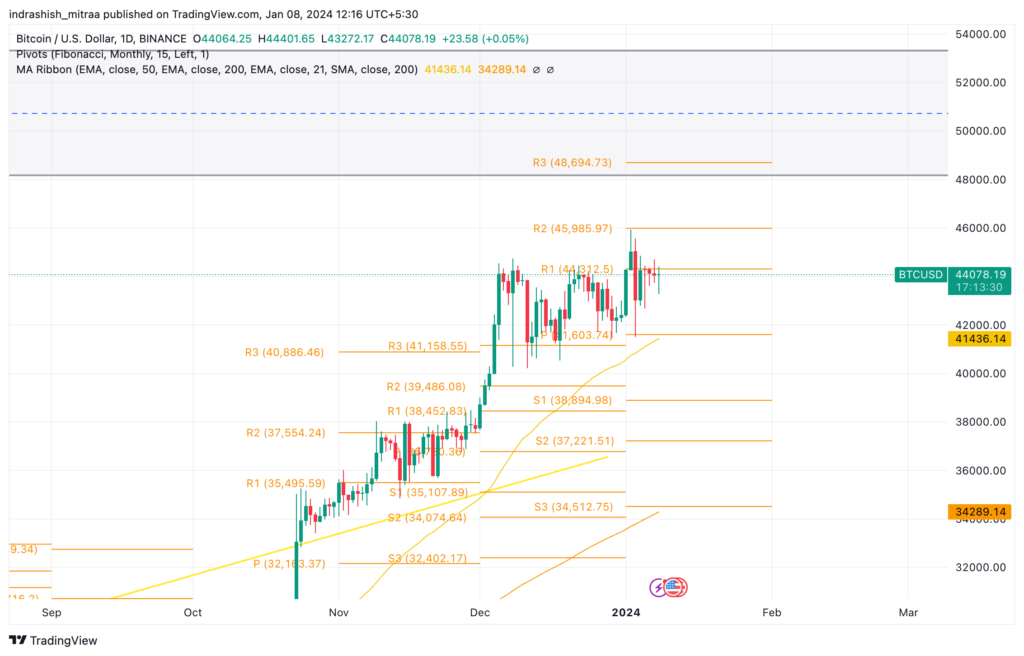

- BTC’s $44K Stability: Bitcoin’s consolidation around the $44,000 mark sets the stage for a pivotal movement, with traders anticipating a significant breakout.

- ETF Decision Anticipation: The imminent decision on the first US spot Bitcoin ETF by January 10 fuels market speculation, with expectations ranging from potential bullish surges to temporary setbacks.

- Indicators Point to Breakout: Key indicators, including the Bollinger Bands contraction on daily timeframes, suggest an impending breakout, signaling an imminent price expansion.

- Cautious Derivative Market: Active “spot premiums” and market caution among derivative traders reflect a wary sentiment, with positions building up and stop losses strategically placed.

- Macro Factors and Market Volatility: The US inflation data release, including CPI and PPI for December, alongside the ETF decision, stand as significant factors triggering short-term market volatility and potential shifts in BTC price trajectory.

As the crypto market ushers in the new year, Bitcoin price remains firmly anchored around the $44,000 mark, setting the stage for a potential market-altering move in the upcoming week. The looming decision on the United States’ inaugural spot Bitcoin exchange-traded fund (ETF) and the impending release of US inflation data are poised to drive substantial shifts in BTC price trajectory.

Throughout the past weekend, BTC price action reflected a notable reduction in volatility, a trend closely observed by market analysts. The anticipation surrounding the approval or rejection of the US spot Bitcoin ETF by January 10 has contributed to this subdued market sentiment. Analysts speculate various scenarios, with expectations ranging from a temporary setback for bullish trends, commonly referred to as a “sell the news” event, to a potential price surge, challenging significant psychological thresholds.

Read More: Bitcoin Price Prediction

Despite the uncertainty regarding BTC price’s immediate direction, several indicators suggest an imminent breakout from the current tight trading range. The Bollinger Bands, a volatility indicator, have notably contracted on daily timeframes—a classic precursor to an impending price expansion. Analysts have highlighted this tightening pattern, with Matthew Hyland, a prominent trader and commentator, signaling this event to his subscribers.

Simultaneously, derivative traders appear cautious, showcasing an active “spot premium” on Bitcoin markets. The recent market fluctuations and snap liquidations have led traders to exercise vigilance in taking long or short positions. The prolonged consolidation around the current price level has built up positions, featuring stop losses and liquidations strategically placed above and below BTC price range.

While all eyes remain fixated on the ETF decision, additional macroeconomic factors, namely the impending release of US inflation data for December, stand poised to impact short-term market movements. These data points, including the Consumer Price Index (CPI) and Producer Price Index (PPI), historically trigger volatility not only in the crypto market but also across conventional risk assets. Investors closely watch for signs of inflation’s continued decline, a factor potentially influencing the Federal Reserve’s stance on interest rates, although no significant policy changes are anticipated at the upcoming month-end meeting.

As Bitcoin traders brace for a potential breakout amidst rising volatility and key fundamental developments, the coming days are poised to usher in a significant shift in market sentiment and price action.

This article summarizes the current status of Bitcoin, highlighting the factors contributing to its stabilization around the $44,000 mark and the impending events set to shape its future trajectory.

Additional Read: Bitcoin Halving Countdown

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more