Table of Contents

ToggleKey Takeaways:

- Significant Whale Accumulation: Bitcoin whales have acquired 71,000 BTC worth $4.3 billion during the recent market slump, marking the most substantial level of accumulation since April 2023.

- Market Bottoming Out: Data from CryptoQuant indicates that the current rate of Bitcoin accumulation by whales suggests a possible bottoming out of Bitcoin price, potentially signaling the end of the downturn.

- Divergent Trader Behaviors: While whales are buying large amounts of Bitcoin, smaller traders have been selling their holdings, although there has been an increase in wallets holding at least 10 BTC, showing confidence in Bitcoin’s long-term potential.

- Dormant Whale Activity: A dormant whale moved 1,000 BTC worth nearly $60 million after a 12-year hiatus, highlighting that not all whales are following the same strategy of holding onto their Bitcoin.

- External Market Influences: Factors such as the Mt. Gox Bitcoin settlements and the German government’s Bitcoin sale have contributed to recent price volatility, but Bitcoin price has shown signs of recovery, increasing 6% after a brief dip below $60,000.

A Surge in Whale Activity

In an extraordinary move, Bitcoin whales have seized the opportunity presented by a recent market slump to amass an impressive 71,000 BTC, valued at approximately $4.3 billion at the current market rate. This surge in accumulation represents the most significant level of whale activity since April 2023, a period marked by the collapse of several local banks in the United States.

Market Insights and Analysis

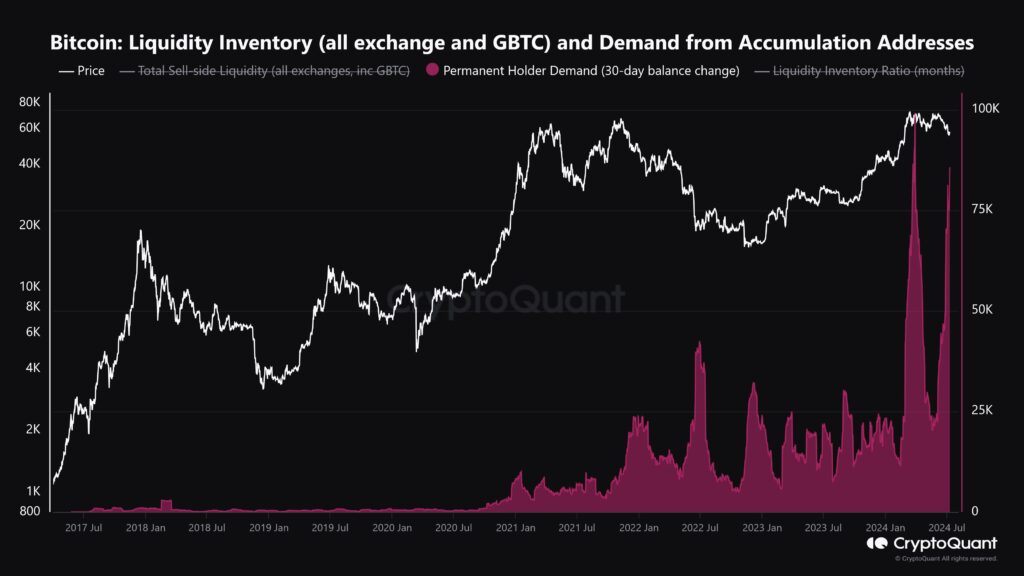

On July 5, Bitcoin price dipped to $54,200, prompting a buying frenzy among large-scale investors. Crypto analytics firm IntoTheBlock provided data indicating this surge in whale activity. Similarly, CryptoQuant has highlighted that Bitcoin whales are currently accumulating Bitcoin at an unprecedented rate, judging by the 30-day moving average.

These whales have bought over 47,000 #BTC at an average price of $57K.

This suggests that the bottoming out of #BTC may be nearly complete.#BTC #Bitcoin pic.twitter.com/MpNqAETAqZ

— 우민규 (Woominkyu) (@Woo_Minkyu) July 10, 2024

Minkyu Woo, an analyst at CryptoQuant, emphasized the implications of this trend. “This suggests that the bottoming out of #BTC may be nearly complete,” Woo commented in a post on the social platform X. His insights suggest that the recent accumulation activity could signal the end of the current market downturn and the beginning of a recovery phase.

Divergent Behaviors Among Traders

Contrasting with the aggressive buying by whales, smaller traders have been offloading their Bitcoin holdings during this dip. Santiment, another crypto analytics firm, reported a net increase of 261 Bitcoin wallets holding at least 10 BTC in the first ten days of July. This data suggests that despite the short-term market volatility, there is an underlying confidence in Bitcoin price’s long-term potential among significant holders.

Not All Whales are HODLing

While many whales are taking advantage of the current prices to bolster their holdings, not all are following the same strategy. A notable event occurred on July 14 when a dormant Bitcoin whale, inactive for 12 years, transferred 1,000 BTC—worth nearly $60 million—to two new wallets. This movement was flagged by Whale Alert, a service that tracks large crypto transactions.

External Market Influences

Several external factors have contributed to Bitcoin price’s recent fluctuations. The ongoing preparation by Mt. Gox to offload $8 billion in Bitcoin to its creditors and the German government’s sale of nearly 50,000 BTC (valued at $3 billion) have significantly influenced the market, contributing to the price decline.

Despite these downward pressures, Bitcoin price has shown signs of resilience. Over the past weekend, Bitcoin price breached the $60,000 resistance level, marking a 6% increase since the close of trading hours on Friday. This recovery was partly fueled by a sharp price uptick following an attempted assassination on US presidential candidate Donald Trump during a rally in Butler, Pennsylvania, on July 13. This incident caused a temporary market shock, underscoring the sensitivity of crypto markets to major geopolitical events.

Read On: Bitcoin Price Prediction

Conclusion

The recent activities of Bitcoin whales during this market downturn illustrate the strategic moves made by large-scale investors to capitalize on lower prices. While smaller traders have been more reactive to the market dip, the overall increase in significant Bitcoin holdings suggests a robust belief in the long-term value of the crypto. With external factors like the Mt. Gox settlements and government Bitcoin sales adding to market volatility, the path forward remains dynamic. However, the recent signs of price recovery provide a beacon of hope for traders and investors alike.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more