Table of Contents

ToggleKey Takeaways:

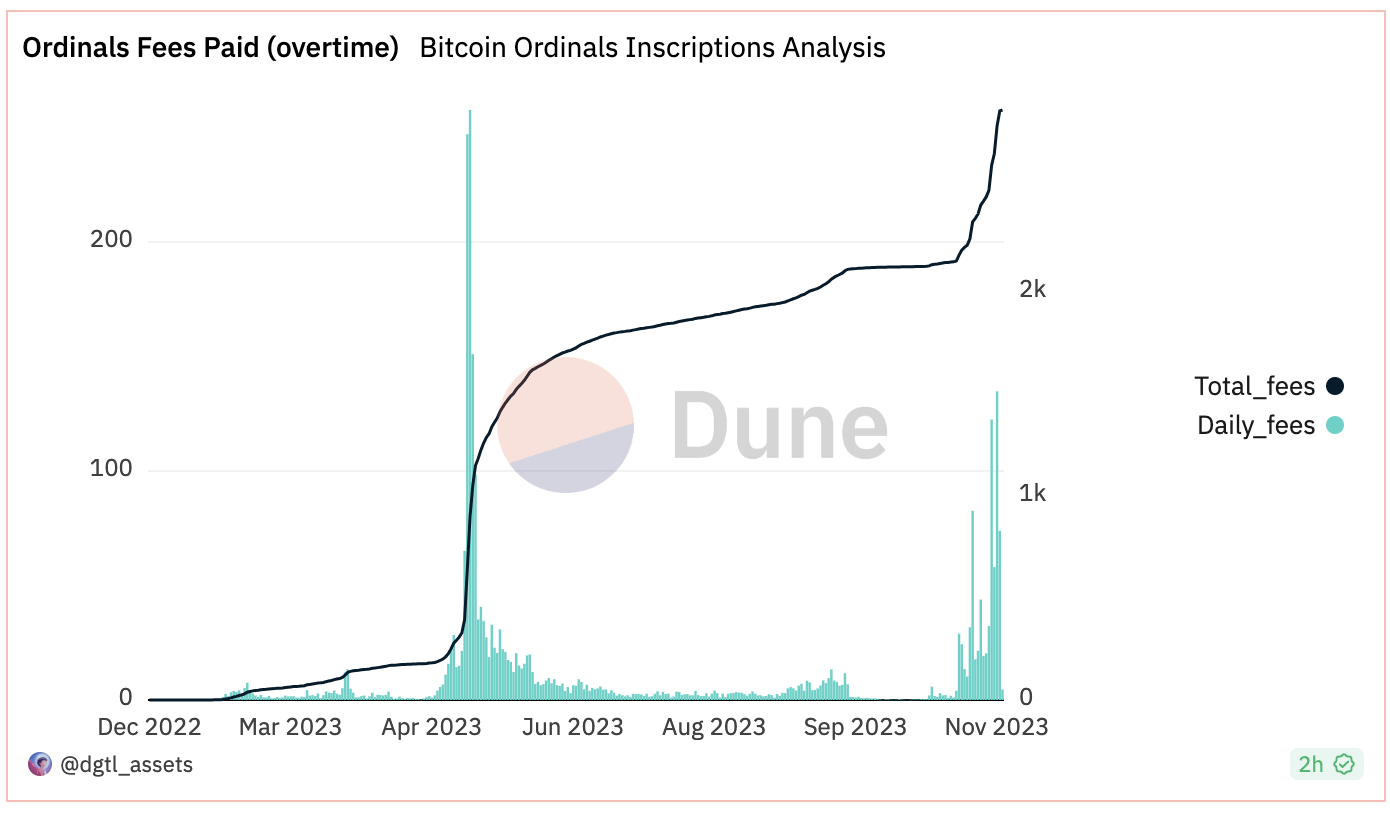

- In November, Bitcoin transaction fees experienced an extraordinary surge of almost 1,400%, propelled by increased demand for Bitcoin Ordinals inscriptions.; which facilitates the creation of NFTs on the Bitcoin blockchain.

- The prevalence of Ordinals has taken center stage in Bitcoin transactions, surpassing 41 million inscriptions. This dominance has had a substantial impact on the network’s fee dynamics, contributing to an overall escalation in transaction costs.

- Driven by the growing popularity of Ordinals, the Bitcoin network witnessed a notable shift, with the substantial volume of inscriptions significantly influencing fee structures and amplifying the total transaction expenses.

As per reports, the initial data from CryptoFees.info showed skyrocketed fees from a modest $779,549 at the beginning of the month to an astounding $11.63 million by November 17, 2023, marking a 1,391% increase. However, as of the current moment, this surge has retraced to $11,559 million.

Ordinals, a novel feature on the Bitcoin blockchain, have played a pivotal role in this surge by enabling the inscription of digital assets onto individual satoshis. Ordinal inscriptions have dominated Bitcoin transactions, resulting in over 41 million inscriptions and generating fees equivalent to approximately 2,876 BTC, valued at around $104.8 million. The rise of Ordinals is reshaping Bitcoin’s transaction landscape and indicating a broader utility beyond its original design.

Dominance of Ordinals in Bitcoin Transactions:

Ordinals have ushered in a revolution in how digital assets are managed on the Bitcoin network, effectively introducing non-fungible tokens (NFTs) within its ecosystem. Dune Analytics’ analysis reveals that Ordinal inscriptions have been the focal point of Bitcoin transactions throughout November. A significant portion of these transactions involves embedding text onto satoshis, the smallest denomination of Bitcoin. The total number of ordinal inscriptions has surpassed 41 million, generating substantial fees amounting to approximately 2,876 BTC, valued at around $104.8 million.

Source: Dune Analytics

This growing interest in Ordinals is not merely a passing trend but is significantly altering the Bitcoin transaction landscape. Beyond the financial implications, this shift signifies a new era for Bitcoin, expanding its utility beyond the initial concept of a peer-to-peer electronic cash system.

Read More: Bitcoin Price Prediction

ORDI’s Performance Since Listing

An analysis of ORDI’s daily timeframe chart indicates a consistently positive price trend, despite occasional declines. The chart illustrates that ORDI has consistently remained above its initial listing price, demonstrating a significant increase of over 70% from its listing value.

As of the current writing, ORDI is trading at $22.79, reflecting a 5.66% decline in the last 24 hours. Meanwhile, Bitcoin has seen a modest increase, currently trading at $36,867.

Source: CoinMarketCap

Conclusion

The surge in Bitcoin transaction fees, fueled by the dominance of Ordinals, highlights a transformative shift in the blockchain’s dynamics. This evolution, driven by the inscription of digital assets on individual satoshis, signifies a broader utility for Bitcoin. As the transaction landscape continues to evolve, the implications of this shift extend beyond financial considerations, shaping a new era for the leading crypto.

Source: Cryptopolitan

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more