Key Takeaways:

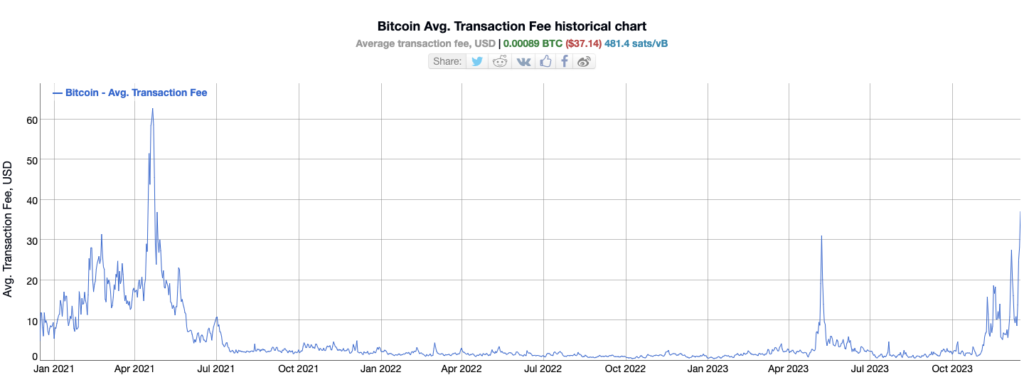

- Surging Fees: Bitcoin’s on-chain fees hit a 20-month high near $40, causing a backlog of 350,000 transactions, especially impacting smaller-value transactions.

- Miner Windfall: Miner revenues align with Bitcoin’s peak prices, reflecting unexpected gains despite concerns over escalating fees.

- Debate on Solutions: A heated debate ensues; some view high fees as inevitable, while others advocate for embracing layer-2 solutions like Lightning Network for scalability.

- Influencer Perspectives: Voices like Hodlonaut and Beautyon stress the urgency of adapting to layer-2 solutions. Adam Back emphasizes that high fees spur innovation in these solutions.

- Adaptation Imperative: Consensus leans towards adapting to layer-2 solutions rather than expecting lower on-chain fees, highlighting the need for innovation in the crypto space.

In a major new development for Bitcoin – miner revenues for Bitcoin miners have risen to match $69k BTC price levels! Additionally, as of December 17, on-chain transaction fees for Bitcoin have soared, with the average fee hovering around $40, according to BitInfoCharts.

This upsurge in fees has sparked a significant debate within the crypto community. While some view these fees as an inevitable consequence of increased network activity, others express concerns about the implications, especially for smaller investors for whom on-chain spending might become economically unfeasible.

Read More: Bitcoin Price Prediction

The current backlog in Bitcoin’s mempool, with nearly 350,000 transactions awaiting confirmation, highlights the strain on the network. Even transactions bearing fees as high as $2 struggle for on-chain priority, underscoring the challenges faced by users looking to conduct smaller-value transactions.

Notably, this fee surge has provided an unexpected windfall for Bitcoin miners. Data from Blockchain.com reveals that miner revenue, comprising block subsidies and fees in USD, has mirrored the heights observed during Bitcoin’s previous peak in November 2021, aligning with the $69,000 valuation.

Prominent figures in the crypto sphere have divergent views on these escalating fees. While some argue that these high fees catalyze the adoption of layer-2 solutions like the Lightning Network, specifically designed to accommodate increased traffic, others contend that such costs are an inherent part of Bitcoin’s evolution.

Individuals like Hodlonaut emphasize that these fees are a glimpse into the future and advocate for embracing layer-2 solutions rather than expecting low fees for on-chain transactions. Similarly, Beautyon underscores the importance of layer-2 solutions in addressing the on-chain fee issue, highlighting that failure to adapt might result in significant challenges for users unprepared for these fee dynamics.

Adam Back, a co-founder of Blockstream, aligns with the perspective of expanding layer-2 capabilities, attributing high fees to encouraging innovation and adoption in this space. He emphasizes that fee complaints fuel further innovation and development in layer-2 solutions.

Despite the dissatisfaction among some users due to the escalating fees, the consensus among key voices in the crypto world seems to converge on the importance of adapting to layer-2 solutions rather than attempting to curb on-chain fees.

As Bitcoin continues its trajectory in the market, currently trading around $41,000 as of writing – the ongoing debate surrounding transaction fees and scalability solutions remains a crucial point of discussion within the community.

Additional Read: Can Bitcoin Halving Initiate a Bull Run in 2024?

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more