Table of Contents

ToggleKEY TAKEAWAYS:

- Bitcoin price records major recovery in the past couple of days.

- BTC price rallies nearly 9% since end of last week and about 7% in the past two days alone.

Bitcoin in the last two days has managed to recover significantly, so much so that BTC price from the end of last week has gone from sub-$18,000 level to over $20,000. Even as of writing, BTC price was trading near $20,700, having almost touched $20,800. Now this is a significantly good news for investors across the board as it indicates that some positivity may be brewing underneath. Last week, we had explored how Bitcoin’s on-chain valuation metrics indicated that the king coin was severely undervalued in the market – and that seems to be playing out less than a week later.

Addition read: How long will Bitcoin stay undervalued?

Before we get further into that, let’s take a look at the technical position of the grandfather of cryptos on the charts.

BITCOIN TECHNICAL OVERVIEW

From a technical perspective, BTC price has broken out of two key levels on the chart. In just a matter of two to three days, Bitcoin price has managed to break out of the bearish descending triangle pattern (marked in black) and also the 50 day moving average (marked in cyan). That is significant because as is evident from the chart, Bitcoin had been stuck in that descending triangle pattern for over two and a half months now and also trading below the 50 day moving average for almost the same time period. So a breakout over that looks pretty optimistic for the immediate short term price action going forward.

However, Bitcoin price is still below the immediate level of $22,000 (marked in blue) which would serve as a stiff resistance level and a convincing sustained price action above $22,000 would trigger further upward moves. But at the same time, we can see the Relative Strength Index, thanks to this recent rally has jumped up to near 65 levels. While this is high, it isn’t overbought levels yet so if the buying momentum continues, we could see a rally above the $22,000 mark pretty soon too.

Related: Bitcoin Price Prediction

Bitcoin supply in top 100 addresses near its ATH

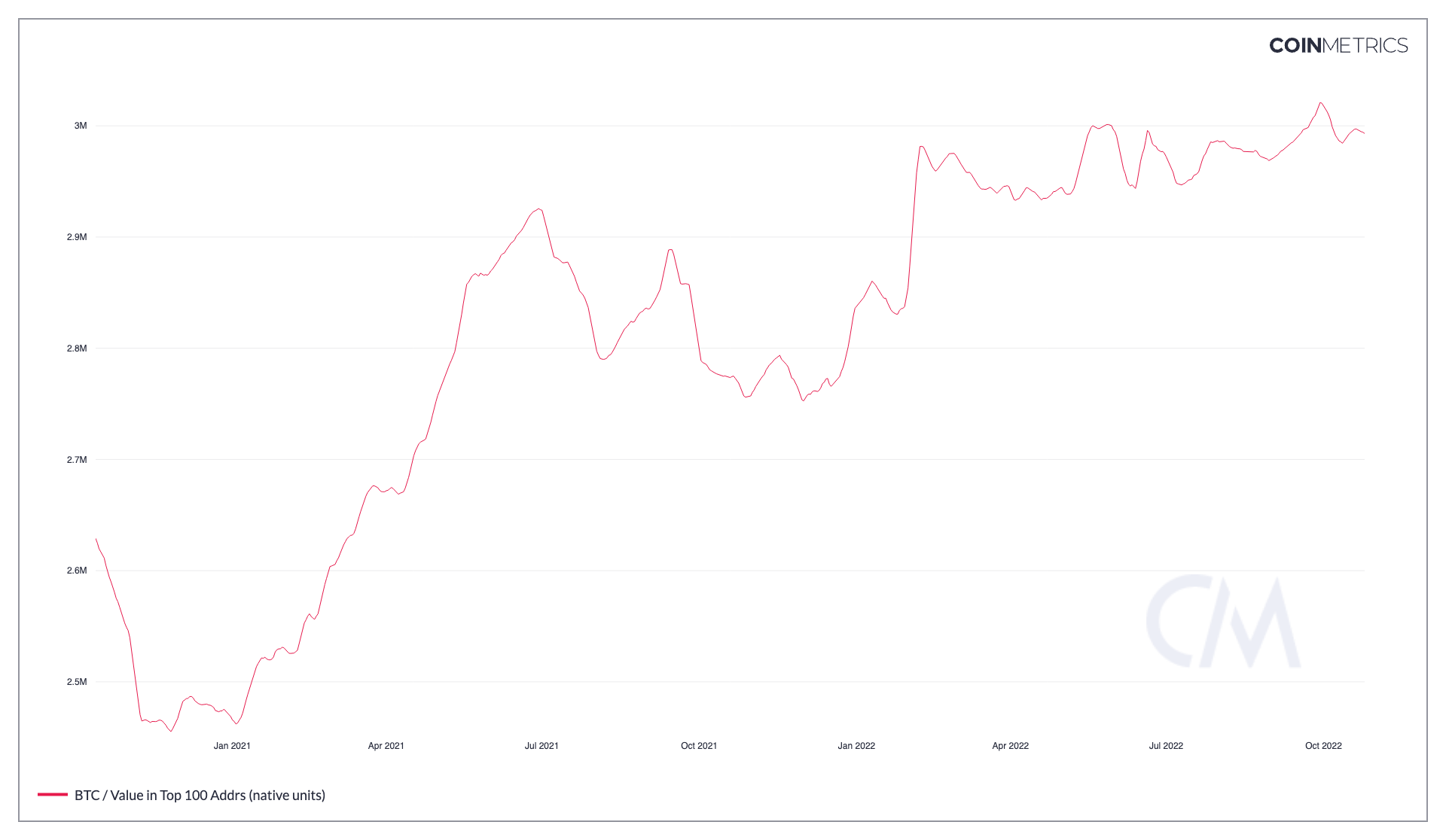

So apart from having very attractive valuations as mentioned in an article from last week, another metric that indicates underlying bullishness in the king coin is its supply in top 100 addresses. So, to clarify – the top 100 addresses basically are the top 100 richest Bitcoin holders who have a large supply of Bitcoins in their repositories. These are arguably some of the biggest long-term ‘HODLers’ of Bitcoin and have made a lot of money, and they have continued to take up long positions in the Bitcoin – and hence, this metric touching a new all-time-high.

What this indicates is that these long-term holders are still strongly bullish on the king coin and are buying more and more at these lower levels, presumably thinking that the prices may go up in the future. A high in this metric also tends to depict predict market bottoms pretty accurately, based on historical data.

Active supply at one of the lowest points ever!

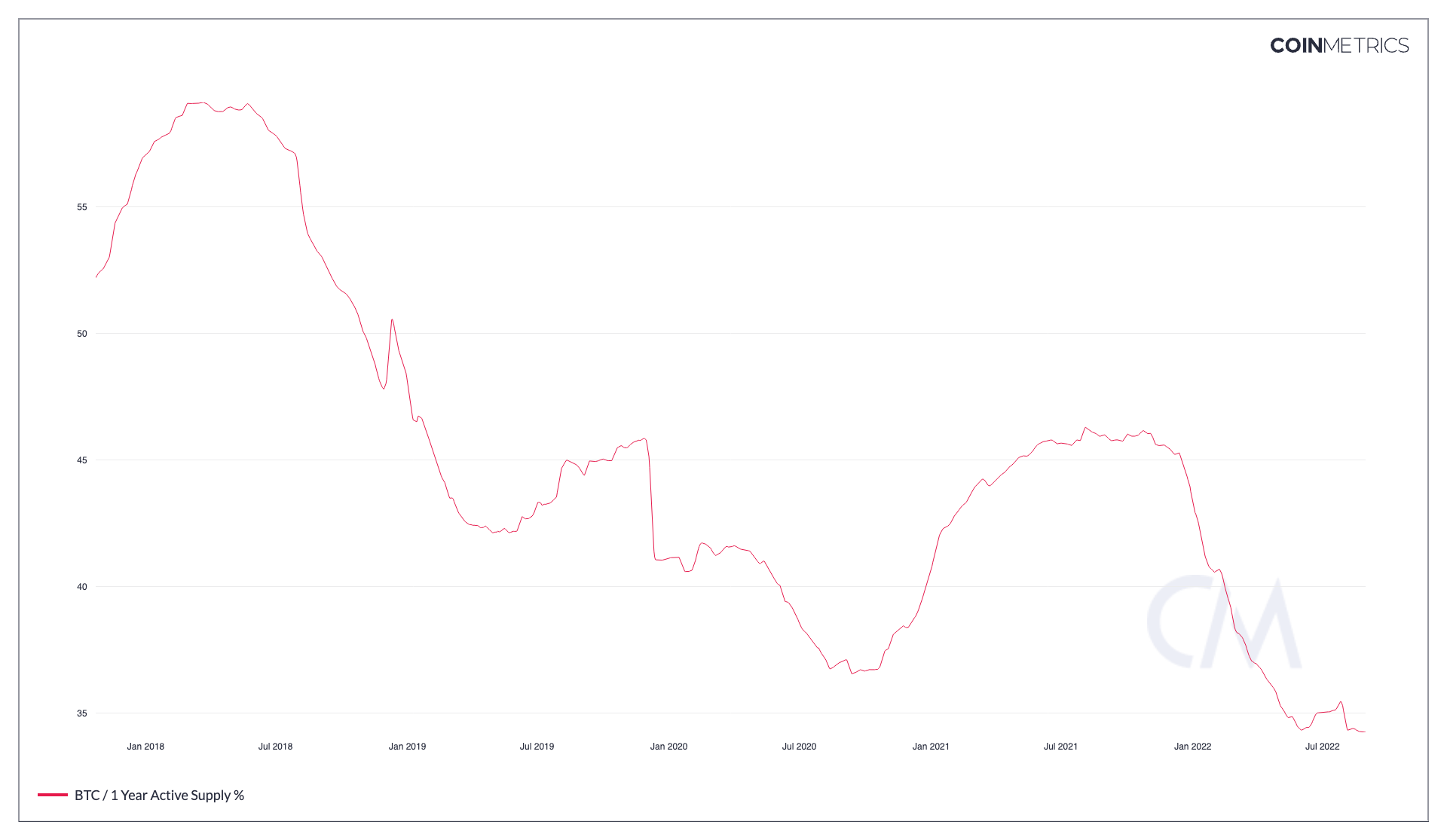

This is another crucial metric that needs a look at. Active supply is a very useful on-chain metric that measures ‘HOLDing’ mentality in the crypto market. The active supply metric measures the number of Bitcoins transacted at least once over a given period – hence a dip in this metric indicates more Bitcoin holders are moving with an intention to ‘HODL’ while a high active supply means that there are more people in the market to trade than to hoard Bitcoin.

Hence, as is evident from the chart above, Bitcoin’s active supply percentage is at the lowest point in several years, which indicates strong HODLer activity happening. And with the Bitcoin price trading within a range, it signifies that these Bitcoin holders are accumulating as many coins as they can.

Conclusion

In light of the above observations, we can conclude that Bitcoin’s metrics seem very optimistic as of now. Bitcoin is pretty undervalued, has a hash rate near its all time highs and is seeing active supply at one of the lowest points ever. Not to mention, supply with the top 100 addresses is at the highest point in two years. So overall things look pretty optimistic for the coin for the time being and a recovery in overall market sentiment, backed up by strong macro economic factors can trigger a major upside in Bitcoin.

Read more: Investors bullish on BTC holdings

Prices as on 26th October, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more