Table of Contents

ToggleKey Takeaways:

- Bitcoin’s Impressive Rally: Bitcoin’s price has seen a strong rally with a consistent higher high, higher low pattern, resulting in an impressive 90% jump from the beginning of the year to the YTD high of around $31,900.

- Sideways Movement: Despite a slight correction, BTC has been trading in a narrow range between $29,500 to $30,500. This sideways movement is not uncommon, and BTC has experienced similar phases twice before this year alone, lasting for almost two and a half months.

- Consolidation Range: BTC price is expected to continue trading within the broader consolidation range of $28,500 to $32,000. A convincing breakout above $32,000 could bring in fresh bullishness.

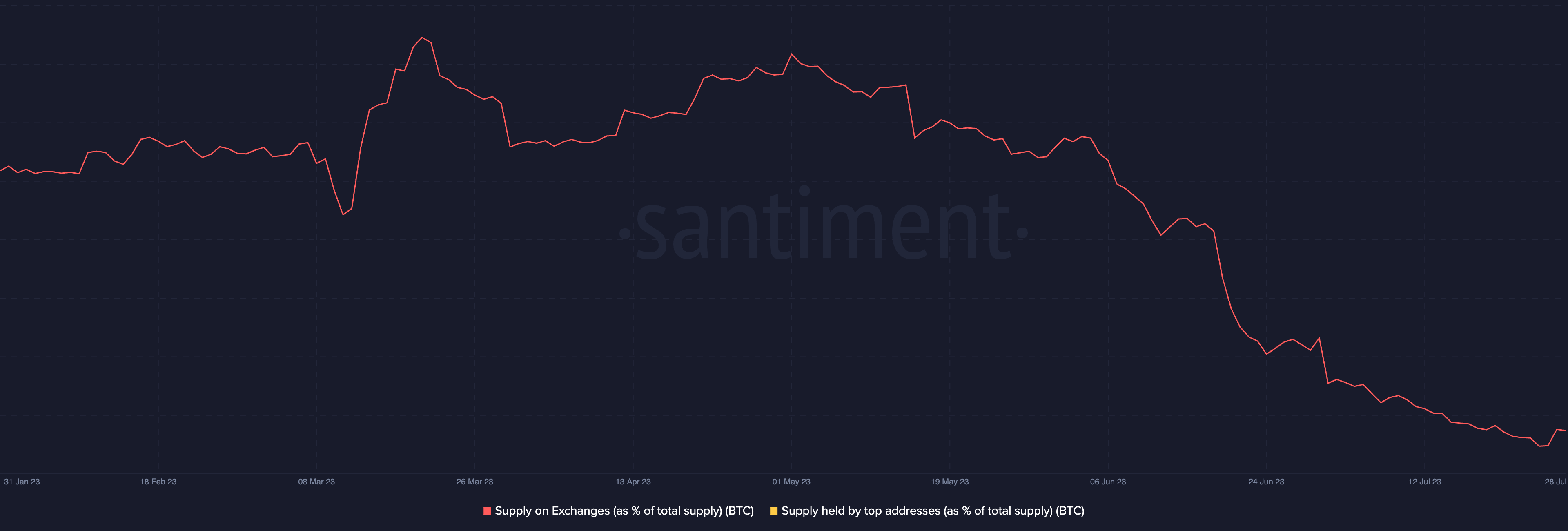

- HODLer Mindset: The decreasing supply of BTC on exchanges suggests a growing HODLer mindset, as more people are moving their holdings to long-term private wallets. This historically indicates bullishness for the market.

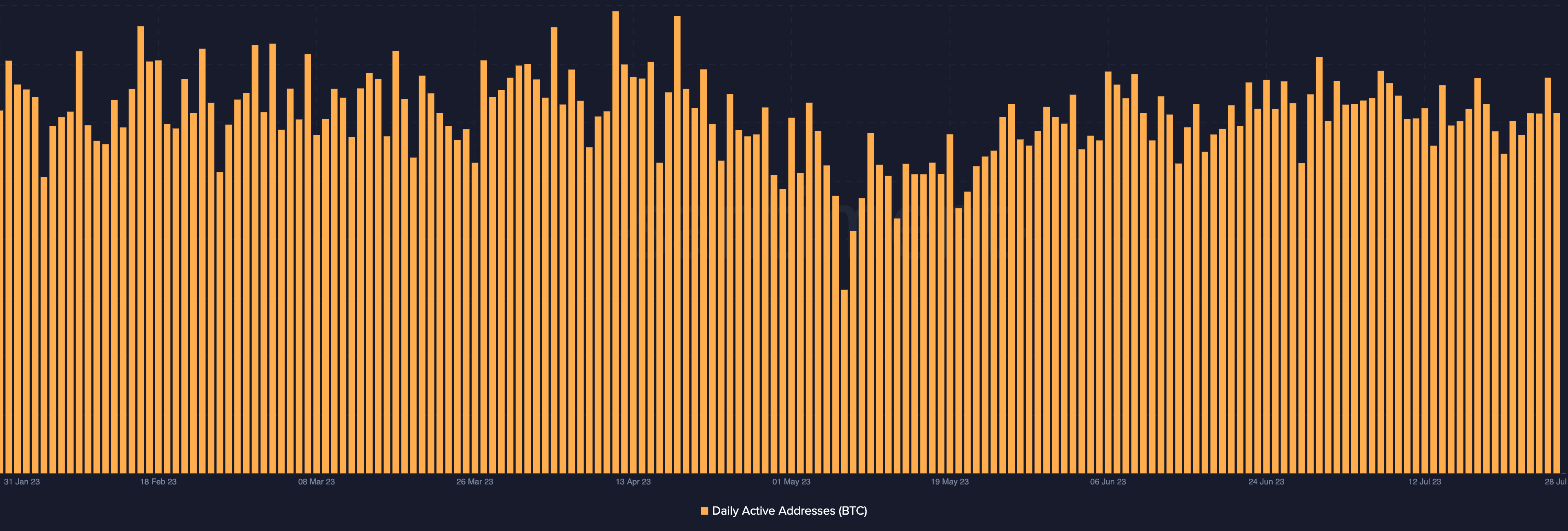

- Active Addresses Indicator: Bitcoin’s active address count has remained consistently high since the beginning of the year. This reflects a growing and engaged user base, indicating strong interest and potential upward price movement. A healthy and vibrant Bitcoin ecosystem contributes to investor confidence, supporting positive price momentum in the short term.

Bitcoin Price Analysis

- Bitcoin price has had a strong rally since the beginning of the year, with an impressively consistent higher high, higher low price action pattern playing out on the charts.

- This led to BTC’s price attaining a nearly 90% jump from the beginning of the year to the YTD high of around $31,900. It has seen a slight correction since then, but there is nothing to be concerned about yet, from a technical perspective.

- BTC price is currently taking support of the 50-day exponential moving average and has practically been trading in a narrow range between $29,500 to $30,500.

- This is not out of the ordinary as a broader picture of the price action in 2023 shows us that BTC has faced this kind of sideways movement twice before this year alone, with the second one spanning almost two and a half months!

- BTC price can be expected to trade within the broader consolidation range between $28,500 and $32,000 for some more time, and only a convincing breakout beyond $32,000 can bring in fresh bullishness.

- The RSI for Bitcoin is on the lower side, which further attests to the idea that a slight flat to bearish view can be taken for Bitcoin in the immediate short term, but the view may change very quickly.

- Thus overall, BTC bulls do not have much to fear about yet despite the current humdrum state of the crypto market overall.

Read On: Bitcoin Price Prediction

Bitcoin Supply on Exchanges Down 12%!

Bitcoin’s supply on exchanges has been going down very sharply since the beginning of May 2023, a decently positive indicator for the price of BTC. This is because a decrease in the supply of BTC on exchanges directly suggests that more and more people are taking their BTC holdings off the exchange wallets and into their own long-term private wallets, indicating a HODLer mindset setting in. And historically, whenever this has happened, we have seen some bullishness coming into the market as a whole. Thus, from the beginning of May, BTC supply on exchanges as a percentage of total supply has shrunk from 6.87% to 6.05%, marking nearly 12% decrease in three months!

Bitcoin Active Addresses Holding Strong!

Bitcoin’s on-chain metric, the active address count, has been consistently high since the beginning of the year. This surge in active addresses is an encouraging sign for the short-term future of the Bitcoin price. The active address count reflects the number of unique addresses involved in Bitcoin transactions on a daily basis. A consistently high active address count indicates a growing and engaged user base, with more individuals participating in Bitcoin transactions. This increased activity suggests a strong interest in the crypto and a higher demand for Bitcoin, which could potentially lead to upward price movement. Moreover, a robust network with a high number of active addresses signifies a healthy and vibrant Bitcoin ecosystem, adding to the overall confidence of investors and traders. As long as the active address count remains elevated, it may contribute to positive price momentum for Bitcoin in the short term.

Read More: BTC Price Rebounds to $29.4K Amid Curve Exploit; Russia’s Bitcoin Mining Boom

Values as on July 28, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more