Key Takeaways:

- Bitcoin Price Rally Towards $40K: A noteworthy $1 billion worth of BTC withdrawals from exchanges in recent weeks signal a bullish sentiment, strengthening the case for Bitcoin price rally towards the $40,000 milestone.

- Long-Term Investor Sentiment: The significant withdrawal suggests investors prefer long-term holding strategies, reflecting optimism amid discussions about an upcoming spot ETF launch in the US.

- Market Impact of Withdrawals: Historically, such substantial outflows from exchanges have signaled local price lows, contributing to expectations of a mid-term upward price movement for Bitcoin price and the broader crypto market.

- Market Expansion and Sentiment Shift: The crypto market’s capitalization has surged to $1.5 trillion, reminiscent of levels seen in May 2022, indicating an approximate addition of $400 billion since October.

- Regulatory and Market Dynamics: Insights from key figures like Federal Reserve governor Chris Waller hint at potential economic slowdowns and a moderation in inflation, potentially influencing future interest rate cuts that could impact various asset classes, including cryptos.

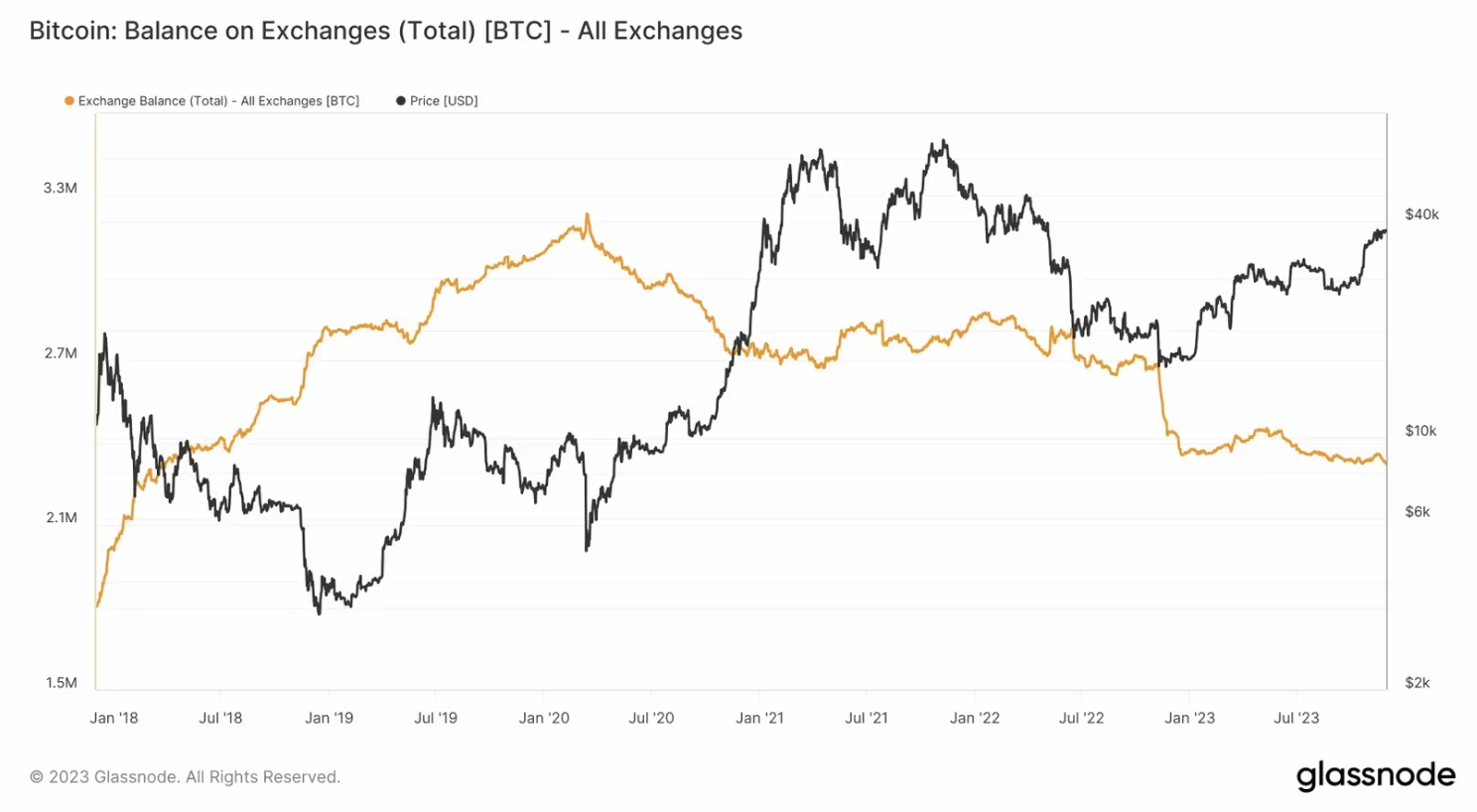

Amidst the current market surge, Bitcoin is eyeing a pivotal $40,000 mark, drawing strength from an impressive development: a substantial withdrawal of Bitcoins worth over $1 billion from exchanges in the last week. Glassnode’s data reports a massive exodus of approximately 37,000 BTC, valued at $1.4 billion, from centralized exchanges since November 17. This departure suggests a strong inclination among investors to secure direct custody of their assets, indicating a possible shift towards a long-term holding strategy.

While this withdrawal surge could partially relate to recent exchange legal issues in the crypto market, the broader sentiment seems to signal an optimistic outlook. The anticipation surrounding the potential launch of a spot exchange-traded fund (ETF) in the US has added euphoria to the market, fostering a desire among investors to retain their holdings.

Typically, such substantial outflows from exchanges have historically signaled local price lows, reinforcing expectations of a mid-term upward price movement. The recent surge in Bitcoin price above $38,800 has propelled the token and catalyzed a market-wide surge, with major tokens observing spikes of up to 5% in the past 24 hours.

Read More: Bitcoin Price Prediction

The collective crypto market cap has surged to $1.5 trillion, reminiscent of May 2022, marking a whopping $400 billion addition since the beginning of October 2023. Market experts suggest that future interest rate cuts by central banks might attract more capital, potentially heightening volatility in speculative markets like cryptos.

Anthony Rousseau, head of brokerage at TradeStation, highlighted this dynamic, stating,

“We are potentially entering, in 2024, an opportunity for a net positive liquidity for the markets. Bitcoin is a pure reflection of net liquidity in the markets, and we would need to see positive liquidity to support any substantial bullish activity.”

Bitcoin price momentum gained traction following Federal Reserve governor Chris Waller’s comments, signaling a potential economic slowdown and a continuous moderation in inflation. If these trends continue, Waller indicated a possibility of rate cuts within a few months. Typically, higher interest rates trigger market shifts, potentially causing risk assets like stocks and cryptos to face downward pressure as investors seek refuge in bonds.

As Bitcoin eyes the $40,000 milestone and beyond, these recent developments suggest a potential bullish trend underpinned by market dynamics and regulatory cues. The massive withdrawal from exchanges signifies a significant sentiment shift among investors, possibly paving the way for further upward movement in the crypto space.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more