Table of Contents

ToggleKey Takeaways:

- Bitcoin’s Surge: Bitcoin is on a significant surge, surpassing July 2023 levels and hitting new highs for 2023.

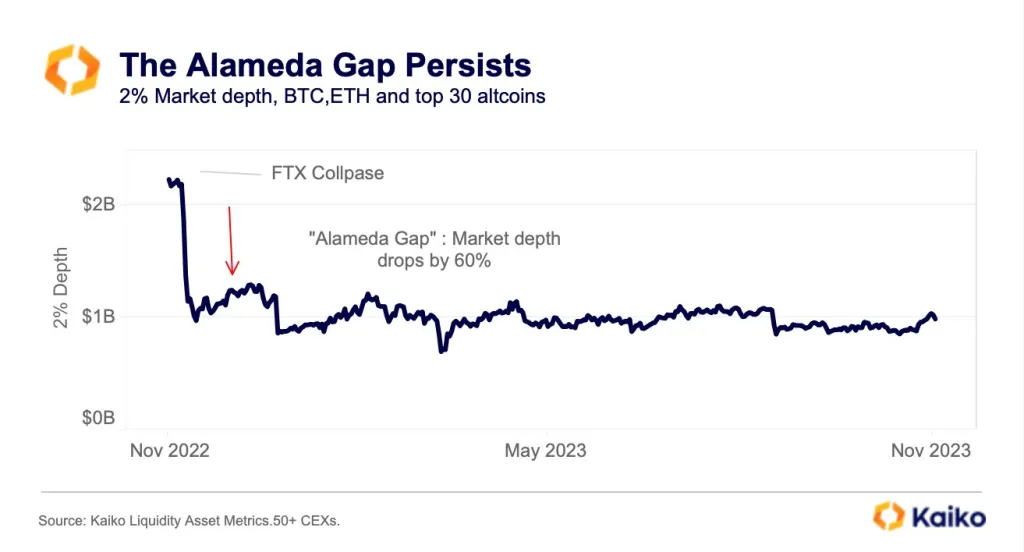

- Post-FTX Impact: The 2022 downturn, linked to FTX and Alameda Research collapse, still affects Bitcoin liquidity, despite the ongoing rally.

- Alameda Gap Persists: The “Alameda gap,” indicating liquidity drop post-FTX, persists even with a 20% Bitcoin rise in October.

- Trading Challenges: FTX and Alameda Research’s collapse created challenges in Bitcoin trading, especially in terms of liquidity.

- Spot Bitcoin ETF Potential: SEC approval of a spot Bitcoin ETF could improve liquidity, increase Bitcoin demand, and attract institutional interest.

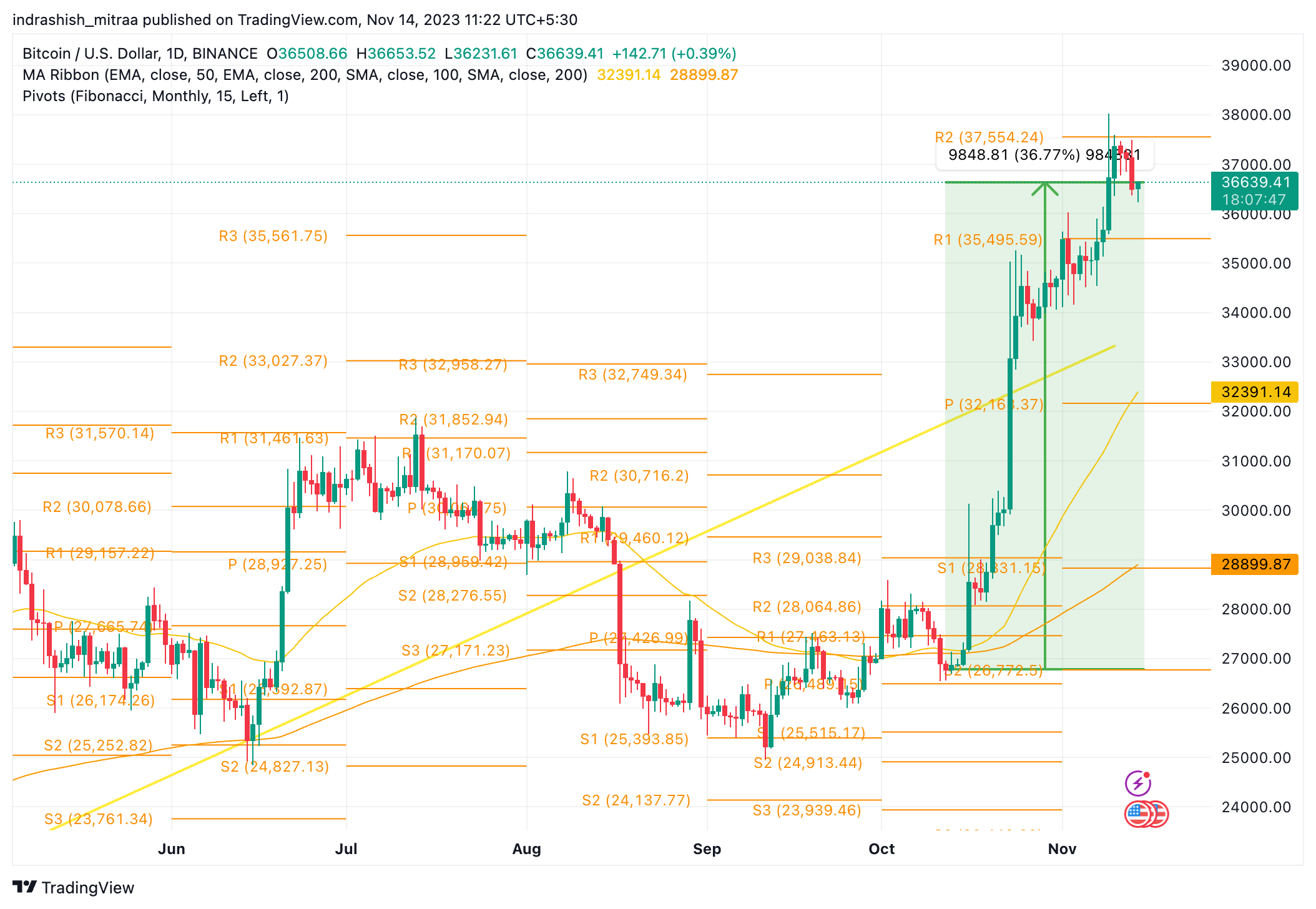

Bitcoin price is currently witnessing a remarkable surge in its spot rates, surpassing the resistance level seen in July 2023. This surge has propelled the crypto to new highs for 2023, marking a strong recovery from the lows experienced in 2022. A significant factor contributing to the downturn in 2022 was the collapse of FTX and Alameda Research, the trading arm associated with the now-defunct crypto exchange.

BTC Price Rally Amidst Liquidity Concerns

Despite the ongoing BTC price rally, Bitcoin’s liquidity is currently hovering around the levels witnessed after the collapse of FTX, and the Alameda gap, a term referring to the observed drop in liquidity post-FTX’s collapse, remains a persistent concern. This is particularly noteworthy considering the rapid surge in crypto prices throughout late October and early November 2023.

At the time of writing, Bitcoin’s price is trading well above the $36,600 mark, having touched approximately $37,500 a few days ago. This surge represents nearly a 5% increase within the past week and underscores the king coin’s impressive performance, with a year-to-date increase of over 121% as of writing this article. However, it’s essential to note that despite these gains, Bitcoin is still significantly below its all-time high of above $69,000 in November 2021.

Read More: Bitcoin Price Prediction

Kaiko Reports on Liquidity and the Alameda Gap

Reports from Kaiko, a blockchain analytics platform, reveal that despite the 20% rise in October in Bitcoin price, the “Alameda gap” persists, and overall market liquidity remains constrained. The Alameda gap is the decline in liquidity that impacted the Bitcoin market following FTX’s filing for bankruptcy in November 2022.

The collapse of FTX, coupled with the folding of Alameda Research, one of the top crypto and Bitcoin market makers, led to a significant drop in Bitcoin liquidity. This decline has endured, even as Bitcoin prices have more than doubled from the pits of 2022.

With the collapse of FTX making headlines, Alameda Research’s role in providing liquidity to the market was crucial. The firm actively bought and sold large amounts of BTC, facilitating smooth trading without slippage. The subsequent drop in Bitcoin liquidity has persisted, making trading less smooth than pre-FTX and Alameda Research’s collapse.

Spot Bitcoin ETF Approval: A Potential Solution?

Approving a spot Bitcoin exchange-traded fund (ETF) by the United States Securities and Exchange Commission (SEC) could be crucial in addressing Bitcoin’s liquidity challenges. A spot Bitcoin ETF would allow investors to gain direct exposure to Bitcoin without the need to buy or sell the crypto directly.

The SEC’s potential approval of such a product might lead to increased demand for Bitcoin, potentially driving up market volatility. Furthermore, clearer regulations could surge institutional interest, bringing additional capital into the crypto industry.

Conclusion

In conclusion, while Bitcoin is experiencing a bullish surge, liquidity concerns persist, reflecting the lasting impact of the collapse of FTX and Alameda Research. The narrowing of the Alameda gap and the prospective approval of a spot Bitcoin ETF offer hope for improved liquidity and increased market activity in the months ahead. As the crypto market continues to evolve, balancing the excitement of price rallies with a focus on underlying market structures remains crucial for investors.

Source: Bitcoinist

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more