Key Takeaways:

- Bitcoin’s Resurgence: Bitcoin has experienced a remarkable surge, surpassing the $57,000 milestone for the first time since November 2021, signaling a resurgence in BTC price.

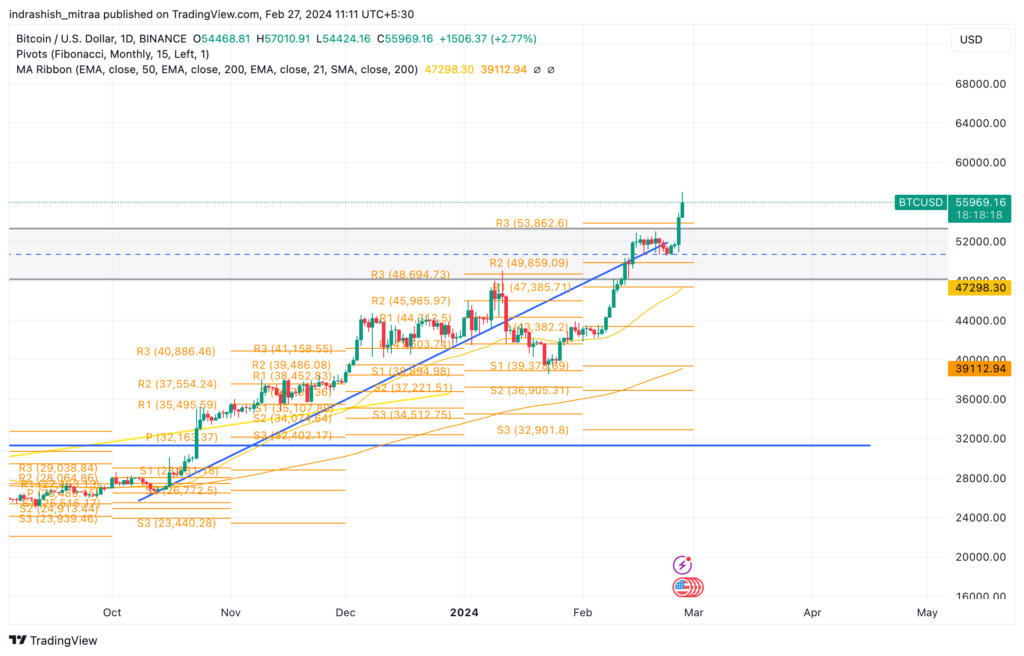

- Bullish Momentum: The rally began during Monday’s US trading hours, with Bitcoin price breaking through key levels such as $53,000, $54,000, $55,000, $56,000, and finally reaching $57,000. The momentum reflects a renewed bullish sentiment in the market.

- Record Spot ETF Activity: US-based spot Bitcoin ETFs, excluding Grayscale’s GBTC, witnessed record volumes totaling $2.4 billion in trading on Monday. This surge indicates increased institutional interest and participation in the crypto market.

- GBTC’s Shifting Dynamics: Grayscale’s GBTC, which had experienced consistent outflows since the launch of spot ETFs, saw a significant change. It recorded its smallest one-day outflow of Bitcoin since January 11, shedding just 921 tokens. This shift suggests a potential reassessment of investor sentiment.

- Market Impact: The positive market sentiment driven by Bitcoin’s price surge and heightened ETF activity is expected to influence trading strategies. Investors are closely monitoring these developments as the crypto market undergoes dynamic changes, with potential implications for future trends.

Read More: Bitcoin Price Prediction

In a remarkable turn of events, Bitcoin (BTC) has experienced substantial gains, surpassing key milestones and reigniting excitement in the crypto market. The leading crypto soared through various round-number benchmarks, reaching a significant high of $57,000 for the first time since November 2021. This surge follows a trend of bullish momentum that commenced during Monday’s US trading hours.

As of the latest update, Bitcoin has slightly pulled back to $56,500, maintaining an impressive gain of over 9% within 24 hours. The broader CoinDesk 20 Index (CD20) also reflects the positive sentiment, recording an 8.9% increase over the same timeframe.

The rally unfolded during the US morning on Monday when Bitcoin surpassed the $53,000 mark, a level unseen since November 2021. The momentum continued to build throughout the day, with the price surging above $54,000. However, the most significant movements occurred during the US evening and early Asia morning, as Bitcoin swiftly conquered the $55,000, $56,000, and $57,000 levels in minutes.

Notably, this surge in Bitcoin price triggered heightened activity in US-based spot Bitcoin ETFs. The group, excluding Grayscale’s GBTC, achieved a record-high trading volume of $2.4 billion on Monday, as reported by Bloomberg. This surge in ETF activity underscores the growing interest and participation of institutional investors in the crypto market.

Even Grayscale’s GBTC, which had seen consistent outflows since the launch of spot ETFs on January 11, experienced a notable shift. The fund recorded its smallest one-day outflow of Bitcoin, shedding just 921 tokens. This shift in GBTC’s dynamics indicates a potential shift in investor sentiment as the market rally prompts a reassessment of investment strategies.

The resurgence of Bitcoin and the heightened trading activity in spot ETFs mark a significant development in the crypto landscape. Investors are closely monitoring these movements, and the positive market sentiment is expected to influence trading strategies in the coming days. As Bitcoin continues to showcase resilience and break key resistance levels, the broader crypto community eagerly anticipates further developments in this ongoing bullish trend. Stay tuned for more updates as the crypto market dynamics unfold.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more