Key Takeaways:

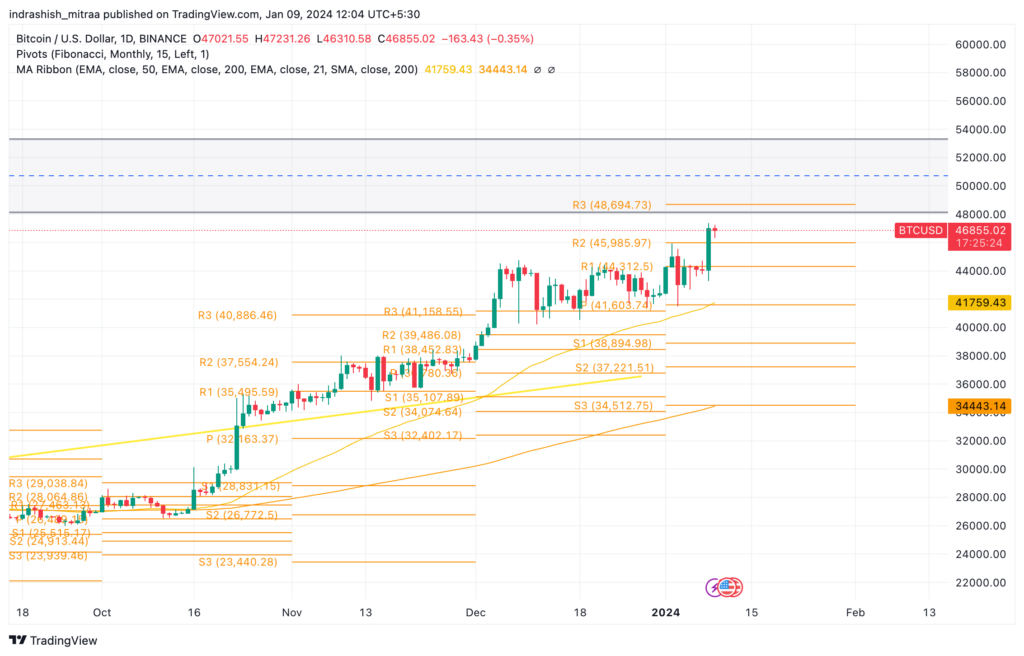

- BTC Soars Beyond $47,000: Bitcoin price surged to its highest since April 2022, reaching $47,192 amidst fervent anticipation of SEC approval for spot-based BTC ETFs.

- Eyes on SEC Decision: Investors eagerly await the SEC’s ruling on spot-based BTC ETFs, which could usher in a new era, expanding the investor base and attracting significant capital.

- Analyst Projections: LMAX Group’s Joel Kruger forecasts a potential 10%-15% surge after SEC approval, highlighting the potential influx of sidelined capital into the market.

- Potential Scenarios: Kruger warns of a potential correction if the ETFs are not approved but remains optimistic, noting robust support anticipated above $30,000 for Bitcoin.

- Market Sentiment: The market is abuzz with excitement and cautious optimism, recognizing the monumental impact the SEC’s imminent decision could have on Bitcoin’s trajectory and the broader crypto landscape.

Bitcoin price has stormed past the $47,000 mark, marking its highest point since April 2022, riding the wave of high expectations surrounding the approval of a revolutionary spot-based BTC ETF in the US Analysts are eyeing a potential 10%-15% surge should the SEC greenlight this eagerly awaited financial instrument.

This surge unfolded rapidly, with Bitcoin soaring by almost 7% within the span of hours, catapulting from $43,200 to a staggering $47,192 during the bustling US trading session. The spike reflects a palpable market enthusiasm fueled by the imminent regulatory verdict regarding the pioneering spot-based Bitcoin exchange-traded funds.

Additional Read: Bitcoin Price Prediction

The anticipation among investors is palpable, as the approval of these ETFs is anticipated to herald a new era, expanding the investor base and attracting substantial capital inflows. The anticipation has been further intensified by significant players like BlackRock, Fidelity, and Grayscale updating their filings with the SEC, revealing their proposed fees for these ETFs, adding to the anticipation and speculation surrounding their potential impact on the market.

Analysts, including Joel Kruger from LMAX Group, have provided insights into the potential scenarios following the SEC’s decision. Kruger highlighted the prospect of an SEC approval acting as a springboard for Bitcoin, projecting an additional surge of 10%-15%. He emphasized the influx of sidelined capital, ready to pour into the market upon regulatory validation.

However, Kruger offered a cautionary note, underscoring the possibility of a correction in the event of disapproval. Despite this, he expressed confidence in Bitcoin price resilience, pointing to robust support anticipated above the $30,000 mark, highlighting the pivotal nature of the impending SEC ruling and its profound influence on Bitcoin price trajectory.

The overarching sentiment in the market is feverish excitement and cautious optimism as investors eagerly await the SEC’s decision, which is anticipated to be revealed imminently. The prospect of a groundbreaking financial instrument like a spot-based BTC ETF getting regulatory approval in the US stands as a significant milestone in the evolution of crypto investments, potentially reshaping the landscape and accessibility for both institutional and retail investors.

The market is primed for a seismic shift, and the imminent SEC decision serves as a pivotal juncture that could shape the immediate trajectory of Bitcoin and reverberate throughout the broader crypto market. Investors and enthusiasts alike are on tenterhooks, eagerly awaiting the verdict that could mark a transformative moment in the Bitcoin price journey and the broader digital asset sphere.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more