Key Takeaways:

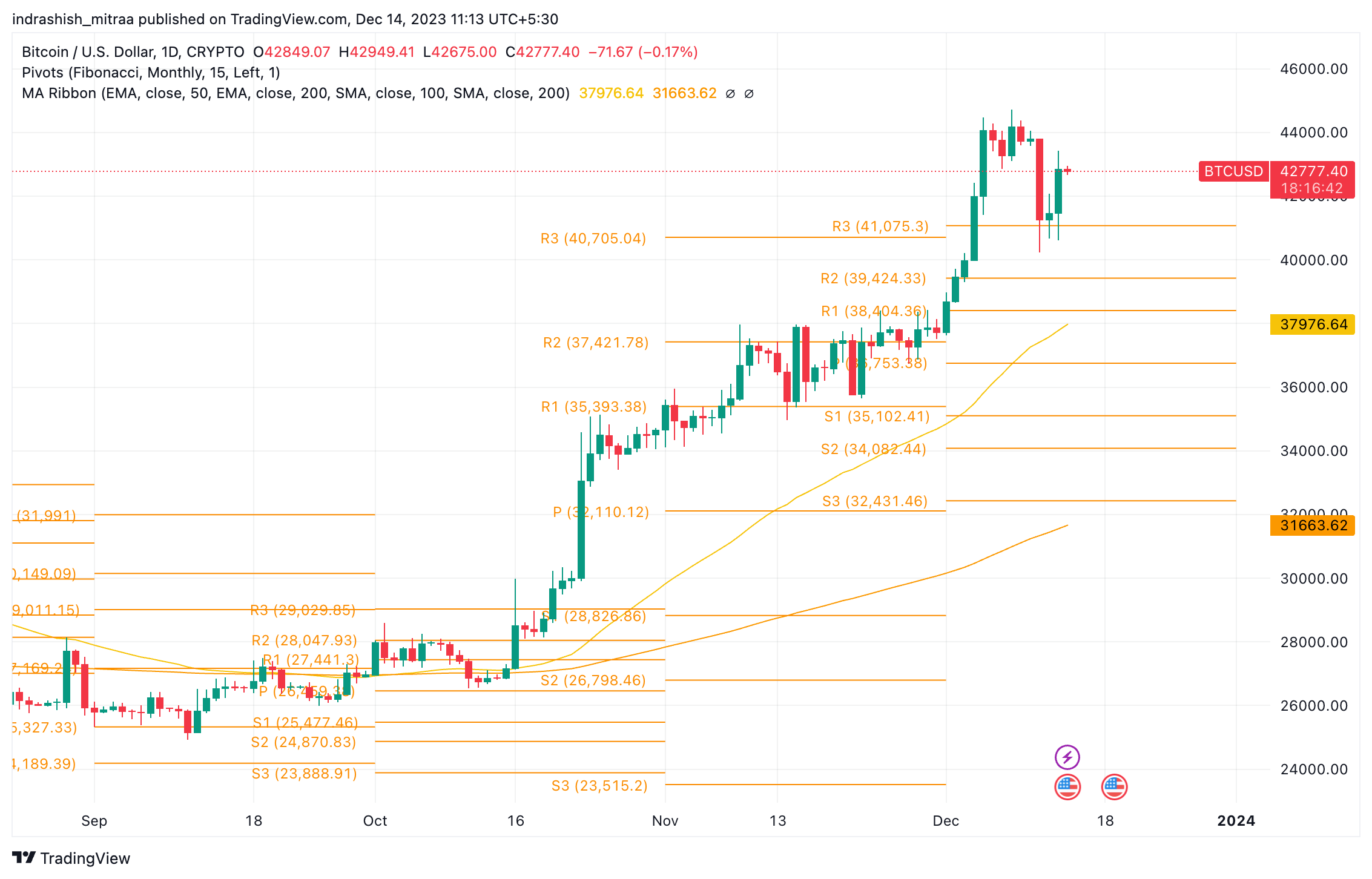

- Bitcoin Surges Beyond $43K: BTC price bounce over $43,000 led a market-wide surge following signals of Fed rate cuts, driving optimism across crypto assets.

- Altcoin Performance Soars: Altcoins like Cardano’s ADA, Avalanche’s AVAX, and Injective’s INJ witnessed substantial gains, propelling the CoinDesk Smart Contract Platform Index upwards.

- Federal Reserve’s Dovish Stance: US Fed’s hint at upcoming rate cuts triggered declines in bond yields and the US dollar index, fueling a robust rally across risk assets, including cryptos.

- Marketwide Crypto Boost: The CoinDesk Market Index (CMI) surged by 3.8%, reflecting gains across nearly 200 digital assets, while crypto-related stocks also surged, including Coinbase and MicroStrategy.

- Impact on Bitcoin Mining Stocks: US-listed Bitcoin mining firms Marathon Digital, Riot Platforms, and CleanSpark substantially increased, indicating the broader market’s influence on related stocks.

Bitcoin price surged past $43,000, leading a market-wide upswing as the Federal Reserve hinted at upcoming rate cuts, propelling crypto stocks and altcoins like Cardano’s ADA, Avalanche’s AVAX, and Injective’s INJ to significant gains.

The Federal Reserve’s dovish stance at the December FOMC meeting indicated a potential decline in the Fed funds rate to 4.6% by 2024, suggesting around three 25 basis point cuts. This dovish projection triggered sharp declines in bond yields and the US dollar index (DXY), fueling a robust rally across risk assets, including stocks and cryptos.

Additional Read: Bitcoin Price Prediction

Watch Chair Powell’s statement from the #FOMC press conference:

Intro clip: https://t.co/X9WFdW7rqB

Full video: https://t.co/wZGReSuH1e

Press Conference materials: https://t.co/a3sEt1So0h

— Federal Reserve (@federalreserve) December 13, 2023

BTC soared nearly 5% to surpass $43,000 during the US trading hours, stimulating notable increases in AVAX, ADA, and INJ, contributing to the impressive performance of the CoinDesk Smart Contract Platform Index. It has since corrected slightly after US trading hours, but nothing to be worried about.

Amidst this surge, the CoinDesk Market Index (CMI) surged by 3.8% within 24 hours, tracking gains across nearly 200 digital assets. The rally extended beyond cryptos, influencing crypto-related stocks like Coinbase (COIN), which closed nearly 8% higher, and MicroStrategy (MSTR), gaining 5%.

Furthermore, US-listed Bitcoin mining firms such as Marathon Digital (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) experienced substantial upticks ranging from 8% to 16%.

Analysts at Bitfinex noted that historically, sustained or reduced interest rates tend to boost investor optimism, implying increased disposable income and potential diversification into various asset classes, including cryptos.

Bitcoin price surge beyond $43,000 amid the Fed’s signals of forthcoming rate cuts has ignited a broader market rally, indicating growing investor confidence across traditional and novel asset classes. This optimism reflects the potential for continued growth and investment diversification amid evolving economic dynamics.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more