Table of Contents

ToggleKey Takeaways:

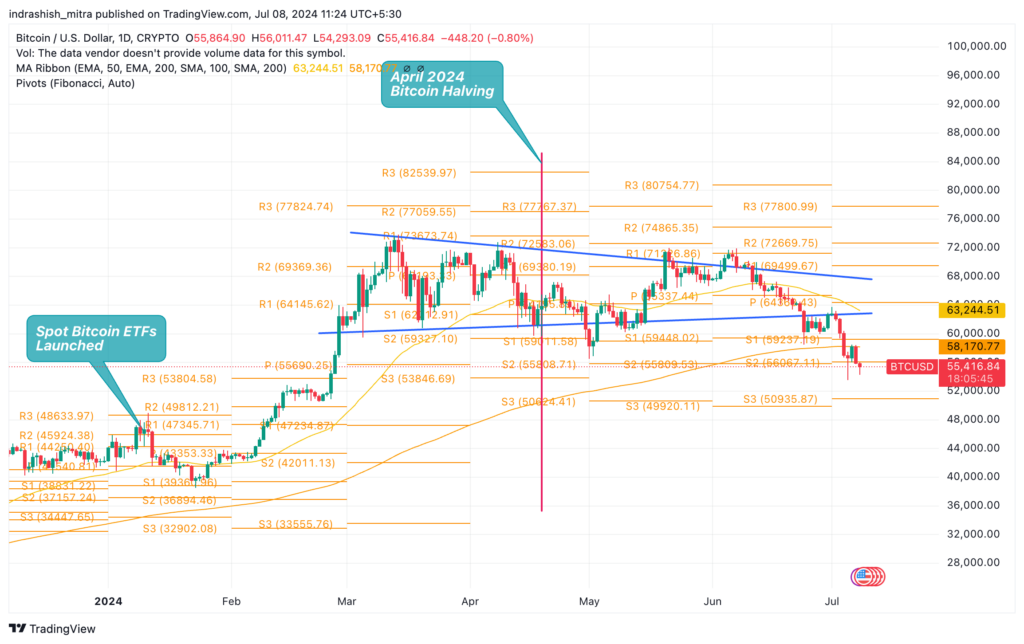

- Bitcoin Price Drop: Bitcoin price is falling, hitting a low of $54,000 over the weekend, marking its lowest point since late February.

- Mounting Selling Pressure: Significant selling is anticipated due to potential liquidations from the German government’s 39,826 BTC holdings and 142,000 BTC repayments from the defunct Mt. Gox exchange.

- Market Liquidations: Recent sell-offs resulted in $600 million in liquidations, with long positions wiped out by $175 million and short positions by $35 million.

- Liquidity Challenges: Broader market liquidity issues are impacting crypto prices, influenced by the Federal Reserve’s reverse repo balance surge and reduced liquidity injections from China since February 2024.

- Future Outlook: Experts suggest that Bitcoin price may stabilize only after the selling pressure from Mt. Gox and the German government subsides, leaving traders to navigate a potentially volatile market in the coming months.

Bitcoin, the largest crypto by market capitalization, has faced another challenging weekend, dropping by 6% to $54,600. This decline comes despite the asset’s attempt to recover from losses incurred towards the end of last week.

Weekend Bitcoin Price Movement

During the weekend trading, Bitcoin price fell to a low of $54,000 on Friday, as reported by Decrypt data. Although it has since recovered slightly to trade at $55,300, the crypto continues to face several headwinds. The most significant factors contributing to this recent Bitcoin price drop include market uncertainty, potential selling pressure from the German government, and the impending release of funds from the Mt. Gox bankruptcy estate. Bitcoin price has recovered sightly after touching lows under the $55,000 mark but the overall trajectory looks bearish.

Bitcoin price has struggled to maintain its footing amidst a series of market uncertainties. One of the primary concerns is the potential selling pressure from the German government, which holds 39,826 BTC, currently valued at approximately $2.2 billion. According to Arkham Intelligence, these holdings could significantly impact the market if liquidated.

In addition, 127,000 creditors from the defunct Japanese exchange Mt. Gox are set to receive up to $7.7 billion in Bitcoin and Bitcoin Cash as repayments begin this month. The release of these funds has added to the already prevalent market anxiety.

Additional Read: Bitcoin Price Prediction

The Impact of Mt. Gox and German Government Holdings

Observers and experts alike are closely monitoring the situation, speculating that the end of the Bitcoin sales from Mt. Gox and the German government might mark a bottom for the crypto. In late Thursday trading, Bitcoin shed 7% of its value, plummeting to $53,550. This significant drop sparked a wave of liquidations, further compounding the market’s woes.

K33 Research has highlighted that while it remains unclear how much of the total distribution from Mt. Gox will be sold on the open market, the selling pressure is expected to be substantial. Summer, typically a quieter period for crypto markets, could see increased activity as the excess supply floods the thinly traded order books.

Liquidations and Market Liquidity

The recent sell-off has led to considerable liquidations across the crypto market. Data from CoinGlass reveals that long positions worth $175 million have been wiped out, along with $35 million in short positions, totaling approximately $210 million in liquidations.

The broader markets have also felt the impact of a liquidity shortfall in Q2 2024. Web3-focused venture capital firm Ryze Labs noted that the Federal Reserve’s reverse repo balance surged by over $200 billion last week, reaching $664.5 billion. This substantial increase hints at a significant liquidity drain.

Additionally, the reduction in China’s liquidity injections since February 2024 could further tighten global liquidity. Ryze Labs has pointed out that this tightening might affect crypto prices, increasing market volatility.

Will Bitcoin Price Rise Again?

Despite the current bearish outlook and ongoing sell-offs, there is a silver lining. Will Bitcoin rise again? Historically, Bitcoin has shown resilience and the ability to rebound from significant downturns. Market sentiment can shift rapidly, and positive regulatory developments or increased institutional interest could catalyze a recovery.

Institutional support remains strong, with major financial entities continuing to invest in and adopt Bitcoin. This ongoing support, coupled with advancements in blockchain technology and increasing mainstream acceptance, could help stabilize the market and pave the way for future gains.

Know More: How Low Can BTC Price Go in 2024?

Conclusion

Bitcoin’s recent drop below $55,000 underscores the volatile nature of the crypto market. While Bitcoin price is falling due to multiple headwinds, including potential sales from the German government and Mt. Gox creditors, the long-term outlook for Bitcoin remains cautiously optimistic. As investors navigate this turbulent period, understanding why Bitcoin crash events occur and analyzing market dynamics will be crucial. The answer to how low will BTC price go is uncertain, but Bitcoin’s resilience suggests that a future rise is likely. By staying informed and adapting to market changes, investors can better position themselves for potential recovery.

Source: Decrypt

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more