Table of Contents

ToggleKey Takeaways:

- Unlike previous cycles, Bitcoin’s present cycle demonstrates an unprecedented lack of volatility.

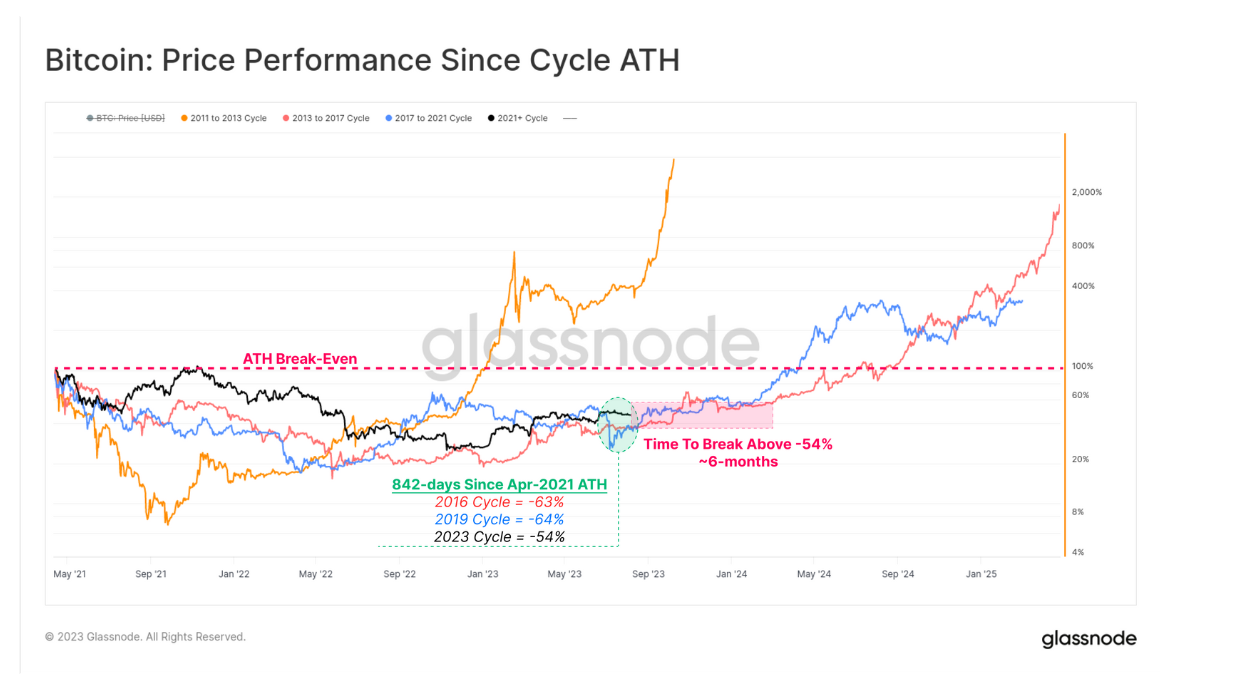

- The 54% difference from its peak indicates progress when compared to previous market cycles.

- Glassnode’s data highlights recovery beyond 54% took about six months in previous cycles, coinciding with the upcoming bitcoin halving event.

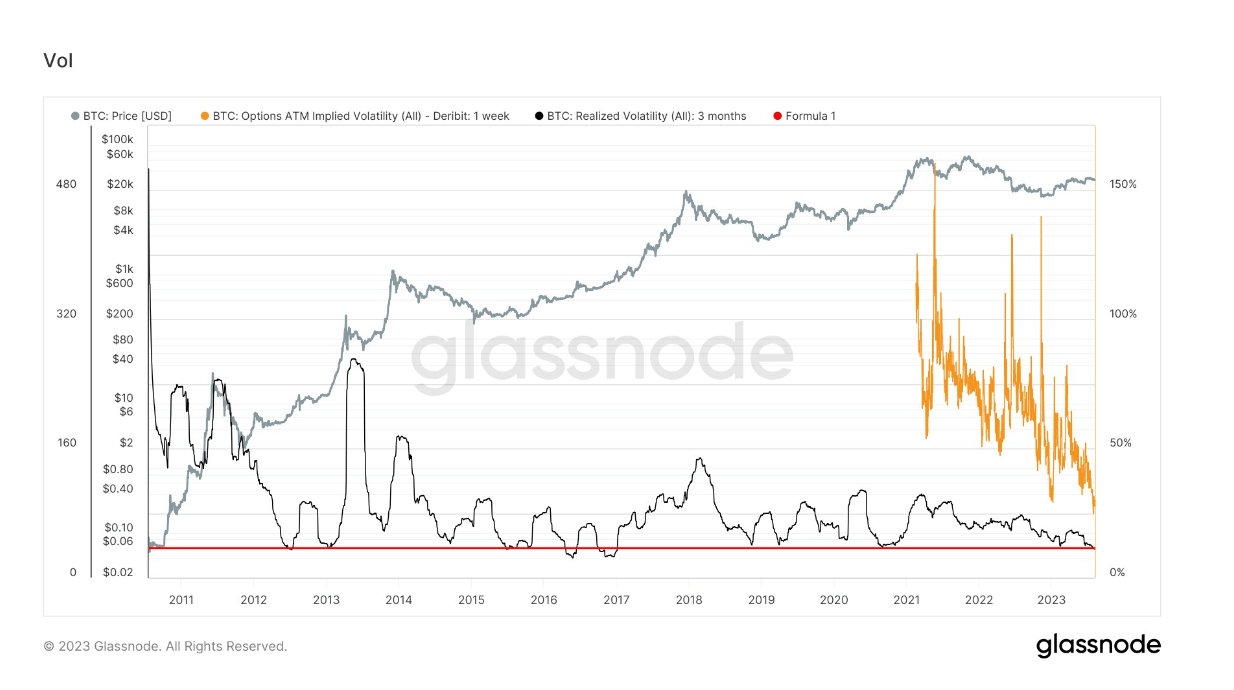

- Both realized and implied volatility metrics show a decreasing trend, resembling levels seen in 2016/2017.

Introduction

The current phase of the crypto market has brought forward a remarkable characteristic—Bitcoin’s uncharacteristically subdued volatility. Hovering around the $30,000 mark, the leading crypto’s price trajectory showcases minimal fluctuations. Despite occasional dips and spikes here and there, there’s a prevailing sense of anticipation for more significant moves. As investors eye upward momentum, the persistent proximity to $30,000 ignites hopes for a breakthrough. Interestingly, this phase also marks over 840 days since Bitcoin reached its historical peak in April 2021.

Since the third week of June 2023, Bitcoin price action has been humbling, with no indication of any breakout or breakdown from within the consolidation range (marked in grey). The broader trajectory of the king coin’s price seems to be strongly on the bullish side, and with BTC price just above $30,000, according to data from TradingView, things seem well positioned for a strong rally ahead of the bitcoin halving event in May 2024!

Read More: Bitcoin Price Prediction

Bitcoin’s Volatility and Recovery Trends

The noteworthy aspect of Bitcoin’s current trajectory is the notable absence of dramatic volatility, setting it apart from previous cycles. Although encouraging in terms of its 54% difference from the all-time high, this sideways movement has the potential to challenge even the most resolute investors. Glassnode’s analysis reveals that surpassing the 54% threshold typically took around six months for recovery in earlier cycles, aligning intriguingly with the upcoming bitcoin halving event projected for April 2024.

Additionally, Bitcoin’s realized and implied volatility indicators present a compelling picture. Realized volatility, reflecting past price shifts, currently stands at 35%, signifying a relatively stable trend. Implied volatility, which anticipates potential price changes, has dipped to 30%, a new low that harkens back to the levels witnessed during the 2016/2017 period. This subdued volatility showcases a market atmosphere akin to the times preceding Bitcoin’s meteoric rise.

Conclusion

The current phase of the crypto market, characterized by Bitcoin’s restrained volatility, starkly contrasts previous cycles. The gradual approach to recovery, remaining 54% below the all-time high, highlights a positive deviation from past trends. Historical parallels offer intriguing insights as the market inches closer to the upcoming bitcoin halving event. The metrics of realized and implied volatility further emphasize the unique nature of this phase, evoking memories of the market conditions preceding Bitcoin’s unprecedented surge.

Source: CryptoSlate

FAQs

How does Bitcoin's current volatility compare to previous cycles?

Bitcoin's current cycle showcases remarkably low volatility, differing significantly from the higher volatility experienced in past market cycles.

What is the significance of the 54% difference from Bitcoin's peak?

The 54% deviation from Bitcoin's peak represents progress compared to earlier cycles and has taken approximately six months for recovery in past instances.

What do the volatility metrics imply for the crypto market?

Bitcoin's realized and implied volatility metrics, standing at 35% and 30% respectively, suggest a stable market atmosphere akin to the period before its historical rise.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more