Table of Contents

ToggleKey Takeaways:

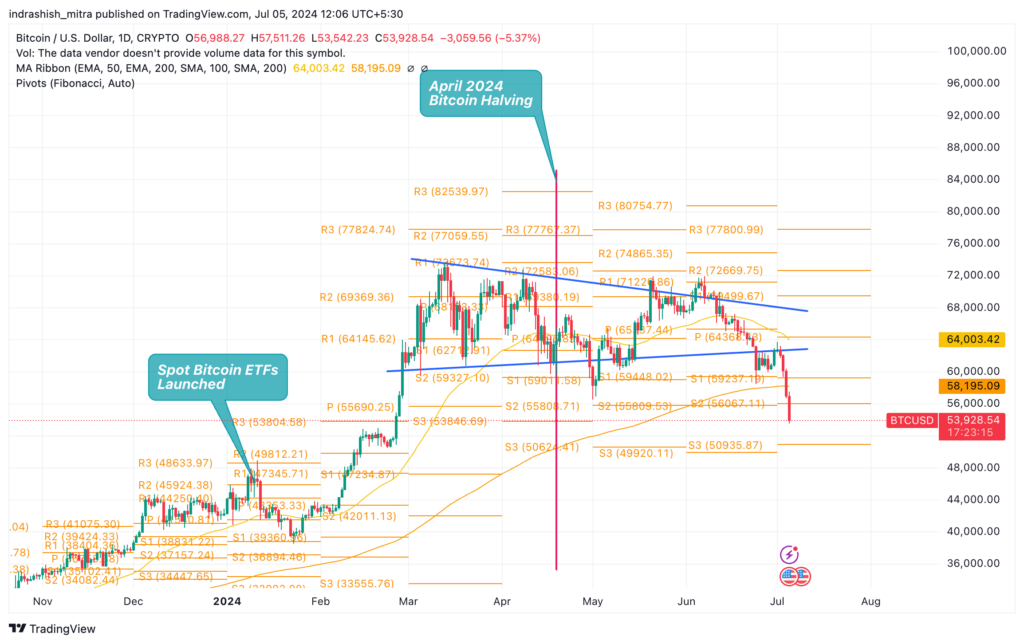

- Bitcoin Price Drop: Bitcoin price fell below $54,000, reaching its lowest point since February, which triggered widespread market volatility and nearly $665 million in liquidations.

- Market Sentiment: The Crypto Fear & Greed Index hit a score of 29 out of 100, indicating significant fear and the lowest positive sentiment towards cryptos since January 2023.

- Mt. Gox and Government Sell-Offs: The market was further pressured by the transfer of 47,229 BTC from the collapsed Mt. Gox exchange and the German government’s sale of 7,583 BTC, contributing to the overall decline.

- Analyst Predictions: Analysts, including Markus Thielen, predict further drops for Bitcoin price, potentially down to $50,000 due to continued sell pressure and market volatility.

- Shift in Trading Dynamics: The Bitcoin futures-to-spot trading volume ratio has decreased by 63% since the last bull market peak, indicating a shift towards more stable spot trading and the increasing influence of spot exchange-traded funds (ETFs).

Bitcoin price has experienced a sharp decline, falling below the $54,000 mark and triggering significant market volatility. This drop, which saw Bitcoin hit its lowest point since February, has led to widespread liquidations across the crypto market, totaling nearly $665 million.

Read More: Bitcoin Price Prediction

Significant Liquidations and Market Impact

In the past 24 hours, approximately $222 million in long Bitcoin positions were liquidated, highlighting the intense sell-off. This substantial liquidation has contributed to Bitcoin price plummeting to $53,499 on Coinbase at 4:19 am UTC on July 5, as reported by TradingView. Following this dip, Bitcoin managed a slight recovery to around $54,300, yet it remains down by approximately 7.4% over the last day.

Other major cryptos have also been affected. Ethereum price and Solana price have both seen nearly 10% declines, with ETH price falling below the critical $3,000 level it had maintained since mid-May, according to Cointelegraph Markets Pro.

Additional Read: Ethereum Price Prediction

Wider Market Sentiment and Key Indicators

The overall sentiment in the crypto market has taken a hit, with the Crypto Fear & Greed Index registering a score of 29 out of 100 on July 5, indicating a state of “Fear.” This marks the lowest positive sentiment towards cryptos since January 2023.

The anticipation of significant sell pressure from the collapsed crypto exchange Mt. Gox has further unsettled traders. On July 5, Mt. Gox transferred 47,229 BTC, valued at around $2.6 billion, to a new address. This was the exchange’s first major transfer since May, raising concerns about additional market sell-offs.

Germany’s government has also contributed to the selling pressure, offloading 7,583 BTC worth $419.5 million since June 19. Despite these sales, Germany still holds 42,274 BTC, valued at approximately $2.3 billion.

Analyst Predictions and Market Projections

Analysts, including Markus Thielen from 10x Research, anticipate further declines for Bitcoin. Thielen predicted on July 4 that Bitcoin could drop as low as $50,000 due to ongoing sell pressure.

Data from CryptoQuant reveals a shift in trading dynamics. The Bitcoin futures-to-spot trading volume ratio has decreased by 63% since the peak of the last bull market. This ratio, which compares the volume of futures trading to spot trading, indicates a decrease in speculative activity. During the 2021 bull run, the ratio exceeded 12, meaning futures trades outnumbered spot trades by over twelve times. However, this metric has since declined and now indicates a greater reliance on spot trading, which is viewed as a positive development for market stability.

Bitcoin Futures-To-Spot Volume Ratio Down 63%

Data shows the Bitcoin futures-to-spot trading volume ratio has decreased by 63% since the peak of the last bull market. According to CryptoQuant founder and CEO Ki Young Ju, the BTC market appears less futures-driven than during the previous bull run. The “futures-to-spot trading volume ratio” keeps track of the ratio between Bitcoin futures and spot trading volumes. When the ratio is high, the futures market observes more trading volume than the spot market. Conversely, low values imply spot trading dominance.

A chart from Ki Young Ju reveals that the ratio surged to high levels during the 2021 bull run, peaking above the 12 mark. This implied that futures volume outweighed spot trades by more than twelve times. The ratio cooled down during the second half of the 2021 bull run but remained high. These high levels continued into the first half of 2022.

However, as bear market lows approached, the ratio plunged as interest in speculative activity around crypto waned. The indicator saw some revival during the 2023 recovery run, touching the same levels as in the first half of 2022 in June. Since then, the ratio has slumped back to relatively low levels and continued to consolidate. Compared to the 2021 peak, the indicator’s value is down around 63%.

Conclusion

The recent decline in Bitcoin price below $54,000, coupled with significant liquidations, has highlighted the volatility and uncertainty within the crypto market. As traders navigate these turbulent times, the focus remains on key support and resistance levels, market sentiment indicators, and the evolving landscape of crypto trading instruments such as spot ETFs. While challenges persist, these developments also offer insights into the market’s maturation and the potential for future recovery.

Source: CoinTelegraph / Bitcoinist

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more