Key Takeaways:

- Similarities to US Spot Bitcoin ETF Launch: The recent decline in Bitcoin price is similar to the price behavior seen after the launch of spot Bitcoin ETFs in the US in January. This could suggest a potential breakout in the “next week or so.”

- Hong Kong ETF Inflows vs US Outflows: While the Hong Kong spot Bitcoin ETFs have seen $217 million in net inflows since launch, the US ETFs experienced $794 million in outflows over the same period. This difference could impact the potential for a similar breakout pattern.

- Lower Hong Kong ETF Trading Volume: The Hong Kong-based ETFs accumulated only $12.4 million in trading volume on their first day, significantly lower than the $4.6 billion first-day trading volume of the US spot Bitcoin ETFs. This could indicate lower adoption in Hong Kong.

- Healthy Market Correction: Some traders believe the recent price decline is a healthy market correction for Bitcoin, with the “sideways” price action following the bitcoin halving and other macroeconomic factors contributing to this.

- Uncertainty and Complexity: The debate among traders and analysts highlights the complexity and uncertainty surrounding the crypto market. While some see the potential for a breakout, others are concerned that the Hong Kong inflows may not be enough to offset the US outflows.

Read More: Bitcoin Price Prediction

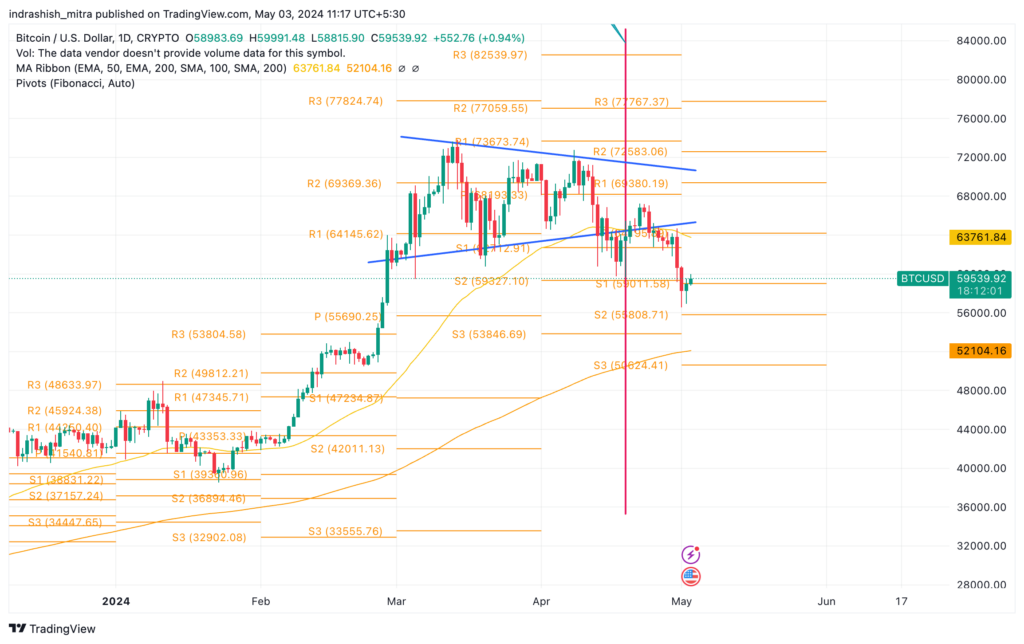

The recent decline in Bitcoin price has sparked a debate among traders and analysts about the potential for a breakout in the coming weeks. This speculation is fueled by the similarity between the current price chart and the pattern seen after the launch of spot Bitcoin ETFs in the United States. The launch of these funds in Hong Kong on April 30 has also contributed to the discussion, with some experts suggesting that the price of Bitcoin could rise in the near future.

The initial decline in Bitcoin price following the Hong Kong ETF launch has been significant, with a 7% drop since the launch date. This is comparable to the 14% drop seen in the United States after the launch of spot Bitcoin ETFs in January. However, BTC price in the US eventually rebounded by 7% over the following seven days. If this pattern is repeated, it could indicate an upswing in the “next week or so,” according to Quinten Francois, a trader and co-founder of WhereAt Social.

The launch of spot Bitcoin ETFs in Hong Kong has seen significant inflows, with $217 million worth of net inflows since the launch date. This is a substantial amount considering the relatively smaller size of the Hong Kong market compared to the US. However, some key differences between the two launches could impact the potential for a breakout. For instance, the US ETFs experienced $794 million in outflows over the same period, which could offset the inflows from Hong Kong.

Another difference is the trading volume. The Hong Kong-based ETFs accumulated only $12.4 million in trading volume on their first day, significantly different from the $4.6 billion first-day trading volume of US spot Bitcoin ETFs. This lower trading volume could indicate that the Hong Kong ETFs are not yet as popular or widely adopted as their US counterparts.

Despite these differences, some analysts believe the recent price decline is a healthy market correction for Bitcoin price. The “sideways” price action following the Bitcoin halving and ongoing tensions in the Middle East and the United States Federal Reserve’s extension of interest rates could contribute to this correction.

The debate among traders and analysts highlights the crypto market’s complexity and uncertainty. While some believe that the recent price decline is a sign of a potential breakout, others are concerned that the inflows from Hong Kong might not be sufficient to offset the large amount of recent outflows from the US, potentially preventing a similar breakout pattern.

In conclusion, the similarity between the current price chart and the pattern seen after the launch of spot Bitcoin ETFs in the United States suggests that a breakout could be imminent. However, the differences between the two launches, including trading volume and outflows, could impact the potential for a significant price increase. As the market continues to evolve and respond to various factors, traders and investors must carefully monitor the situation to make informed decisions about their investments.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more