Key Takeaways:

- Mayer Multiple Mean Analysis: Tradingshot’s analysis hinges on the Mayer Multiple Mean, a technical indicator that measures Bitcoin price relative to its 200-day moving average, providing valuable insights into potential price movements.

- Historical Price Patterns: By referencing past cycles where Bitcoin price breached the MM Mean, the analysis parallels instances like July 2013, highlighting the potential for significant price rebounds and bullish momentum.

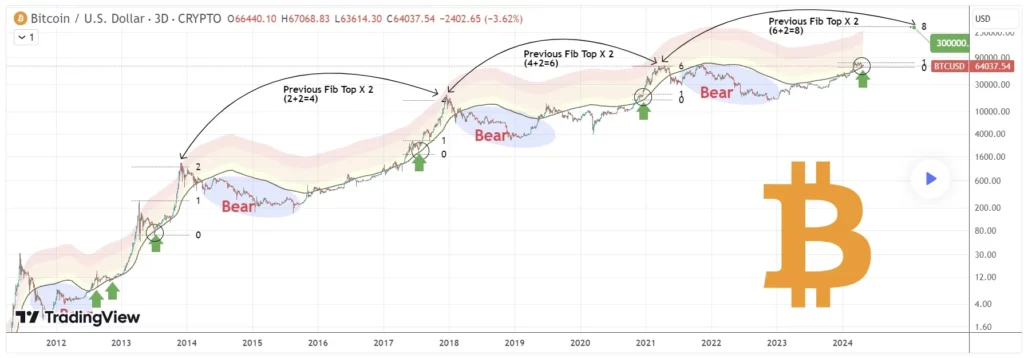

- Fibonacci Extensions: Tradingshot’s examination of Fibonacci extensions from the MM Mean’s low to the preceding high reveals a consistent growth pattern across cycles, offering further evidence of Bitcoin price’s upward trajectory.

- Projection to $300,000: Based on historical data and technical analysis, Tradingshot suggests a potential price target of $300,000 for Bitcoin price, rooted in the Fibonacci levels and past cycle performance.

- Caution and Adaptability: While optimistic about Bitcoin price’s potential, traders are advised to remain vigilant and adaptable, as market conditions can change rapidly. Staying informed and adjusting strategies accordingly is crucial for effectively navigating the dynamic crypto landscape.

Read More: Bitcoin Price Prediction

Bitcoin’s trajectory in the coming months has garnered significant attention from traders and analysts alike, with many closely monitoring key technical indicators for insights into potential price movements. Tradingshot, with a substantial following of over 72,000 on Tradingview, has emerged as a notable voice in this conversation, offering valuable insights into Bitcoin’s current position in the market cycle.

In the analysis titled “Bitcoin: This Marks the Historic Starting Point,” Tradingshot highlights the importance of the Mayer Multiple Mean in understanding Bitcoin’s price dynamics. This technical indicator, which measures Bitcoin’s current price relative to its 200-day moving average, has historically provided valuable signals regarding the Bitcoin price trajectory. By successfully testing and holding the MM Mean, Bitcoin has positioned itself for potential bullish momentum, signaling the beginning of what could be an aggressive phase in the bull cycle.

Tradingshot’s analysis delves deeper into historical Bitcoin price patterns, particularly focusing on instances where Bitcoin breached the MM Mean. Drawing parallels to past cycles, such as the notable rebound witnessed in July 2013, Tradingshot underscores the potential for significant price appreciation in the near future. The Fibonacci extensions from the MM Mean’s low to the preceding high offer further insights, revealing a consistent pattern of growth across cycles. With Cycle 4 projected to reach an 8.0 Fibonacci level, the stage is set for Bitcoin price to potentially soar to unprecedented heights, with a $300,000 valuation not deemed entirely unrealistic by some analysts.

While projections of this magnitude may seem ambitious, they are firmly rooted in technical analysis and historical data. As Bitcoin continues to attract interest from institutional investors and retail traders alike, the coming months could prove to be pivotal in determining the Bitcoin price trajectory. With market sentiment remaining cautiously optimistic and key technical indicators signaling potential bullish momentum, traders are advised to stay vigilant and adapt their strategies accordingly to capitalize on emerging opportunities in the dynamic crypto landscape.

Source: Bitcoin.com

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more