Key Takeaways:

- Bitcoin Resurgence: Bitcoin price‘s recent surge past $50,000 marks a significant 17% increase within the week, signaling a bullish turn in its market trajectory. Currently, Bitcoin price is trading just shy of $52,000!

- ETF Impact: Following the launch of spot Bitcoin ETFs in January, Bitcoin experienced a brief setback, but investor attention has since shifted, leading to substantial inflows into alternative ETFs.

- Changing Fund Flows: Recent data indicates a slowdown in outflows from the high-fee Grayscale Bitcoin Trust (GBTC), with significant inflows observed in other ETFs, highlighting a shift in investor sentiment.

- Crypto Winter Recap: Despite challenges in 2022 and a lackluster performance throughout much of 2023, Bitcoin witnessed a resurgence in the final quarter of 2023, driven by growing confidence in the SEC’s potential approval of spot Bitcoin ETFs.

- SEC Confidence Boost: Bitcoin price’s ability to rebound and surpass key resistance levels demonstrates its resilience and underscores investor confidence in its long-term potential amidst evolving market dynamics.

Read More: Bitcoin Price Prediction

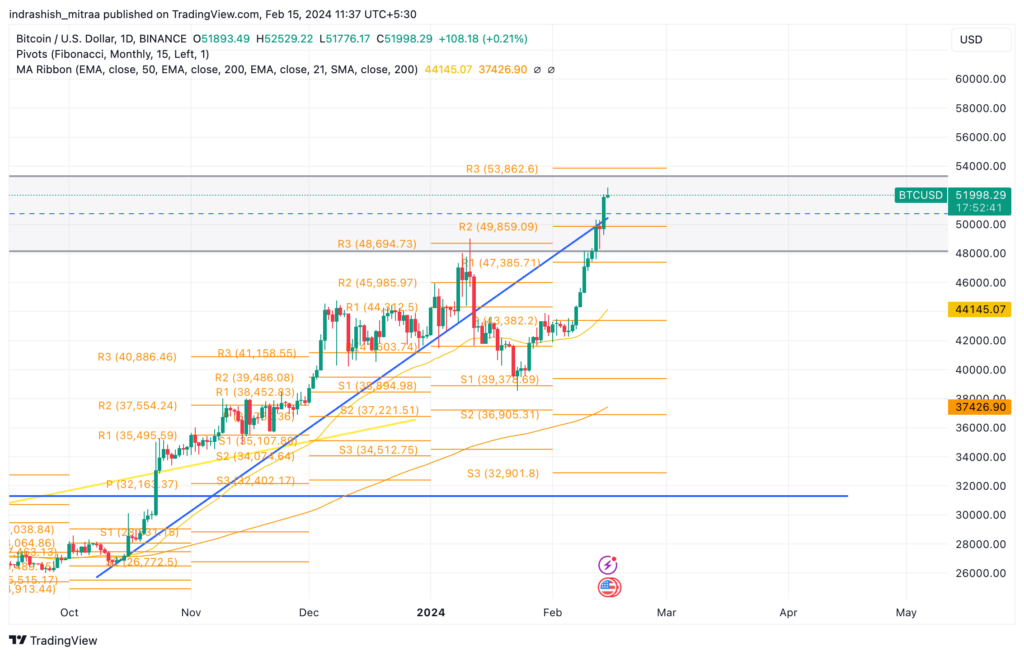

In a notable rebound, Bitcoin price has surpassed the $50,000 threshold, marking a remarkable 17% surge within the week – and is now trading just shy of the $52,000 mark. This resurgence follows a temporary setback following the January 11 launch of spot ETFs, signaling a new phase in the Bitcoin bull market that commenced in January 2023.

The initial weeks after the ETF launch witnessed substantial inflows, with billions pouring into the new products. Interestingly, investor focus shifted from the high-fee Grayscale Bitcoin Trust (GBTC), resulting in Bitcoin price dipping to $38,500 shortly after the ETFs went live.

Recent developments, however, indicate a shift in this trend, as outflows from GBTC have slowed down while the new ETFs continue to attract substantial inflows. On February 8, Grayscale witnessed a modest outflow of 1,850 Bitcoin, contrasted by the other nine ETFs accumulating nearly 11,000 tokens. This pattern persisted on February 9, with Grayscale shedding 2,252 coins and the alternative ETFs amassing over 13,000. Notably, daily mined Bitcoin stands at 900, set to decrease to 450 after the anticipated Bitcoin halving in April 2024.

The crypto winter, which saw Bitcoin peak at approximately $69,000 in November 2021, was marked by challenges in 2022, including the collapse of the Terra ecosystem and FTX crypto exchange. Bitcoin concluded 2022 at slightly above $16,000, experiencing a 75% drop from its all-time high. Despite a lackluster performance for much of 2023, with Bitcoin trading at $27,000 on October 1, the final quarter witnessed a resurgence, driven by growing confidence in the SEC’s imminent approval of spot Bitcoin ETFs in early 2024. Consequently, Bitcoin price surged nearly 60% in the last three months of 2023, closing the year above $42,000.

As Bitcoin breaks the $50,000 barrier, the market eagerly anticipates further developments and assesses the impact of ETF dynamics on its future trajectory. This recent upswing underscores Bitcoin price resilience and its ability to rebound amidst shifting market sentiments. Investors are now closely watching for potential catalysts that could shape Bitcoin’s journey in the coming months.

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more