Table of Contents

ToggleKey takeaways:

- Bitcoin hash rate continues to hold strong!

- Bitcoin Fear & Greed Index at 51 – hinting at a “Neutral” sentiment in the market.

- Bitcoin market cap dominance sees a sharp increase over the past half year.

- Bitcoin volatility index has been falling since April 2023.

- Two out of three major Bitcoin futures markets are running positive funding rates.

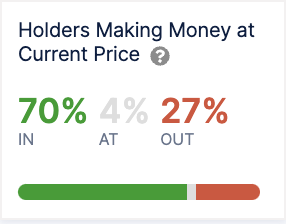

- 70% of BTC holders are now in the green!

Bitcoin – the largest crypto by market capitalization in the crypto market is well known for many other things. The grandfather of cryptos, which has the largest trading volumes in the market too. According to CoinMarketCap, Bitcoin’s 24-hour trading volumes stand at about $11.5 billion as of writing! To understand the scale, Ethereum, which is the second largest crypto by market cap has a 24-hour trading volume of about $3.6 billion as of writing. The only other crypto that has a trading volume above Bitcoin is Tether (USDT) – which is a centralized stablecoin used to trade in various cryptos, hence doesn’t really qualify.

Now that we know Bitcoin is the most traded crypto out there, let’s take a look at some of the broader indications that you can use to take your first trade in Bitcoin too.

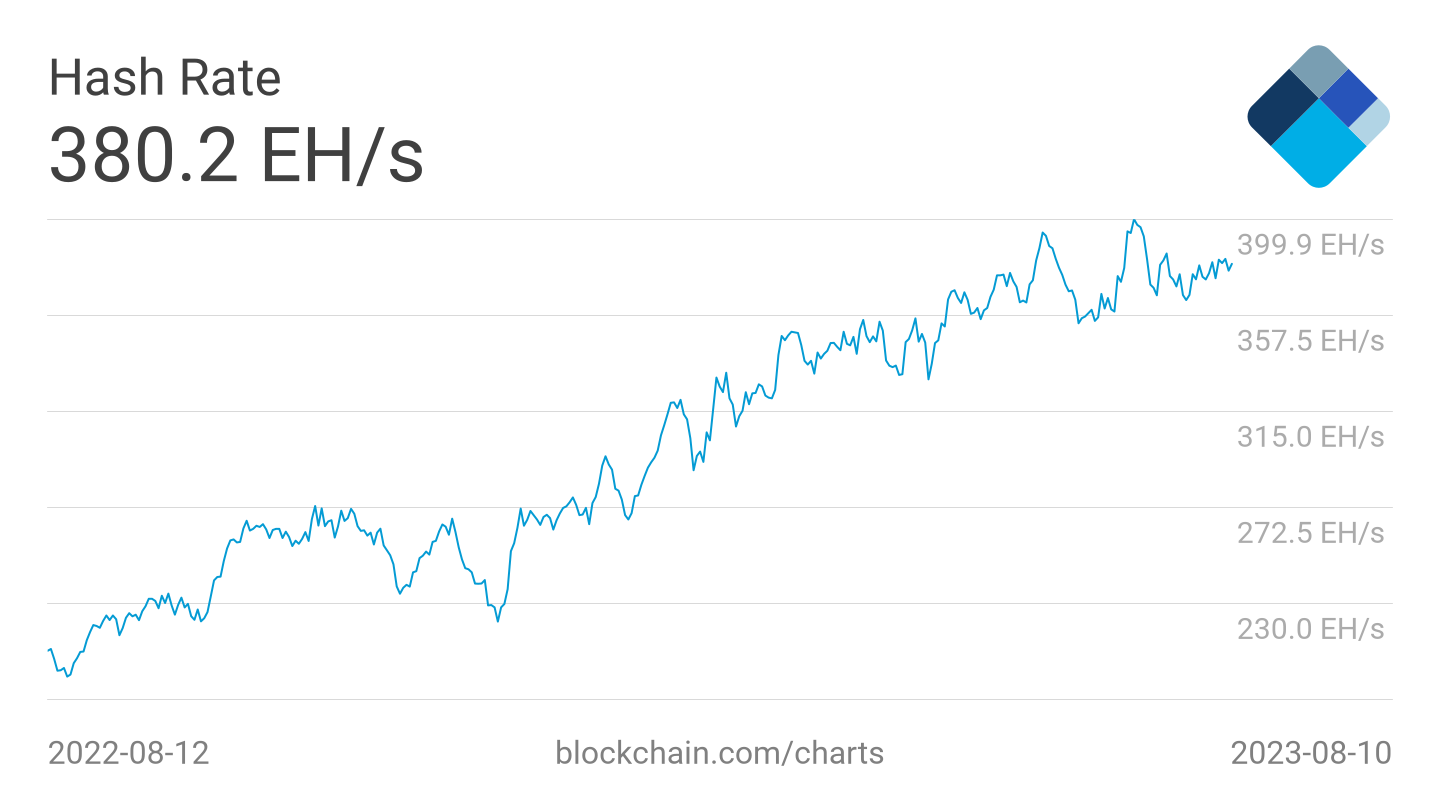

Bitcoin hash rate witnesses strong recovery!

BTC Hashrate | Source: Blockchain.com/explorer

As is evident from the chart above, the Bitcoin daily hash rate chart has been on a steady upward trend ever since the middle of 2022 – despite the raging bear market that ensued in the same timeframe. However, since the beginning of the new year of 2023, the Bitcoin hash rate – which had fallen down significantly towards the end of the year amid the holidays – has managed to recover strongly along with the increase in BTC price. Bitcoin’s daily hash rate has climbed steadily, from around 253 million terahashes per second on January 1, 2023, to nearly 380 million terahashes per second as of writing. In the same time frame, Bitcoin price has also rallied over 76%!

Now, why is Bitcoin hash rate important? For any proof-of-work (PoW) based blockchain network, hash rate essentially depicts how secure a particular network is and how many miners are there on the network, continuously competing to secure, complete and add the next block to the blockchain.

Read more: BTC Price Prediction

Bitcoin Fear & Greed Index at 51

Bitcoin Fear and Greed Index is 51 – Neutral

Current price: $29,427 pic.twitter.com/d6V6o5dewG— Bitcoin Fear and Greed Index (@BitcoinFear) August 11, 2023

The Bitcoin Fear & Greed Index which had slipped into the extreme fear territory in the last two months of 2022, has recovered strongly since the beginning of the new year thanks to a strong recovery in BTC price. But now, with Bitcoin maintaining a humdrum price action over the past two months, the fear and greed index has come back down to neutral territory.

This is a multi-factorial crypto market analysis that analyses the sentiments of the market participants. It does so by calculating several metrics including volatility, market momentum, volume, and social media sentiment of a particular crypto, in this case, Bitcoin. However, as of writing, Bitcoin’s fear and greed index is in the greed area as there has been a strong recovery in BTC price, and seems like it will continue as there is still some more area to cover before we get into the extreme fear region.

Bitcoin Holder Data: 70% of holders now in profits!

According to data from IntoTheBlock – only about a quarter of the BTC holders are below their purchase price on their Bitcoin investments. Along with that, about 70% are in the money, which means they are still holding on to some unrealized gains on their books while the remaining 4% are at break-even. This shows that the recent BTC price recovery has brought a lot of investors and HODLers back into the green.

Bitcoin Market Cap Dominance sees a Sharp Increase Through H1 2023

Since the beginning of 2023, Bitcoin has seen a strong price rally and has been single-handedly responsible for pulling the crypto market up. It is very evident from the rise in Bitcoin’s market cap dominance, which has gone from sub-40% levels to nearly 48% as of writing! In fact, Bitcoin market cap dominance has seen a near 17% in Q1 2023!

This means that as Bitcoin price is rising in the current market scenario, the broader market recovery is being led by none other than the king coin and is thus continuing to gain market cap dominance.

Read more: BTC price prediction

Bitcoin Volatility Index Sliding Downwards

As we can observe from the chart above, the Bitcoin volatility index which had been rising since the beginning of 2023, has been on a gentle downward trajectory since the middle of April 2023. This indicates while the BTC price may be holding steady at around $30,000, the possibility of whipsaws in price movements seems to be low.

BTC price is trading around $29,400 as of writing and is in a strong bullish position. BTC price has been stuck trading within a very narrow range between $28,000 to $31,000 for the last couple of months which has resulted in a decrease in volatility and this can be expected to continue unless there is a major trigger in the market.

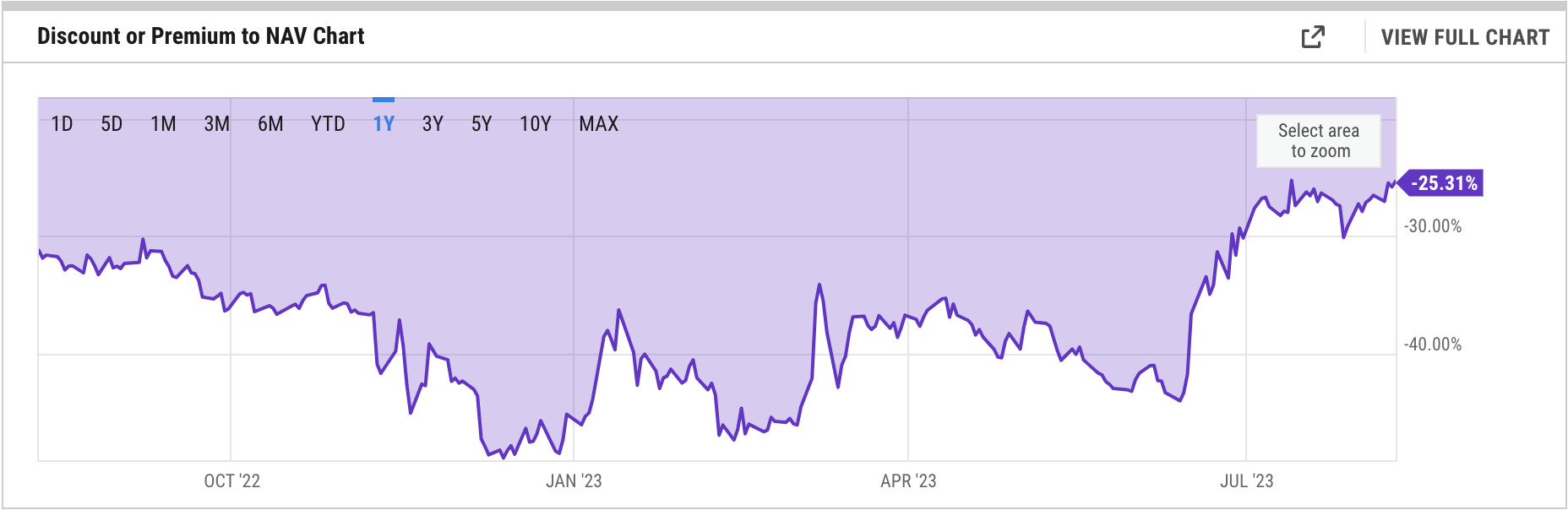

Grayscale Bitcoin Trust (GBTC) makes some recovery

The recent recovery in Bitcoin prices has brought about a very welcome change in the data from the Grayscale Bitcoin Trust as the Net Asset Value or the NAV for the GBTC has recovered from record lows. GBTC NAV is at the highest point of 2023, currently only 25% is in the red and things seem to be improving.

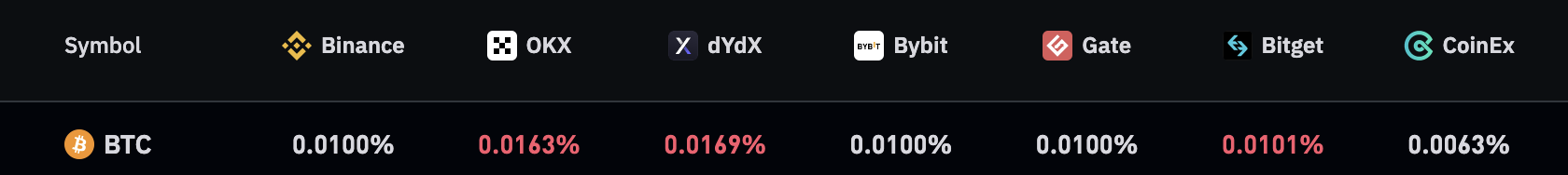

Bitcoin Perpetual Futures Funding Rates

As of writing, all the mentioned futures funding rates on exchanges for Bitcoin are on the positive side, as depicted in the image above – which is a pretty bullish indication and is pretty much in line with Bitcoin’s current price action since the beginning of 2023.

Now let’s understand funding rates – a funding rate is essentially an amount paid by traders holding perpetual futures to hold on to their positions. This is enforced by futures exchanges primarily to ensure that futures prices do not fluctuate too much above the actual spot price of the asset. Hence a positive funding rate indicates traders holding long positions are willing to pay extra to hold on to their positions while a negative funding rate means that traders holding short positions are willing to pay to hold on to their contracts.

Conclusion

Thus, in conclusion, from the above observations, we can clearly conclude that Bitcoin’s current situation looks pretty bullish as of now, thanks to positive funding rates, improving hash rates, and an increasing Bitcoin market cap dominance. A drop in Bitcoin’s volatility index and the neutral sentiment on the Bitcoin Fear and Greed Index has been aiding the market to sustain some bullishness.

Values as on August 11, 2022.

Read more: Top Cryptos that crashed more than 70 percent in 2022

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more