While 2022 has been a somber year for the crypto markets, we’re nearly 4 months into 2023 and it has been a fantastic year so far! A deeper look at financial markets across the world reveals that amongst all of them, Bitcoin so far has posted the strongest quarterly gains since its November 2021 all-time high of around $69,000.

In fact, the king coin, Bitcoin has gained over 83% since the beginning of 2023 and is continuing to hold strong around the $30,000 mark. This has made Bitcoin the best-performing asset overall in 2023 so far!

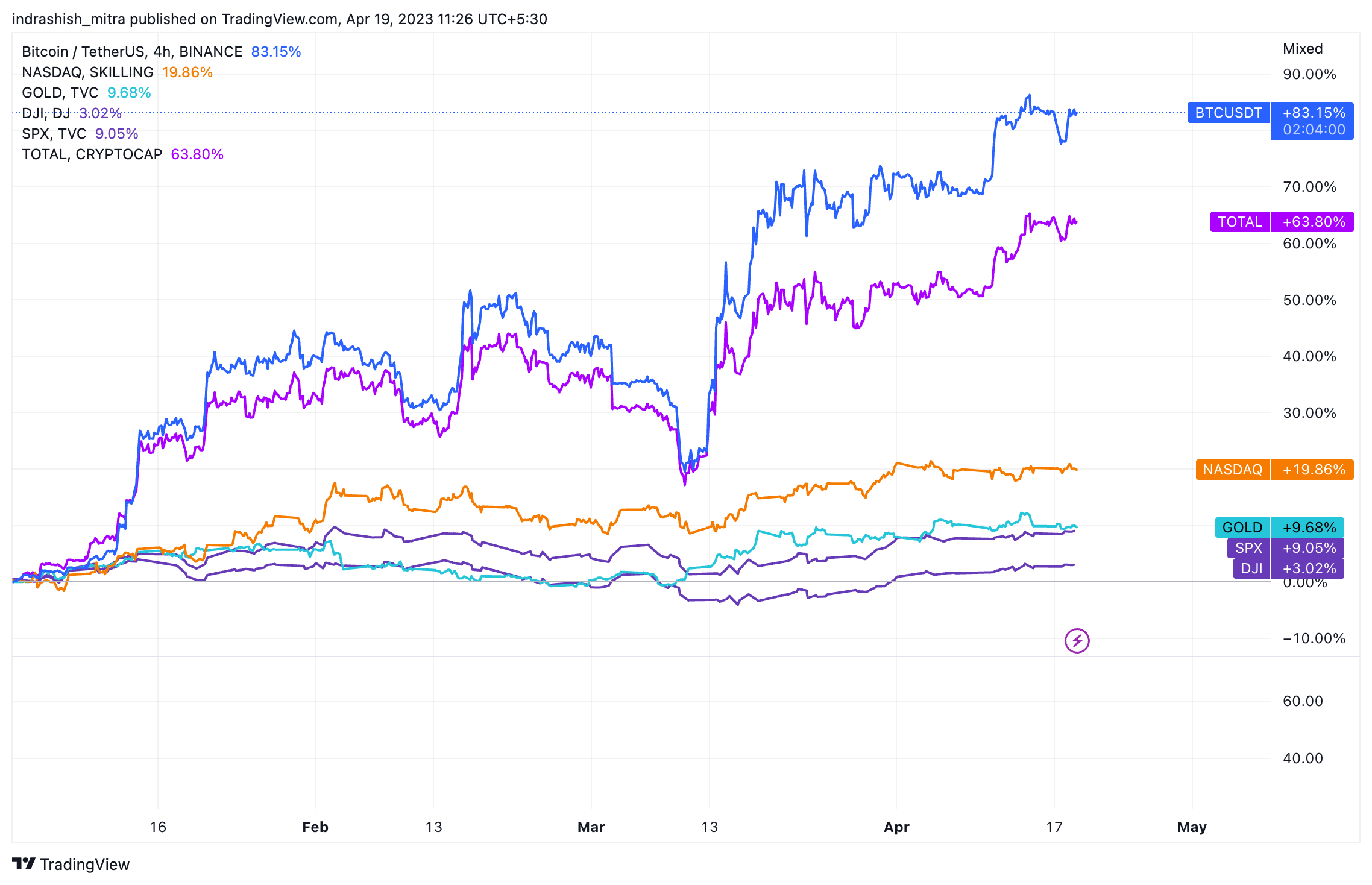

Comparatively in the same time frame, gold has managed to gain only 9.65% while the tech-heavy NASDAQ 100 stock index has managed to gain about 20% since January 1. Additionally, in the same period of study, the US S&P 500 index also gained about 9% while the behemoth Dow Jones Industrial (DJI) gained a paltry 3%! Even the Total Crypto Market Capitalization gained over 63% since the beginning of 2023, led primarily by the rally in Bitcoin. Take a look at this comparative chart below.

Read more: Bitcoin Price Prediction

Even on April 17, Glassnode, a popular on-chain analytical service provider, in its weekly crypto market report stated its confidence in Bitcoin’s performance stating:

“The strong market performance in 2023 is a stark contrast to 2022, and suggests a favorable regime shift is underway.”

Is Bitcoin Getting Ready for Another Round of Rally?

In the same report, Glassnode also looked at the increasing correlation between Bitcoin and gold in the fears of another banking crisis in the United States. Gold is well known traditionally as a “safe haven” asset during times of crisis for many many decades. So, more recently, according to the report,

“On a 30-day, 90-day, and 365-day basis, the correlation between these two assets is now strongly positive, remaining elevated during the recent US banking crisis a few weeks ago.”

Additionally, it has also been reported that a large number of Bitcoins in supply have turned profitable after the recent rally. In 2023, a total of about 6.2 million BTC have returned to the profitable zone, representing a little less than one-third of Bitcoin’s total supply of 21 million. The report states,

” In 2023, a total of 6.2M BTC have returned to profit (32.3% of supply), giving an indication of just how large this cost basis foundation is below $30k.”

Is the #Bitcoin bear market over?

With a rally 100% off the lows, $BTC is trading above a very large cluster of supply, that formed the 2022 floor.

This week, we investigate indicators showing if the market making a robust bear market recovery…or not.https://t.co/eeQ1xeE07I pic.twitter.com/PKHJc7EF18

— glassnode (@glassnode) April 17, 2023

Furthermore, the NUPL or the Net Unrealized Profit/Loss metric for the king coin is currently neutral, suggesting that BTC is not in an oversold territory (which it was near $20,000) and neither is it overbought (as in, over $50,000).

“This is coincident with past cycles where a transition between a bear and bull markets have taken place.”

Thus, overall things seem to be moving well in favor of the king coin. While an altcoin season might be around the corner with Etheruem’s near 75% rally in 2023 so far – Bitcoin seems to be the clear leader as of now. With a near 46% market cap dominance, Bitcoin is well positioned to lead the rally from current levels, if it is able to breach past the crucial resistance level of $30,000.

Additional read: How to Buy Bitcoin in India

Values as on April 19, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more