Table of Contents

ToggleKey Takeaways:

- Record Profitable Addresses: A record 39.1 million Bitcoin addresses are in profit, even though Bitcoin price is 50% below its all-time highs.

- Steady Profit Growth: Profitable addresses have reached 81.1%, with a 20% increase over the past two months.

- Investor Behavior Contrast: Short-term holders are taking profits, while long-term holders remain steady in their Bitcoin positions.

- Bitcoin’s Resilience: Bitcoin price remains profitable for many investors, showcasing its resilience and appeal.

Bitcoin, often referred to as digital gold, continues to make headlines as it sets a new record for the number of addresses in profit. Despite trading 50% below its all-time highs, nearly 40 million Bitcoin addresses are currently “in the green.” In this article, we will explore the latest data from Glassnode, which reveals the astounding growth in profitable Bitcoin addresses and its implications for the crypto market.

The Rise of Profitable Bitcoin Addresses

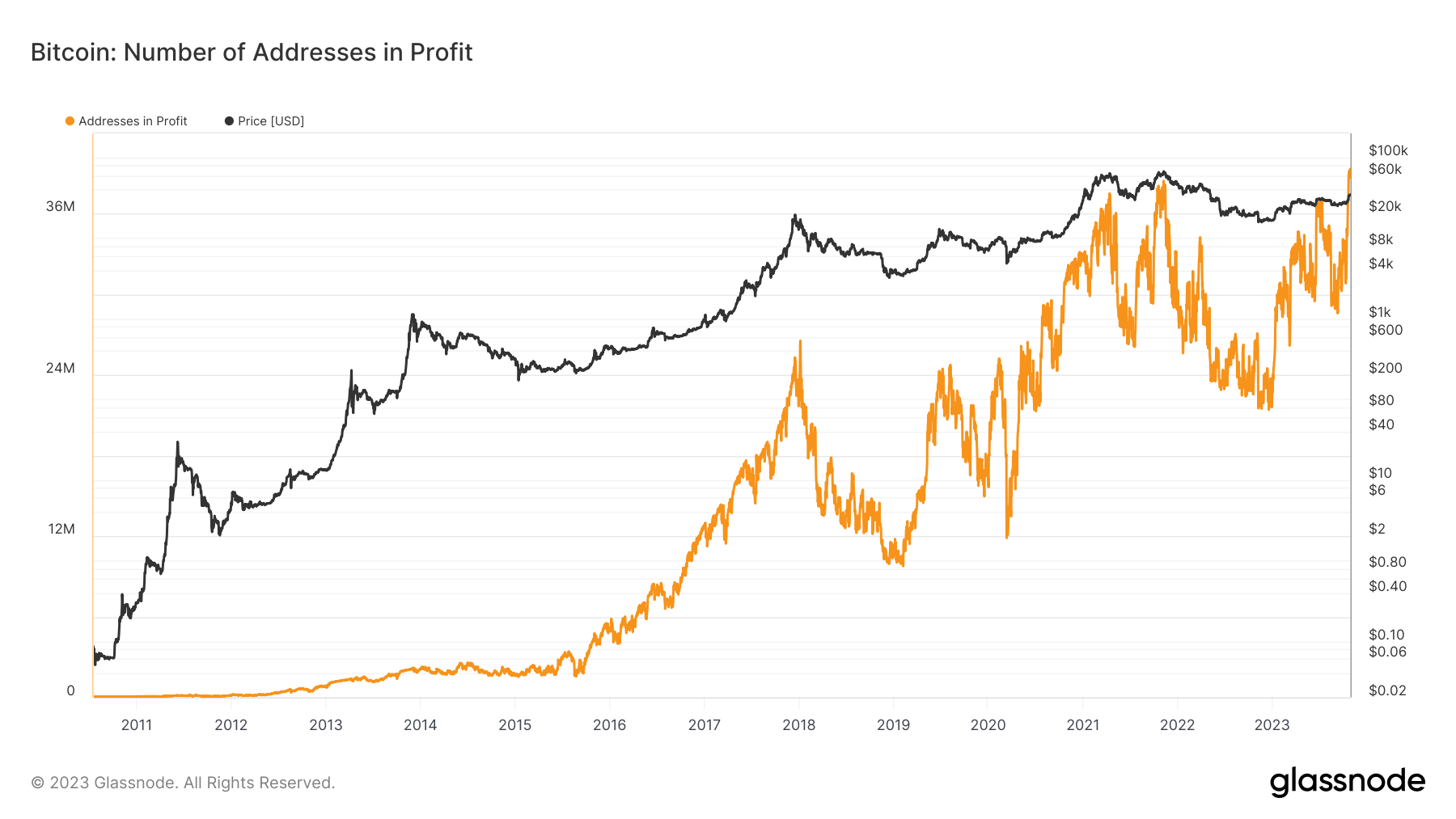

The recent resurgence in Bitcoin price has sparked significant changes in investor profitability. Glassnode’s data, as of October 30, 2023, shows that 39.1 million Bitcoin addresses are now in profit, marking a historic high. This figure surpasses the previous record of 38.1 million recorded in November 2021 when Bitcoin price reached its all-time high.

During the previous peak, when Bitcoin was at an all-time high, 100% of addresses with a non-zero balance were in profit. Although Bitcoin price presently remains well below those levels, the total number of non-zero addresses now stands at 48.3 million.

Learn More: Bitcoin Price Prediction

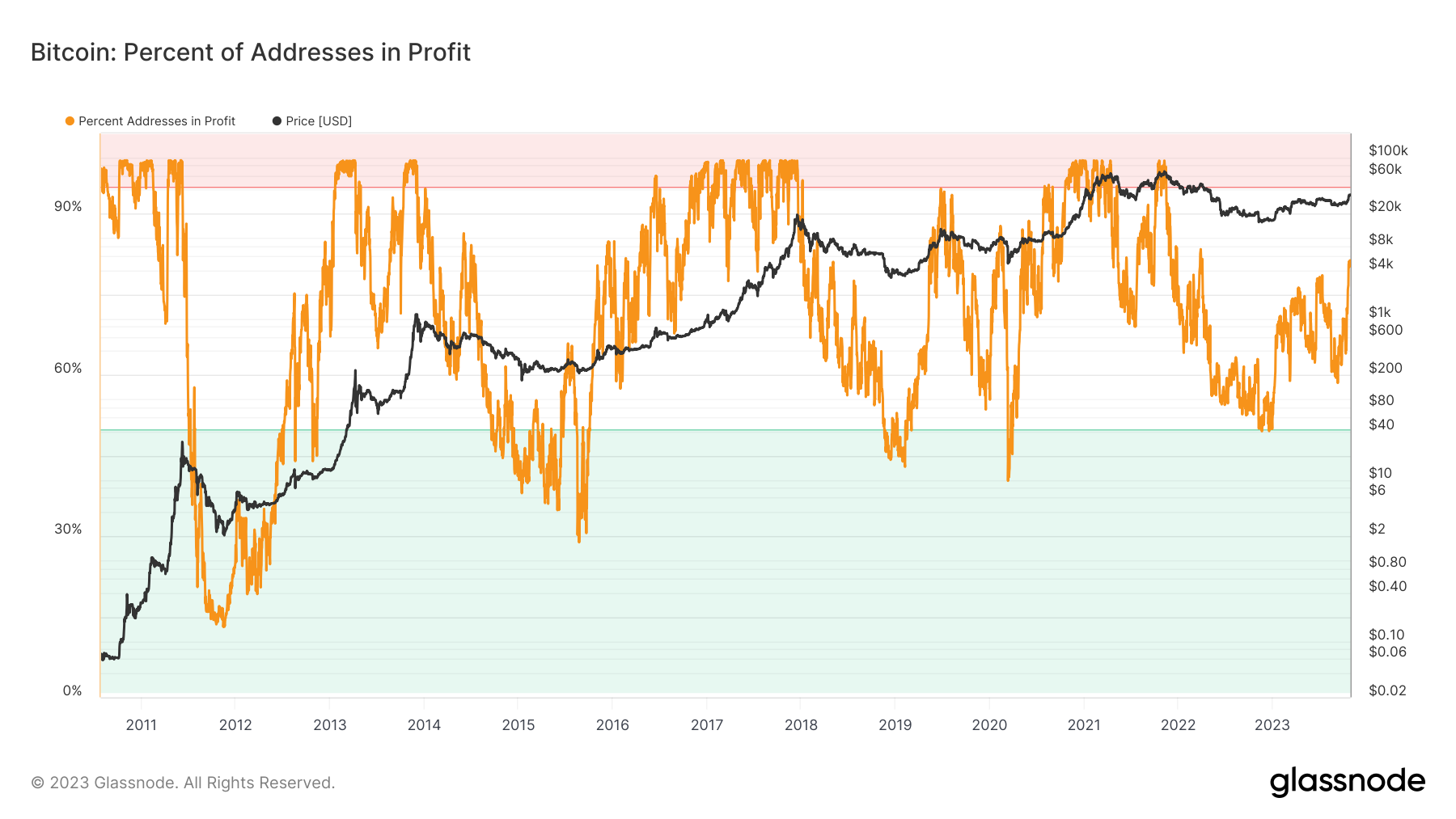

In percentage terms, profitable addresses have yet to match their previous performance in absolute numbers, but they have reached an 18-month high of 81.1%. Over the past two months, this percentage has seen a significant increase, rising from 60% to 80%, as shown in the chart below:

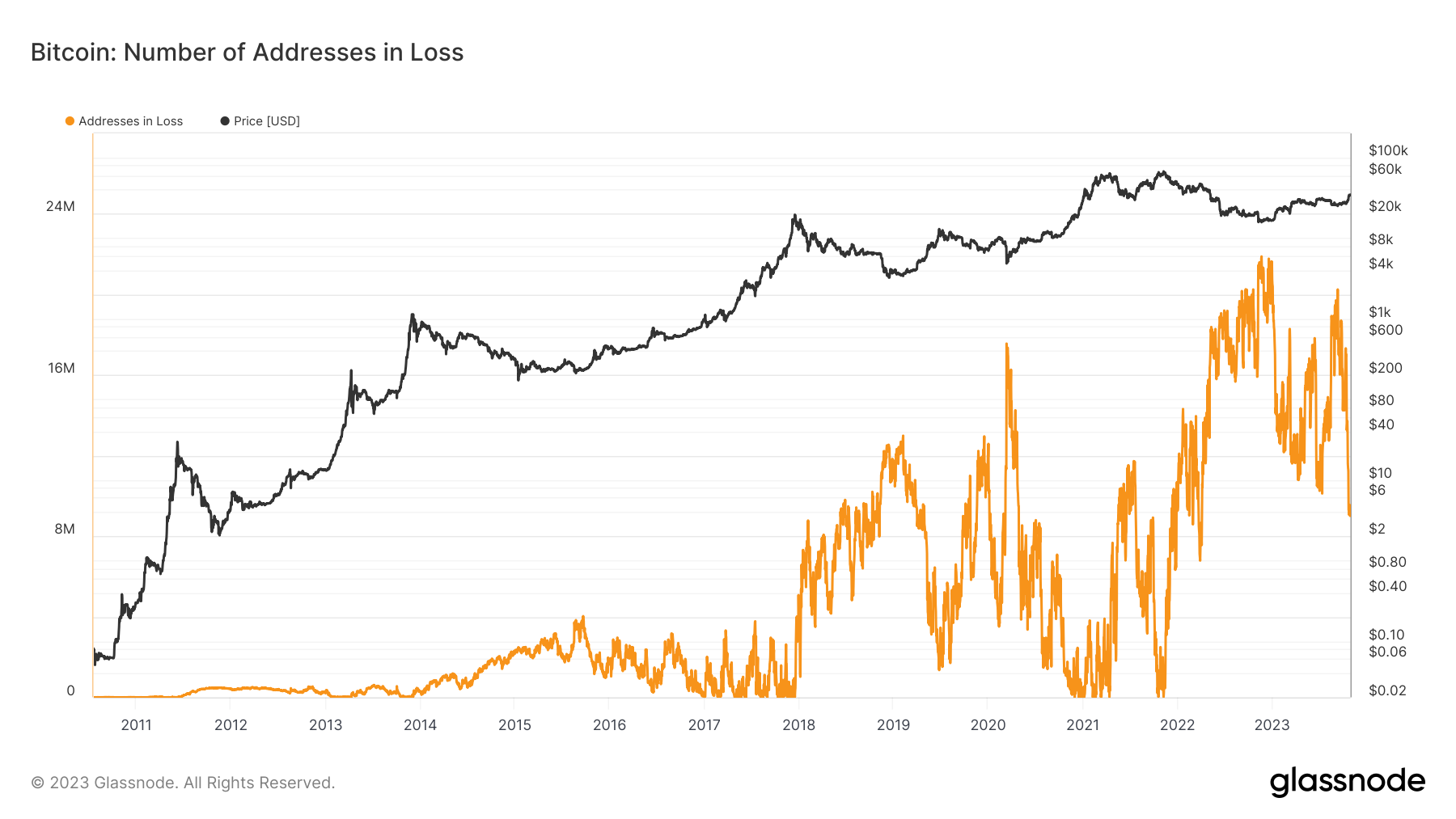

In contrast, addresses at a loss currently number just over 9 million. This figure is significantly lower than the peak of over 20 million addresses in December 2022, following the FTX collapse, as depicted in the chart below:

Profit-Taking and Investor Behavior

The recent surge in Bitcoin price has not only benefited short-term holders but has also allowed long-term holders to reap profits. This increase in profitability has led to profit-taking, especially as the market passed the $34,000 mark.

James Van Straten, a research and data analyst at CryptoSlate, emphasizes the contrasting mentality between these two cohorts. He noted,

“Bitcoin has shown remarkable strength above $34k for the past five days while witnessing one of the strongest profit-takings in the past two years, from STHs. LTHs have barely budged, the sixth largest profit-taking this year, but minimal in the grand scheme of things.”

In addition to this observation, accompanying charts from Glassnode also tracked inflows to exchanges from LTHs and in-profit STH entities, providing insights into how these groups of investors are navigating the market.

Read More: Bitcoin Dominance Hts 53%, Anticipating Bitcoin Halving in 2024

Conclusion

Bitcoin’s ability to maintain profitability for a vast number of addresses, even in a market that is 50% below its all-time highs, is a testament to its resilience and appeal to a diverse range of investors. The surge in profitable addresses, combined with shifting investor behaviors, highlights the dynamic nature of the crypto market. As Bitcoin continues to evolve, these statistics serve as a fascinating lens into the crypto world’s ever-changing landscape.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more