Table of Contents

ToggleKEY TAKEAWAYS:

- Binance crypto exchange’s crypto token, BNB has been in the news of late, thanks to the fear, uncertainty and doubt around the FTX crypto exchange collapse.

- Binance had been a large holder of the FTT tokens which it decided to sell just a day before the news of the Binance-FTX acquisition broke.

Binance’s BNB token has been at the center of all the action in the crypto market, especially in the last few days. But of late, after weeks of spat between the founders of two of the largest crypto exchanges, Binance and FTX – it has finally concluded with Binance’s CZ stating his intention to acquire one of its biggest competitor in the market – and then just a day later, reversing on that decision after checking out the exchange’s books.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

Ever since the news broke three days ago, the crypto market fell headfirst into a freefall, with major heavyweights like Ethereum and Bitcoin losing over 20% in the matter of days. FTX exchange’s crypto token, FTT lost nearly 90% as of writing. But with all that out of the way, let’s take a look at how Binance Smart Chain’s native crypto token, BNB has been performing so far.

Explained in Detail: What caused the FTX Collapse?

Binance Coin TECHNICAL OVERVIEW

BNB price had crashed around 16% ever since the news of the collapse of the FTX crypto exchange broke but quickly recovered much of its lost ground from the lows on the 10th of November – soon after Binance announced that it wasn’t going forward with the proposed acquisition anymore. From a technical perspective, after shedding over 16% in those two days at the beginning, BNB price gained around 14.5% from those lows.

Also, more importantly, the crucial support level on the charts have been respected this time around too. Taking a look at the orange trendlines marked on the charts, one can clearly see how BNB price has been unsuccessful in breaching down below the $265-270 zone. In fact, that has managed to provide price support almost five times in the past four months alone. Along with that, the significant rally before this crash occurred had resulted in the formation of a golden crossover of the 50 and the 200 day moving averages, which is a very bullish indicator. Along with that, the Relative Strength Index of the coin has also sustained just around the 50 mark – 47.5 as of writing.

Read more: Binance Coin Price Prediction

BNB market cap dominance at an ATH!

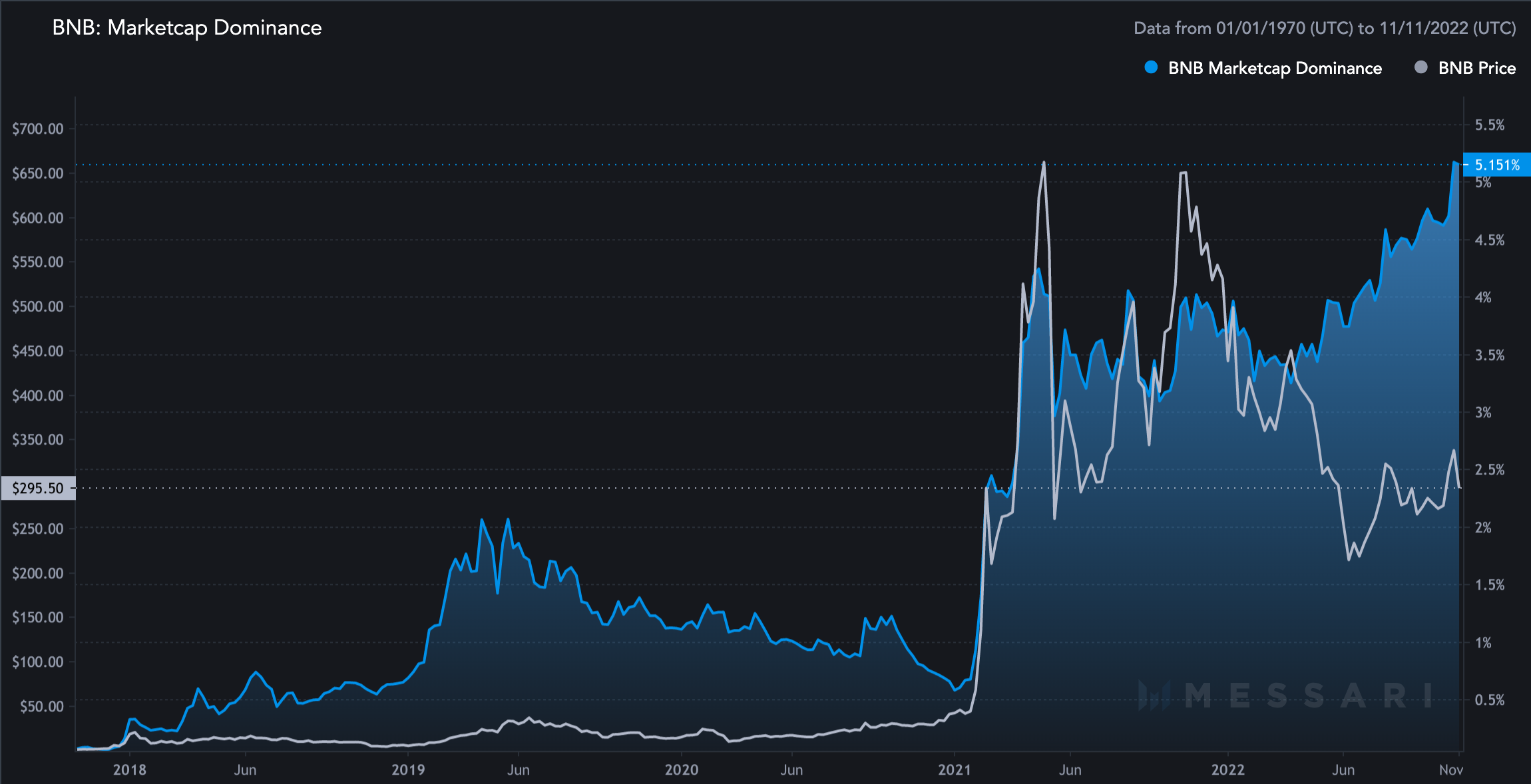

Another positive thing to note about BNB’s current market situation is that despite the bear run crushing its market value, BNB’s market cap dominance has been on the rise and so much so that is has been attaining new all-time-highs on a regular basis ever since June 2022. This is a particularly good sign since it indicates that as and when the market bottoms out, we can see a stronger growth proposition in this particular token going forward.

Binance Coin price showing positive liquidations data

Another interesting thing to note is that in the recent round of BNB price crash, we saw almost equal number of long and short liquidations in the crypto. To simply understand, typically during a crash we see a large number of long liquidations while at the same time, during major price spikes, we see short liquidations across the board. The reason behind that is during a crash, a large number of traders who hold long positions in the market book losses, fearing the market would crash further. Similarly, during a price spike, a large number of short position holders on the asset book losses fearing the market would continue to rally and thus extending losses.

But this time around, we saw nearly equal amount of long and short liquidations on the 8th of November, the day this news broke – to be specific, $10.42 million worth of long positions were liquidated while, $10.1 million of short position were liquidated. What this could possibly indicate is that a major chunk of short sellers in the market booked losses at the lows, which indicates sustained price support at the level mentioned earlier – between $265-270.

CONCLUSION

From the observations above, we can clearly see Binance Smart Chain’s native crypto token has been performing much better than most of the other top altcoins and in fact, gaining ground amid the raging bear market and the FUD around the FTX crypto exchange collapse. Thus, in conclusion from all the observations made above we can conclude that BNB now remains as one of the top recovery candidates amongst the top cryptos by market cap.

Read more: Consumer Protection and Risk management at CoinDCX

Prices as on 11 November, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more