Table of Contents

ToggleKey Takeaways:

- AVAX’s price has been range-bound since early 2023, with notable resistance around $21-$22.

- The substantial death cross between the 50-day and 200-day moving averages points to a bearish trend.

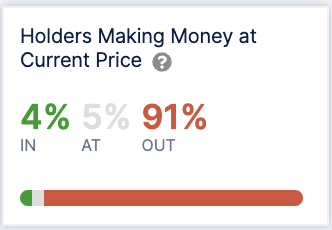

- Only 4% of AVAX investors are in profit, while 91% are facing losses, affecting market sentiment.

- AVAX’s falling volatility (from 1.29 to 0.51) indicates increased stability and gradual price recovery.

AVAX Technical Overview

- Since the middle of January 2023, Avalanche’s AVAX price has primarily traded within a defined range. There was a notable surge in AVAX price early in the year, particularly in January, when it nearly doubled in price, briefly reaching the $22 mark.

- This price range of $21-$22 emerged after resisting multiple attempts to break out. This range demonstrated significant selling pressure, while the support at $14 was breached in early June, mirroring similar price movements seen in Polkadot’s DOT price and Polygon’s MATIC price.

- Although there was a swift recovery from this correction, propelling AVAX price back to $14, it struggled to maintain these levels. By mid-July, its price had fallen below the $10 mark. Overall, the technical indicators point towards a bearish outlook, with a visible falling wedge pattern on the chart.

- Now, in little over a week since the beginning of October, AVAX price has managed to sustain above the falling wedge pattern and is currently trading just shy of the $10 mark. Now a convincing breakout beyond this psychological resistance at $10 is required for a further continuation of this rally.

- The substantial death between the 50-day and 200-day exponential moving averages indicates the likelihood of a continued bearish trend in the foreseeable future.

Read More: Avalanche Price Prediction

Avalanche On-chain Overview

Profitability of AVAX Holders

The current financial outlook for AVAX token holders paints a bearish picture within the token’s ecosystem. Data sourced from IntoTheBlock reveals that merely 4% of investors are currently enjoying profits from their investments, while a substantial 91% find themselves in a loss-making situation, watching their investments dwindle. The remaining 5% are on the edge, only managing to break even as of writing this article.

This prevailing bearish sentiment can hinder price recovery and possibly initiate a downward spiral, making it challenging for AVAX to regain bullish momentum.

In the crypto market, investor psychology plays a pivotal role, and when a significant portion of investors undergo losses, it can contribute to prolonged downtrends and diminished confidence in the future prospects of Avalanche’s AVAX token price.

Avalanche seeing falling volatility!

Avalanche’s (AVAX) price volatility has notably decreased from 1.29 in February 2023 to 0.51 as of writing this article. This reduced volatility signifies greater stability in AVAX’s market. It may lead to a steadier, gradual price increase and boost market confidence, making AVAX more appealing to investors – especially considering that AVAX price is seeing some gradual recovery. Lower volatility attracts a wider audience and contributes to more sustained price growth. This change suggests a maturing market, but investors should remain vigilant amid crypto market fluctuations.

Conclusion

Avalanche’s AVAX has been consolidating within a defined range, encountering resistance and bearing a bearish outlook with moving average signals. The majority of investors are currently facing losses, potentially impacting market sentiment. However, AVAX’s reduced volatility suggests increased stability, promoting gradual price recovery and making it more attractive to investors. This change reflects a maturing market, but caution is essential given the inherent fluctuations in the crypto market.

Values as of October 9, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more