Table of Contents

ToggleKey Takeaways:

- The Long/Short Ratio is an indicator that reflects the sentiment of market participants, capturing their opinions and actions.

- This ratio is derived by dividing the number of long positions by the number of short positions in the market.

- A high Long/Short Ratio indicates a bullish market sentiment, while a low ratio suggests a bearish market sentiment among traders.

Introduction

In the fast-paced world of crypto futures trading, understanding market trends and making informed trading decisions are crucial for success. One powerful tool that traders can utilize is the Long/Short Ratio. The Long/Short Ratio serves as an indicator of market sentiment, providing valuable insights into the positioning of traders in the crypto market.

Before we delve into the Long/Short Ratio, let’s briefly touch upon the concept of crypto futures trading. In futures trading, traders have the opportunity to go long (buy) or short (sell) on an asset, including cryptos. This flexibility enables traders to profit from both rising and falling markets, depending on their market outlook and trading strategy.

In this article, we will explore the Long/Short Ratio indicator in-depth, discuss the dynamics of long and short positions, and explore various long/short trading strategies. By understanding the Long/Short Ratio and incorporating it into your trading analysis, you can enhance your decision-making process and potentially improve your trading outcomes in the dynamic world of crypto markets.

Additional Read: Correlation Between Funding Rates & BTC Prices

What are long and short positions, and how do they work in crypto?

The Long/Short Ratio is a metric that represents the ratio of long positions to short positions in a particular asset or market. It provides a snapshot of the collective sentiment of traders in terms of their bullish (long) or bearish (short) outlook on the market. By analyzing the Long/Short Ratio, traders can gain insights into market trends, identify potential reversals, and make more informed trading decisions. Thus, for example, a trader can go either long or short on a BTCUSDT perpetual futures contract in the futures market.

The Long/Short Ratio is a valuable metric used in crypto futures trading to gauge market sentiment and make informed trading decisions. It provides insights into the positioning of traders in the market, specifically their preferences for long (buy) or short (sell) positions.

By analyzing the Long/Short Ratio, traders can gain a better understanding of market dynamics and potential trends. A high Long/Short Ratio suggests a larger proportion of traders holding long positions, indicating a bullish sentiment in the market. This indicates that traders anticipate the price of the underlying asset to rise. On the other hand, a low Long/Short Ratio indicates a higher concentration of short positions, reflecting a bearish sentiment and the expectation of price declines.

The Long/Short Ratio can be interpreted in various ways. Traders may consider a high Long/Short Ratio as a potential indication of market overheating, as a large number of long positions may lead to profit-taking and a subsequent price correction. Conversely, a low Long/Short Ratio may signal market pessimism and the potential for a price rebound as short positions become overextended.

In addition to providing insights into market sentiment, the Long/Short Ratio can be used as a complementary tool alongside other technical analysis indicators to confirm or question trading strategies. For example, if a trader identifies a potential bullish trend using technical analysis and observes a high Long/Short Ratio, it may strengthen their conviction in the anticipated price rise.

It is important to note that the Long/Short Ratio is just one piece of the puzzle and should be used in conjunction with other factors and indicators to make well-rounded trading decisions. Traders should also be mindful of the risks associated with futures trading, including market volatility and the potential for significant losses.

By monitoring and understanding the Long/Short Ratio, traders can gain valuable insights into market sentiment, identify potential trend reversals, and fine-tune their trading strategies in the dynamic world of crypto futures trading.

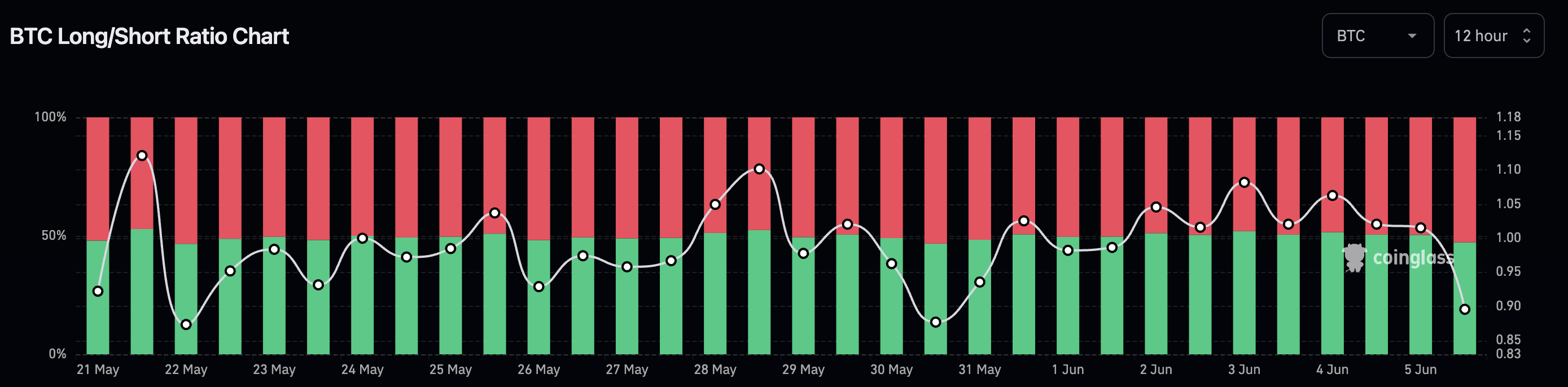

The chart above indicates how a typical Bitcoin long/short ratio chart looks like – effectively the ratio of the long to short positions on the BTCUSDT perpetual futures. The red sections depict short positions while the greens depict long positions. The white line is a continuous indicator of the Long/short ratio.

Additional Read: How to Use Open Interest for Bitcoin Futures Trading

How is the Long and Short Ratio Calculated?

Calculating the Long/Short Ratio involves dividing the total number of long positions by the total number of short positions. For instance, if there are 70 long positions and 20 short positions, the resulting ratio would be 3.5 (70/20).

A Long/Short Ratio exceeding 1 indicates a higher prevalence of long positions compared to short positions, indicating a positive market sentiment toward the asset. Conversely, a ratio below 1 signifies a greater number of short positions in relation to long positions, implying negative expectations for the asset.

Long and short ratio example using Bitcoin

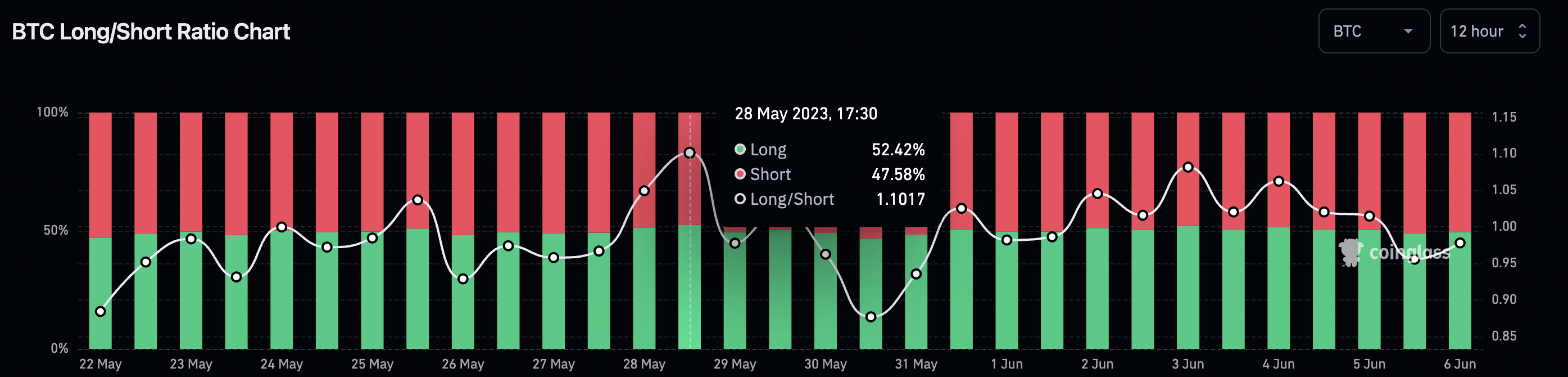

Consider the following illustration that showcases the Long/Short Ratio of the BTCUSDT perpetual contract. The chart represents a 15-day period, with each bar symbolizing 12 hours of a day.

On May 28, 2023, the BTCUSDT Long/Short Ratio concluded at 1.1017. This implies that 47.58% of Binance Futures accounts holding positions in BTCUSDT were net short, while the remaining 52.42% were net long on the Bitcoin futures contract.

Conclusion

In conclusion, understanding and effectively utilizing the Long/Short Ratio can provide valuable insights for crypto futures traders. By analyzing the market sentiment reflected in the ratio, traders can gain a deeper understanding of the prevailing bullish or bearish bias.

The Long/Short Ratio is a powerful indicator, revealing the balance between long and short positions in the market. This information can help traders gauge market sentiment and anticipate potential price movements. A high ratio suggests bullish sentiment, indicating a higher number of long positions than short positions, while a low ratio implies bearish sentiment with more short positions than long positions.

By incorporating the Long/Short Ratio indicator into their analysis, traders can make more informed decisions about their trading strategies. It allows them to assess market sentiment, identify potential reversals or trends, and manage their risk accordingly. Traders can utilize the Long/Short Ratio as part of a comprehensive trading strategy, combining it with other technical indicators and fundamental analysis.

However, it is important to note that the Long/Short Ratio is just one tool among many, and it should not be solely relied upon for trading decisions. It is crucial to consider various factors, such as market conditions, news events, and price patterns, to form a well-rounded perspective.

In the dynamic world of crypto trading, the Long/Short Ratio can provide valuable insights into market sentiment and assist traders in making more informed decisions. By understanding the concepts of long and short positions, traders can navigate the complexities of long vs. short trading and develop effective strategies to capitalize on market opportunities.

Related posts

CoinDCX Launches INR Margin Futures: A New Era for Crypto Futures Trading in India

CoinDCX launches the most cost-effective way to trade futures in India!

Read more

Complete Guide to Trading INR Margin Futures on CoinDCX

Trade crypto futures directly with INR on CoinDCX easily.

Read more