Table of Contents

ToggleIntroduction

Welcome to our comprehensive guide on the tax implications of crypto futures trading in India. As the crypto market continues to gain traction, many traders are venturing into futures trading to explore exciting opportunities and manage risks effectively. However, it’s essential to be aware of the tax obligations associated with this form of trading.

In this article, we will delve into the specifics of taxation for crypto futures traders in India. Understanding tax regulations and reporting requirements will not only help you stay compliant with the law but also optimize your trading strategies to minimize tax burdens.

Whether you are an experienced trader seeking clarity on tax matters or a newcomer eager to understand the tax landscape, our guide is here to provide you with valuable insights. Let’s navigate the world of crypto futures trading and taxation together to ensure a successful and compliant trading journey.

Read More: Crypto Tax Guide 2023

How are Cryptos Taxed in India?

Cryptos in India are categorized as virtual digital assets and are subject to taxation. Here are the key points regarding crypto taxation:

- Gains from trading cryptos are taxed at a rate of 30% (plus 4% cess) under Section 115BBH.

- Section 194S mandates a 1% Tax Deducted at Source (TDS) on the transfer of crypto assets from July 01, 2022, if the transactions exceed ₹50,000 in the same financial year.

- The crypto tax applies to all investors, whether private or commercial, who engage in digital asset transfers during the year.

- The tax rate remains the same for both short-term and long-term gains, and it applies to all types of income earned by the investor.

- Consequently, gains from trading, selling, or swapping cryptocurrency will be taxed at a flat 30% (plus a 4% surcharge), regardless of whether the income is treated as capital gains or business income.

In addition to this tax, a 1% TDS will be applicable on the sale of crypto assets worth more than Rs 50,000.

Read On: Tips to Save Tax on Crypto Gains

Traditional Futures vs Crypto Futures in India

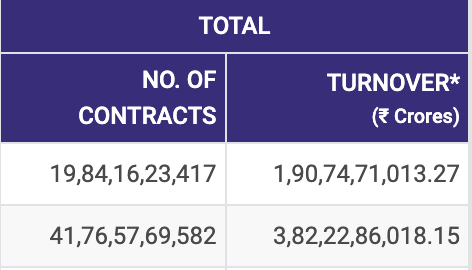

In India, derivatives trading is a very active segment of trading, especially in the equities markets. In fact, derivatives trading in India is one of the largest and the most active in the entire world, thanks to its regulated systems and safety measures in place. Traders can safely speculate on price movements in an effort to make gains. For some context, India has seen well over ₹19,000 trillion worth of derivates trading in 2023-24 alone, and in the previous year, saw over ₹38,200 trillion in derivatives trading turnover in 2022-23. This is data sourced from NSEIndia.com.

Now in India, Futures and Options are commonly referred to as crypto derivatives, and any income generated from these instruments falls under the category of business income. As per the Income Tax Act, it is mandatory to report the income earned from Futures and Options as business income, regardless of the frequency or volume of transactions.

However, things are slightly different in the case of crypto futures trading. To be able to trade in crypto futures, you cannot trade with your fiat INR currency. Experienced traders in the crypto futures market already know this, but for the uninitiated out there, you need to convert your INR into the equivalent USDT stablecoin to be able to participate in the crypto futures market. This is because most of the crypto futures markets out there have crypto/USDT trading pairs, and thus USDT becomes the base currency.

Let’s take an example to understand this better. Say you want to put in ₹1,00,000 as your trading capital to trade in the crypto futures market on CoinDCX. You now need to convert this ₹1,00,000 into USDT, which currently is valued at ₹86.6 – thus after converting, you would roughly have about 1154 USDT, give or take to trade in the futures markets.

Initial Trading Capital: ₹1,00,000

USDT/INR: ₹86.6

INR converted to USDT: 1154 USDT

Now you have 1154 USDT to trade with, and you can trade all you want with it. While equity futures are directly taxed on the gains in India, crypto futures gains are slightly different, and we will get into that up next!

How To Calculate Your Taxes From Crypto Futures Trading?

Calculating taxes on gains made from futures trading in crypto is relatively straightforward in India for now. As explained earlier, since you have to convert your INR into USDT stablecoin crypto to participate in the crypto futures market. Due taxes are applicable as and when you generate any profits in terms of USDT (even before converting the USDT to INR).

For example, you make a 1000 USDT profit on the 1154 USDT trading capital you started out with while trading in the crypto futures market. You will be charged 30% Tax on Gains (plus 4% cess) on the gains (which can be offset only against any loss than you incur on any other futures transaction)Later on, once you convert the USDT profits to INR, you will be subject to 1% TDS on the transaction value of the amount of USDT you are converting to fiat INR. This is claimable at the end of the financial year

Effortless Crypto Tax Reporting with CoinDCX & Koinx

KoinX is an automated tax calculation and portfolio insights platform, where users can seamlessly integrate multiple exchanges, and wallets, enabling crypto investors to track all their crypto transactions, including NFTs and DeFi investments, that too, in real-time.

If you are a trader on CoinDCX, it is super easy for you now to file your taxes on your crypto trading gains! All you need to do is:

- Login to your CoinDCX Account and click on your Account.

- Choose the ‘Tax Report with KoinX‘

- Click on ‘View Taxes FY 2022 – 23′, and then click on ‘Continue’

- Once the tax amount is generated, click on ‘Reveal my Tax Amount‘

- You can then go ahead and even generate the full report and then have the document emailed to you for future purposes!

It is that easy!

Additional Read: How to Report Crypto Taxes in India

Conclusion

In conclusion, understanding the tax implications of crypto futures trading in India is essential for all investors and traders. The Income Tax Act treats income from futures and options as business income, irrespective of the frequency or volume of transactions. As such, it is important to report such income accordingly. Additionally, cryptocurrencies in India are classified as virtual digital assets and are subject to taxation. Gains from trading cryptos are taxed at a rate of 30% under Section 115BBH, and a 1% Tax Deducted at Source (TDS) applies on crypto asset transfers exceeding certain thresholds.

Given the evolving nature of the crypto market and tax regulations, it is advisable for investors to stay updated with the latest guidelines and consult with tax professionals if needed. Compliance with tax laws is crucial to avoid any penalties or legal complications. By being aware of the tax implications and fulfilling tax obligations, crypto futures traders can navigate the Indian crypto landscape with confidence and ensure a smooth trading experience within the boundaries of the law.

Related posts

CoinDCX Launches INR Margin Futures: A New Era for Crypto Futures Trading in India

CoinDCX launches the most cost-effective way to trade futures in India!

Read more

Complete Guide to Trading INR Margin Futures on CoinDCX

Trade crypto futures directly with INR on CoinDCX easily.

Read more