Table of Contents

ToggleWhat is Centralized Finance?

To put CeFi in a nutshell, it is the finance world that we were used to before DeFi came in. However, centralized finance can also be defined as the financial activity in which individuals can earn interest and obtain loans on their crypto assets through centralized exchanges. An individual’s private keys to their crypto assets would be transferred to their favored third-party company in order to conduct their preferred payments and coin orders. The main goal of CeFi is to optimize the performance and cost-efficiency of transactional services along with ensuring fair exchanges.

Real world Use Cases Of CeFi

The most popular CeFi examples are the crypto exchanges like CoinDCX; where users can make use of the crypto investment app after completing their KYC.

Beyond the world of crypto, Centralized Finance can also be equated with other asset investment options; like stock market trading or investing in a mutual fund.

Top Features of CeFi

-

Centralized Exchange (CEX)

One of the first and the most important feature of a centralized exchange is the ability to make use of a CEX. They are traditional crypto exchanges where users send funds to the exchange and manage them within an internal account. As convenient as this feature is for the ever-evolving crypto space, it is also due to this, centralized exchanges have been the target of various situations in recent times. Moreover, these are just a few flaws that have been taking place due to unplanned handling of funds by people, and not the technology; as mentioned by many crypto natives and the Ethereum CEO, Vitalik. The large crypto exchanges have complete departments with customer service teams offering assistance to customers; 24*7.

-

The Flexibility of Fiat Conversion

With such changes happening, where Web2 ecosystem is changing to become compatible with Web3 space requirements, centralized services are the more comfortable handshake for the transition. CeFi represents more flexibility than decentralized service when turning fiat to crypto assets and vice versa. This feature of conversing crypto assets and fiat usually requires a centralized entity. In contrast to CeFi, DeFi services do not offer fiat that flexibility. This makes onboarding customers in the Centralized Finance (CeFi) ecosystem more convenient and as a whole, has the ability to offer a better customer experience.

-

Cross-chain services

In contrast to DeFi, CeFi services can support the trading of on-chains like LTC, XRP, BTC, and other coins that are often issued on independent blockchain platforms. Due to the latency and complicatedness of performing cross-chain swaps, DeFi services do not support these tokens and they are yet to overcome the smoothness of the activity. CeFi has the ability to overcome this issue by getting custody of funds from multiple chains. This feature is a significant benefit for CeFi as many of the frequently traded and highest-market-cap coins exist on independent blockchains and don’t implement interoperability standards.

Read more: How to choose a Safe Crypto Exchange?

What is Decentralized Finance?

Decentralized Finance is a new financial terrain where investors from all around the world explore different financial solutions to check the best fit for their financial needs or goals. DeFi applications are built on open source peer to peer networks that offer good TPS – transaction per second speed, decentralization (for easy traceability of funds) and security.

Read more on: Decentralized Finance Explained for Beginners

Real world Use Cases of DeFi

Borrowing And Lending In DeFi

Open lending protocols are maybe one of the most popular use cases in DeFi. Open DeFi lending and borrowing have many advantages; quick settlement, no KYC, zero to fewer collateral requirements for borrowing, and no requirement for credit checks. Lending and borrowing on DeFi protocols mean that these transactions take place on a peer to peer blockchain that requires zero trust and is open source making it a safe and quick platform to trade on.

Monetary Banking Services

Monetary banking service is a commonly featured use case of DeFi as it offers easy mortgaging services, issuance of stablecoins and insurance. As the blockchain industry is improving, the need and demand for creating fiat-backed stablecoins have increased. Traditional mortgaging services require intermediaries which can be expensive and time-consuming. Underwriting and legal fees can be drastically reduced by using smart contracts on a public or permissioned blockchain.

Decentralized Marketplaces

Decentralized marketplaces or exchanges are the most popular use cases of DeFi. Commonly called as DEX, traders can easily sign up on a decentralized exchange and lend, borrow or trade their crypto assets without any intermediary. Some popular DEXs are Uniswap and Pancake Swap.

Read more: Decentralized Exchange vs Centralised Exchange

Yield Optimization

DeFi applications can be used to automate and optimize the compound of yields gained from staking, pooling, and other interest-bearing investments. Yield optimization is a process that uses data analytics and optimization techniques. In DeFi yield optimization is carried out by applying algorithmic techniques to fetch the best rates on crypto transactions.

Yield optimization is referred to as Yield farming as well. In yield optimization, a smart contract carries out the process of using your crypto rewards to re-invest in order to help you receive optimized returns.

Top Features of DeFi

-

Permissionless

Being decentralized, there is no requirement for permission to use DeFi. While with CeFi, users need to complete a KYC process before they are able to access services, which means they have to share their personal information or deposit some money before accessing services. In contrast to CeFi, DeFi users can directly access the DeFi services using a wallet without providing personal information or depositing money beforehand. It is because DeFi is openly accessible to all parties, without any barrier.

-

Trustless

The most significant benefit of using DeFi services is you don’t need to trust that the service will perform as promoted. Users can authenticate that DeFi services perform as intended by auditing their code and using external tools such as Etherscan to identify if a transaction was correctly executed.

-

Quick Innovation

The more innovative advantage of DeFi is its quick rate of innovation. The Decentralized Finance Ecosystem is constantly building on the current capabilities and experimenting with new capabilities. The constant nature of the DeFi space to create something new has transformed the DeFi space into a rich ecosystem embedded with ground-breaking financial services. In functionalities where centralized financial services have thrived, DeFi space has been working to deliver alternative ways to solve the issue.

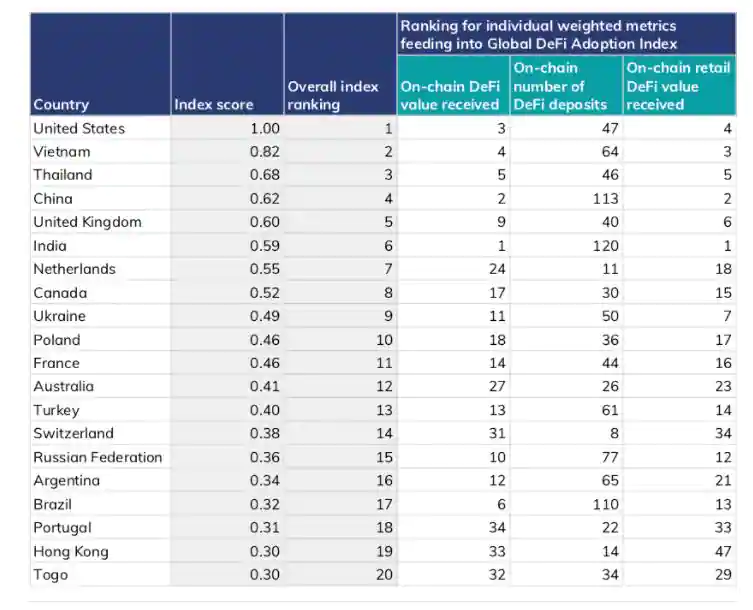

Adoption of DeFi in India

India has been recognized as the 6th biggest country in terms of DeFi adoption. With so many projects, like Polygon and crypto exchanges like CoinDCX working on a new DeFi product, Okto, India is yet to reach its huge potential for being the marker leader for DeFi.

Source: LiveMint

How is DeFi different from CeFi?

| DeFi | CeFi | |

| Funds Custody | The user has complete authority over funds custody. | Outside of user’s custody |

| Services available | Borrowing, Lending, Payments, Trading | Trading, Borrowing, Fiat-to-crypto, Payments and Lending |

| Personal Information | Proof of Work | Pluggable Framework |

| Security | Not accountable for funds. | Vulnerable in case of security bridges on the exchange. |

| Market Cap | $38.23B* | $324B* |

| Customer Service | NA | Provided by major changes. |

| Risk Factor | Security relies on the technology one is using. | Centralized exchanges are responsible for security. |

Synergies between DeFi vs CeFi

The DeFi space is still in its nascent stages. Similar to CeFi, DeFi also has some unique qualities that include transparency, non-custody, and decentralization, thanks to the blockchain settlement layer. While on one hand, it has many qualities, on the other hand, the blockchain limits DeFi’s transaction throughput, confirmation latency, and privacy. However, DeFi still relies significantly on the financial system as we knew it. To narrow it down, the value of crypto assets on DeFi is still primarily determined and recognized in fiat currency.

This is where CeFi comes in. CeFi lending platforms act as a bridge between the traditional monetary system and the crypto asset market. What is more important, is that DeFi and CeFi have the same goal. Both sectors are working to provide high-quality financial goods and services to customers along with powering the economy. In short, both DeFi and CeFi have their own set of benefits and drawbacks, and there is no easy way to combine the best of both systems.

As a result, both of these separate but intertwined financial systems will have to coexist and benefit one another. And there are a few synergy prospects that both DeFi and Cefi can offer each other.

Read more: How to set Smart Crypto Investment Goals

DeFi and CeFi Handshake

Comparing centralized to decentralized finance, the DeFi protocols do not only mimic the basic CeFi services; they also optimize them for the unique qualities that blockchains have to offer. For example, in DeFi, a new exchange mechanism known as AMM has taken the role of CeFi’s popular order-book architecture. To give a short context, AMM is a smart contract that provides the service of taking assets from liquidity providers. As a result, traders trade against the AMM smart contract rather than directly with liquidity providers. Taking inspiration from this, CeFi platforms like Binance has introduced market-making programs.

Learnings of DeFi and CeFi

During the crashes, CeFi and DeFi both the sectors were extremely stressed. Due to an unusual quantity of trading activity, centralized exchange systems were disrupted. But because of the distributed nature of blockchains, DeFi services are technically always available, unlike CeFi. Due to the nature of the market, DeFi systems, become prohibitively expensive for most users during extreme market scenarios. Since then, the resilience of DeFi protocols has received greater attention. Even though CeFi and DeFi have different settlement processes and user behaviors, CeFi has a lot to learn from DeFi’s stress tests.

Major Developments in Decentralized Finance (Year 2022)

DeFi has been making a lot of noise in recent times. Especially after the FTX collapse took place. Some of the top DeFi coins in November has been:

| Name | Uniswap | Chainlink | Tezos | Aave | MakerDAO |

| Launch Date | 2018 | 2017 | 2018 | 2017 | 2017 |

| Founder | Hayden Adams | Sergey Nazarov | Arthur and Kathleen Breitman | Stani Kulechov | Rune Christensen |

| Blockchain Protocol | Ethereum | Ethereum | Tezos | Ethereum | Ethereum |

| Native Token | UNI | LINK | XTZ | AAVE | MKR |

| Token Type | Governance Token | ERC 677 | Governance Token | Utility | Governance |

| Market Cap | $4.2 billion | $3.3 billion | $920 million | $820 million | $650 million |

| Circulating Supply | 762 million UNI | 507 million LINK | 917 million XTZ | 14 million AAVE | 977,631 MKR |

| Max Supply | 1 billion | 1 billion | NA | 16 million AAVE | 1.005 million MKR |

| Consensus Method | Proof of Stake | Proof of Stake | Proof of Stake | Proof of Stake | Proof of Stake |

Read more: Top DeFi Tokens

On 26 August 2022 at the Unfold 2022 event – CoinDCX launched the best solution to the pertaining Web3 problem of interoperability! A continued step towards making things easy for You, the consumer.

Indian crypto exchange CoinDCX has launched Okto, a decentralized finance (DeFi) mobile app that seeks to transition crypto consumers to DeFi.

By @amitojhttps://t.co/lCrEHj5OGG— CoinDesk (@CoinDesk) August 26, 2022

FAQs

What's the difference between CeFi and DeFi?

The most important difference between centralized and decentralized finance is that one has a mediator in the form of KYC set in place while the other is permissionless. Another important difference between centralized and decentralized finance is that centralized finance provides users with lesser anonymity than transactions in DeFi. When coming to custody, in contrast to CeFi, DeFi allows customers to directly control their assets anytime.

Is Bitcoin a CeFi or DeFi?

Bitcoin is DeFi. When Satoshi Nakamoto introduced the Bitcoin whitepaper to the world, his main pitch was to bring in a decentralized peer-to-peer mode of transactions to the finance world. Other than that, while comparing centralized to decentralized finance, CeFi needs KYC verification, thus, founders have to be public. While in DeFi, they can remain anonymous.

Which is better, CeFi or DeFi?

Decentralized finance or Centralized finance; both have their own set of advantages and disadvantages. While CeFi promises the security of funds and fair trade on those funds, DeFi wants to make the space intrusion free. DeFi provides a space for investors to implement their strategies without having to deal with an intermediary body. While the CeFi sector has incidences like FTX happening due to certain malpractices, DeFi is still suffering from a number of roadblocks and challenges themselves. Both CeFi and DeFi have their own sets of pointers that they bring with them; thus there is no definitive yes or no to which one outweighs which yet.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more