Table of Contents

ToggleKey Takeaways:

- BlackRock’s iShares Bitcoin Trust Leads Market: BlackRock’s iShares Bitcoin Trust (IBIT) dominated US Bitcoin ETF inflows, logging $224 million on August 26, pushing its total Bitcoin holdings to over 350,000 BTC.

- US Bitcoin ETFs Show Strong Performance: US Bitcoin ETFs experienced an 8-day winning streak, with net inflows reaching approximately $202 million, reflecting growing investor confidence in these investment vehicles.

- Mixed Results for Competing Funds: While BlackRock’s IBIT saw significant inflows, other ETFs like Franklin Templeton’s and WisdomTree’s reported smaller positive inflows, whereas funds from Fidelity, Bitwise, and VanEck saw negative net flows.

- Market Stabilization in Bitcoin ETFs: Seven months after their debut, US Bitcoin ETFs are showing signs of stabilization, with a more balanced flow of investments and reduced volatility in inflows and outflows.

- BlackRock Increases Exposure to Bitcoin ETFs: BlackRock’s Strategic Global Bond Fund recently increased its holdings in IBIT, adding 4,000 shares and bringing total holdings to 16,000, signaling the firm’s growing confidence in Bitcoin ETFs.

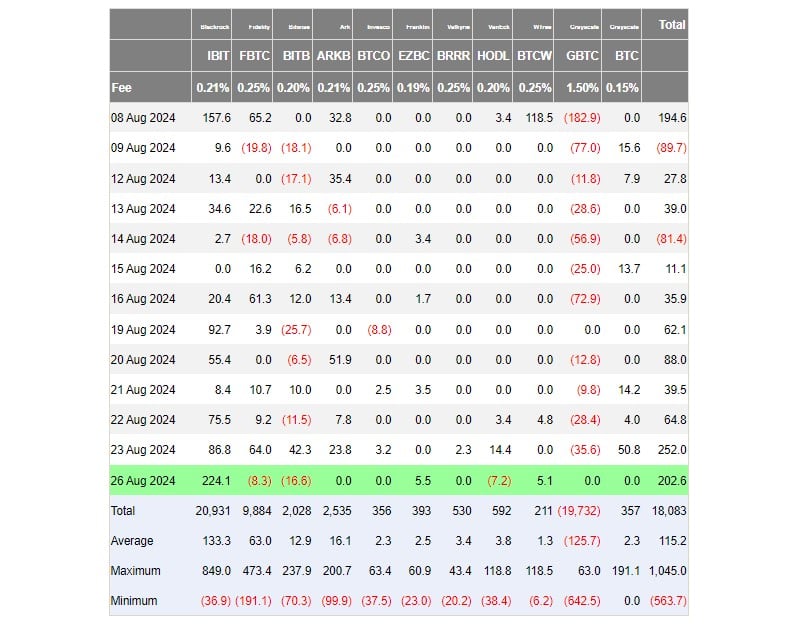

The recent performance of US exchange-traded funds (ETFs) focused on Bitcoin (BTC) has captured significant attention in the financial world. Over the past eight days, these Bitcoin ETFs have experienced consistent net inflows, with total investments reaching approximately $202 million on August 26, according to data from Farside Investors. Leading the pack, BlackRock’s iShares Bitcoin Trust (IBIT) alone accounted for $224 million of this influx, underscoring its dominant position in the market.

BlackRock’s Dominance in Bitcoin ETFs

BlackRock’s iShares Bitcoin Trust has emerged as a key player in the Bitcoin ETF landscape. On August 26, the fund saw net inflows of $224 million, a figure that stands out even in a bullish market. This strong performance has bolstered IBIT’s position, pushing its total Bitcoin holdings to over 350,000 BTC, as reported in the latest update. This growth is a testament to the increasing confidence that both institutional and retail investors have in BlackRock’s strategy and the broader Bitcoin market.

Source: Farside Investors / CryptoBriefing

Comparison with Other Bitcoin ETFs

While BlackRock’s IBIT led the market with substantial inflows, other Bitcoin ETFs in the US also saw positive performance, albeit on a smaller scale. Franklin Templeton’s Bitcoin ETF (EZBC) and WisdomTree’s Bitcoin fund (BTCW) each reported around $5 million in net inflows on the same day. This indicates a growing interest in Bitcoin ETFs across the board, even though some funds are more favored than others.

In contrast, several competing Bitcoin ETFs managed by firms like Fidelity, Bitwise, and VanEck reported negative net flows, reflecting a more cautious investor sentiment towards these funds. The uneven performance across different Bitcoin ETFs highlights the importance of fund management strategies and investor confidence in determining the success of these investment vehicles.

Read On: Bitcoin Price Prediction

Grayscale Bitcoin Trust and Market Stabilization

The US Bitcoin ETF market has seen significant developments since the introduction of the first spot Bitcoin ETFs seven months ago. Initially, the market was characterized by high volatility, with substantial fluctuations in both inflows and outflows. However, recent trends suggest a stabilization, with a more balanced flow of investments.

Notably, the Grayscale Bitcoin Trust (GBTC), which had previously been associated with large outflows, has experienced a slowdown in redemptions over the past two weeks. This shift indicates a potential change in investor behavior, possibly influenced by the broader stabilization in the Bitcoin ETF market.

BlackRock’s Strategic Investments

BlackRock’s growing confidence in Bitcoin ETFs is further evidenced by its recent moves to increase its exposure to the sector. The asset management giant’s Strategic Global Bond Fund added 4,000 shares of IBIT, bringing its total holdings to 16,000 shares as of June 30. This strategic investment reflects BlackRock’s belief in the long-term potential of Bitcoin ETFs and the role they could play in diversifying traditional investment portfolios.

The decision to increase holdings in IBIT is not only a signal of BlackRock’s confidence but also a response to growing investor appetite for Bitcoin-related assets. As more institutional investors seek exposure to Bitcoin through regulated financial products, funds like IBIT are likely to continue attracting significant capital.

Outlook for Bitcoin ETFs

The recent 8-day winning streak for US Bitcoin ETFs suggests a positive outlook for these investment products, at least in the short term. The strong inflows, particularly into BlackRock’s iShares Bitcoin Trust, indicate that investors are increasingly comfortable with Bitcoin ETFs as a way to gain exposure to the crypto market.

As the market matures, it will be interesting to see how the dynamics between different Bitcoin ETFs evolve. With BlackRock leading the charge, other fund managers will need to adapt their strategies to remain competitive. Additionally, the stabilization of inflows and outflows across the market could lead to more sustained growth, provided that investor confidence remains high.

In conclusion, the recent performance of US Bitcoin ETFs, highlighted by BlackRock’s $224 million net inflows, underscores the growing institutional interest in Bitcoin as an asset class. As more investors look to ETFs as a secure and regulated way to invest in Bitcoin, the market is likely to see continued growth and innovation in the months ahead.

Source: CryptoBriefing

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more