Table of Contents

ToggleKey Takeaways:

- Critical Upgrade on the Horizon: Polygon’s MATIC is set to transition to POL on September 4th, an upgrade that could be pivotal in enhancing the network’s performance and efficiency. This migration is seen as a critical test of Polygon’s market resilience during a challenging period.

- MATIC’s Struggles with Price Decline: MATIC has been trading near its multi-year low, currently hovering around $0.40. Over the past week, it has experienced a significant decline of over 20%, mirroring the broader bearish sentiment in the crypto market.

- Key Support and Resistance Levels: Maintaining the $0.40 support level is essential for MATIC’s short-term stability. If this support holds, the next major resistance level to watch is $1.50, with the potential to rally towards $3.00 if bullish momentum returns post-migration.

- Technical Indicators Signal Rebound Potential: The Relative Strength Index (RSI) for MATIC is currently at 35.95, indicating that the token is nearing oversold territory. This suggests a possible buying opportunity, especially if the POL migration renews investor interest and drives upward price movement.

- DeFi Ecosystem and On-Chain Activity Remain Robust: Despite price challenges, Polygon’s DeFi ecosystem shows resilience, with a Total Value Locked (TVL) of $876.12 million and over half a million active addresses in the last 24 hours. These metrics, alongside growing large transactions, indicate sustained engagement and potential for recovery as the network transitions to POL.

As the crypto market navigates a period of uncertainty, all eyes are on Polygon as it prepares for a significant upgrade on September 4. This transition, the MATIC to POL migration, is being closely watched by investors and analysts alike, who are eager to see if it could be the key to reversing the token’s recent downtrend.

🧵 POL Upgrade | Everything to Know 🧵

Users w/ MATIC on Ethereum can upgrade today via Polygon Portal Interface: https://t.co/Ibs1ONels1

There is no deadline for users to upgrade. All MATIC on Polygon PoS & staked MATIC on Ethereum will upgrade automatically on Sept 4. pic.twitter.com/qKnyYFrlqH

— Polygon | Aggregated (@0xPolygon) August 27, 2024

MATIC Price’s Struggles in a Bearish Market

Polygon’s native token, MATIC price has been under considerable pressure in recent weeks. Trading at approximately $0.4001, MATIC has experienced a steady decline, reflecting the broader bearish sentiment that has swept across the crypto market. Over the last 24 hours alone, MATIC has dropped by 2.08%, and in the past week, it has seen a significant 21.95% decrease in MATIC price.

This downturn is part of a larger trend impacting numerous digital assets, as the crypto market grapples with ongoing challenges. However, the upcoming migration to POL, scheduled for September 4, is sparking cautious optimism among investors. This upgrade is a crucial component of Polygon’s strategy to boost network performance and efficiency, and it could potentially shift market sentiment in MATIC’s favor.

Key Support Levels and Potential Price Movements

As MATIC edges closer to its migration to POL, its price is teetering near a critical support level of $0.40, a multi-year low that could determine the token’s short-term trajectory. Holding this support is vital for MATIC’s stability. Should the price hold, the next major resistance to watch is at $1.50. A break above this level could trigger a significant rally, with the possibility of the price surging to $3.00, which would represent a 100% gain from its current level.

Technical indicators also suggest a potential rebound. The Relative Strength Index (RSI) for MATIC is currently at 35.95, indicating that the token is nearing oversold territory. This could signal a buying opportunity, especially if the migration to POL renews interest among buyers and strengthens market confidence.

On-Chain Metrics and Market Signals

Examining on-chain data provides further insight into MATIC’s current situation. The Market Value to Realized Value (MVRV) ratio, which measures the profit and loss of MATIC holders, has shown significant fluctuations over time. Recently, the MVRV ratio has remained close to zero, indicating minimal profitability for holders. As of the latest data, the MVRV ratio was at -0.23%, reflecting slightly negative returns for recent investors and suggesting limited potential for price appreciation in the short term.

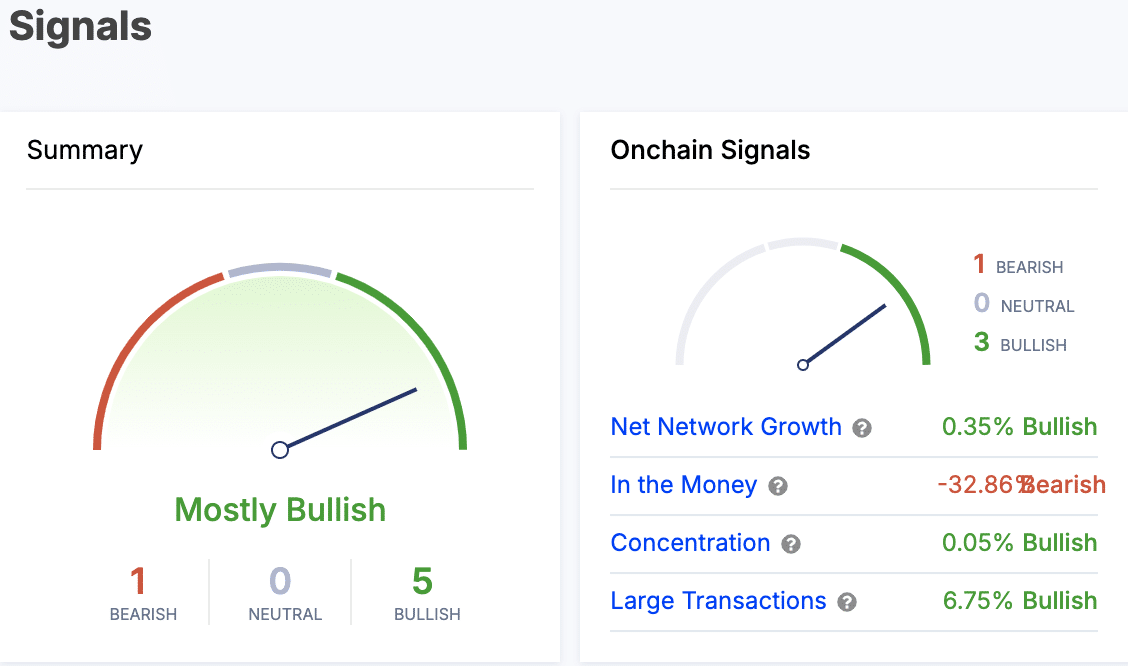

Despite these challenges, some on-chain signals for MATIC remain positive. Data from IntoTheBlock indicates that the overall sentiment is “Mostly Bullish,” with three key bullish indicators. Notably, net network growth has increased by 0.35%, and large transactions have risen by 6.75%, highlighting growing activity on the Polygon network. However, the “In the Money” metric, which was at -32.86%, shows that a significant portion of investors are currently facing losses, adding to the bearish sentiment.

Source: IntoTheBlock

DeFi Activity on the Polygon Network

Beyond market sentiment and price movements, Polygon’s decentralized finance (DeFi) ecosystem continues to demonstrate resilience. According to data from DefiLlama, Polygon’s Total Value Locked (TVL) stands at $876.12 million, reflecting the total capital within DeFi protocols on the network. Additionally, the market capitalization of stablecoins on Polygon is approximately $2.026 billion, underscoring robust activity in the ecosystem.

User engagement on the Polygon network also remains strong, with 576,621 active addresses recorded in the last 24 hours. As the POL migration nears, these metrics will be crucial in assessing the upgrade’s impact on the network’s overall health and growth.

Conclusion: A Critical Moment for Polygon

The impending POL migration is a pivotal moment for Polygon and could determine MATIC’s future in the market. While the token has faced significant challenges recently, the upgrade offers a potential turning point. Investors and market participants will be watching closely to see if this transition can catalyze a rebound and restore bullish momentum for MATIC.

Source: AMBCrypto

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more